A Turning Point for Argentina’s Banking System

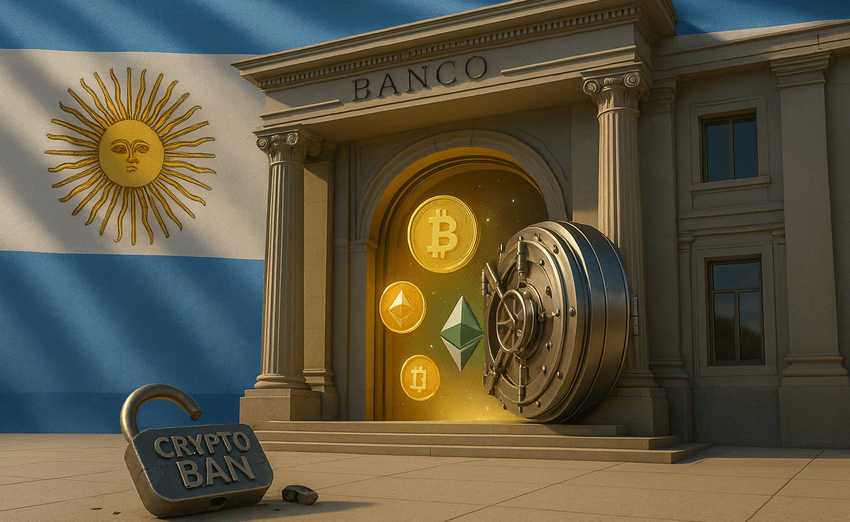

Argentina is preparing for a major reset of its crypto policy, with the Central Bank of the Argentine Republic (BCRA) now working to reverse its 2022 ban on banks offering Bitcoin and stablecoin services. If finalized, this would give regulated financial institutions the ability to offer trading, custody, and direct crypto access, marking one of the country’s most meaningful pivots in years.

The original prohibition-applied after pressure from the International Monetary Fund (IMF)-was framed around financial stability, money laundering risks, and unregulated flows. But today, Argentinian officials acknowledge that crypto is no longer something that can be pushed out of the formal system.

How IMF Pressure Shaped the Original Ban

Argentina’s ban emerged during a period of intense negotiations with the IMF tied to the country’s $44 billion bailout. Documents sent to IMF Managing Director Kristalina Georgieva show a clear mandate to “discourage the use of cryptocurrencies” to curb informality and financial leakage.

This stance forced millions of Argentines into informal trading channels, even as some banks-such as Banco Galicia-experimented with limited crypto services. The new shift signals an intent to reshape the IMF framework so the country can regulate crypto rather than suppress it.

Inflation Crisis Pushes Argentines Toward Crypto

The renewed policy debate comes as Argentines continue turning to Bitcoin and stablecoins as a hedge against the country’s runaway inflation, which remains one of the highest in the world. October’s inflation rate eased slightly to 31.3%, but the relief is barely felt by households battling years of economic instability.

Crypto platforms have seen this behavior firsthand. When the BCRA restricted dollar sales ahead of the recent elections, trading app Ripio recorded a 40% spike in stablecoin-to-peso transactions.

Banks Under Pressure as Crypto Steps In

Argentina’s fragile banking sector is another reason regulators are reconsidering the ban. According to Bloomberg, private banks faced the highest loan delinquency rates in 15 years, squeezed by historic reserve requirements and extreme interest rates.

Bank CEO Julio Patricio Supervielle said “unsustainably high real interest rates” severely damaged the system. Allowing banks to custody or transact crypto could introduce new liquidity channels, particularly in U.S. dollar–denominated assets, easing some of the strain. For many Argentines, the dollar remains the ultimate refuge.

Milei’s Political Momentum Fuels Policy Reversal

The October midterm elections strengthened President Javier Milei’s coalition, giving the administration fresh leverage to overhaul financial policy. However, Argentina still needs dollars to rebuild reserves, and loosening crypto restrictions could help.

Funds like London-based ProMeritum have already re-entered the market, citing improved political signals.

All eyes now turn to how Argentina renegotiates its IMF commitments and whether crypto becomes a formal pillar of its economic rebuilding strategy.