Bitcoin Hits $112K, Shattering Records

Bitcoin just blew past $112,000, setting a new all-time high after gaining nearly 6% in just seven days. The price spike was powered by a $200 million liquidation of short positions, clearing out resistance near a key level and opening the door for another bullish run.

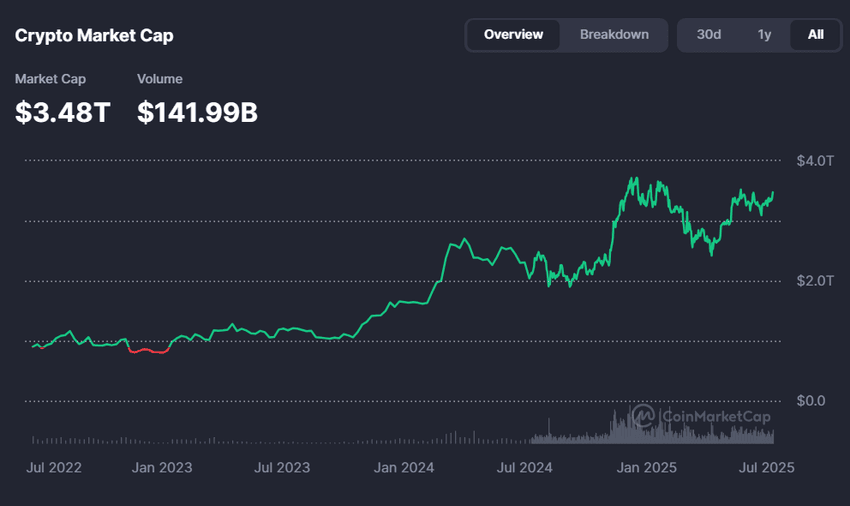

This surge has helped push the total crypto market cap back to $3.47 trillion, a number not seen since June 2025. While still short of the $3.73 trillion record from December 2024, the market’s rapid climb signals renewed investor enthusiasm.

The timing? It comes just days after President Trump announced a new wave of tariffs, including up to 40% levies on Malaysia, Kazakhstan, South Africa, Myanmar, and Laos, while Japan got hit with a 25% rate. The crypto market—particularly Bitcoin—is reacting as a hedge against mounting geopolitical risk and fiat volatility.

Source: Coinmarketcap.com

Real Demand, Not Just Hype

According to Bitfinex analysts, this isn’t just a reflexive bull run from overleveraged traders. In fact, they say the latest rally was built on a “healthier foundation,” thanks to a flush-out of excessive leverage and a rise in spot market buying.

For the rally to continue, they add, spot buyers must keep leading the charge, rather than letting momentum traders take the reins again.

Bitcoin Gains Safe Haven Status

Perhaps more telling than price action is why Bitcoin is moving this way. Sygnum Bank’s head of research, Katalin Tischhauser, told that Bitcoin is increasingly acting like a safe-haven asset—especially in the face of inflation fears and fiat currency concerns.

Since Trump’s Liberation Day speech on April 2, Bitcoin has consistently outperformed, especially during S&P 500 pullbacks, indicating investors are decoupling from traditional markets in favor of decentralized assets.

Shrinking Supply Signals Potential Rally Extension

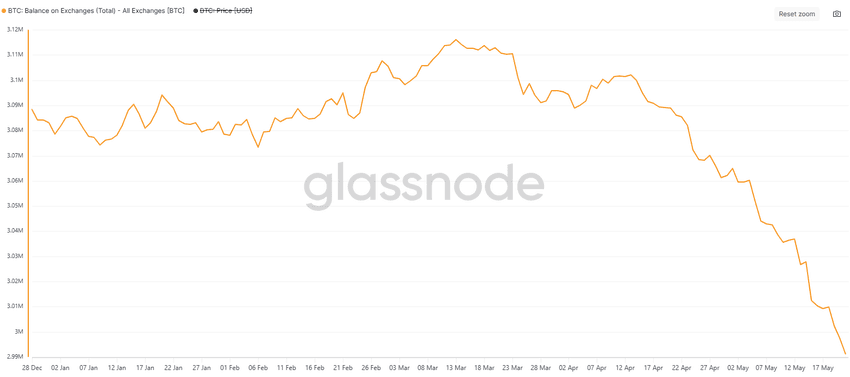

Another bullish metric? Bitcoin reserves on exchanges are drying up. According to Glassnode, total exchange balances have dropped from 3.11 million BTC in March to 2.99 million BTC by May 21. This sharp decline often signals long-term investor confidence and hints at a possible supply squeeze if demand keeps rising.

As fewer coins sit on exchanges ready to sell, buyers may face a scarcity-driven price shock, especially if institutional capital continues flooding into ETFs, state-backed reserves, and corporate treasuries.

Source: Studio.glassnode.com

Where Does BTC Go Next?

Between tariffs, fiat uncertainty, and declining exchange balances, Bitcoin is hitting all the right macro notes for a continued rally. The current move is not just fueled by hopium—but by fundamentals, regulation-driven momentum, and a shift in market psychology.

With ETF flows strong, U.S. states adopting Bitcoin reserves, and global investors seeking safety from economic instability, BTC may be setting the stage for a historic second half of 2025.