Bitcoin Falls from Record Highs Amid Macro Pressure

After hitting an all-time high of $126,080 on October 6, Bitcoin stumbled hard, sliding more than 13% to around $109,820, according to CoinGecko. Over the past 30 days, the world’s largest cryptocurrency is down over 8%, marking its first negative October since 2018.

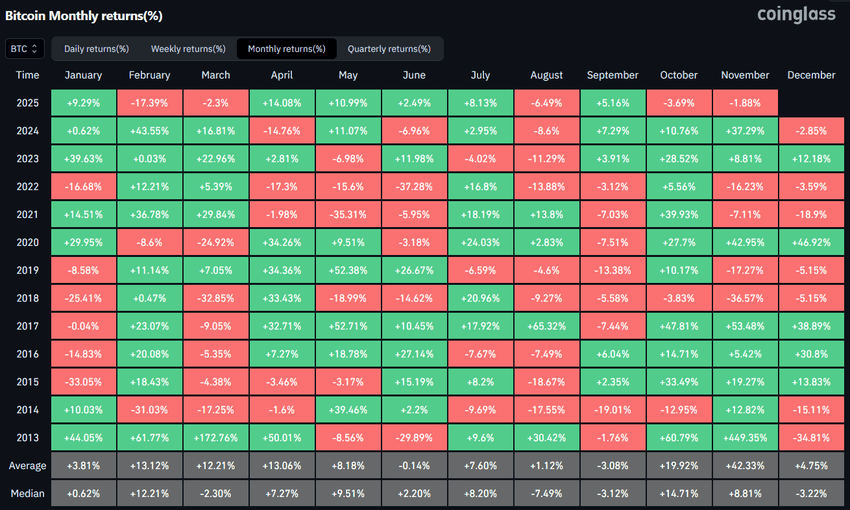

The downturn caught traders off guard, as October has historically been Bitcoin’s most profitable month. CoinGlass data shows that over the past decade, BTC only ended one October in the red - until now.

Leon pointed to the October 11 crash as a key turning point, triggering a wave of long-position liquidations and shaking confidence across crypto markets.

Source: CoinGlass

Powell’s Hawkish Tone Spooks Markets

The sell-off accelerated after Federal Reserve Chair Jerome Powell said that a December interest rate cut was “not a foregone conclusion.” That single comment sent Bitcoin tumbling below $106,000, with Ethereum also sliding sharply alongside stocks and risk assets.

Acheson added that unlike equities or bonds, Bitcoin’s value is driven largely by sentiment, making it particularly vulnerable to shifts in monetary policy and global liquidity.

Trade War and Liquidations Add Fuel to the Fire

Earlier in October, U.S. President Donald Trump’s renewed trade war rhetoric with China added more pressure, sending shockwaves through global markets. Investors rushed to de-risk, liquidating over $19 billion in positions, with nearly 90% being long bets expecting prices to rise.

The result: a double shock - geopolitical tension on one side and tightening liquidity on the other.

Long-Term Holders Start to Sell

Adding to the bearish mix, analysts observed a rise in selling from long-term Bitcoin holders, possibly linked to beliefs that the market may have already peaked in its traditional four-year cycle.

This sentiment could mark the start of a market consolidation phase, as traders reassess risk and long-term investors lock in profits after record highs.

Ethereum Joins the Slide

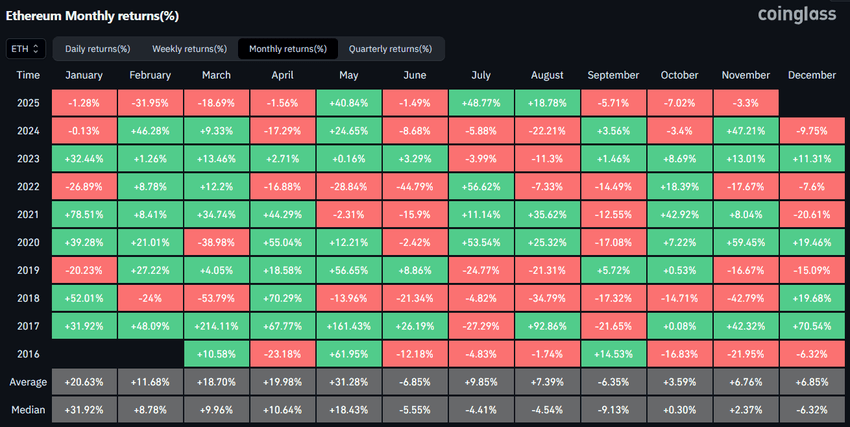

Ethereum (ETH) wasn’t spared either, logging its first October loss in six years. Despite ongoing optimism over scaling upgrades and institutional adoption, ETH mirrored Bitcoin’s trajectory, ending the month in the red as macro factors overshadowed network fundamentals.

Still, analysts say the long-term trend remains intact, with liquidity cycles and institutional inflows expected to play a decisive role heading into 2026.

Source: CoinGlass