Market Panic Sends Bitcoin Tumbling

Over the weekend, Bitcoin sank 6% to $77,730 as a wave of market-wide panic followed President Trump’s new tariffs. The drop marks Bitcoin’s first break below $78,000 in weeks and places it roughly 28% off its January all-time high.

The broader financial markets weren’t spared either. U.S. equities endured their worst week since 2020, dragging crypto down in tandem.

$77,500 is a critical support level in Bitcoin and if that fails, it should plunge sharply from there...$BTC $IBIT pic.twitter.com/G2GyFOHCv1

— Jesse Colombo (@TheBubbleBubble) April 7, 2025

$77,500 is a critical support level in Bitcoin and if that fails, it should plunge sharply from there...$BTC $IBIT pic.twitter.com/G2GyFOHCv1

— Jesse Colombo (@TheBubbleBubble) April 7, 2025

Liquidations Surge, But Bulls Stay Calm

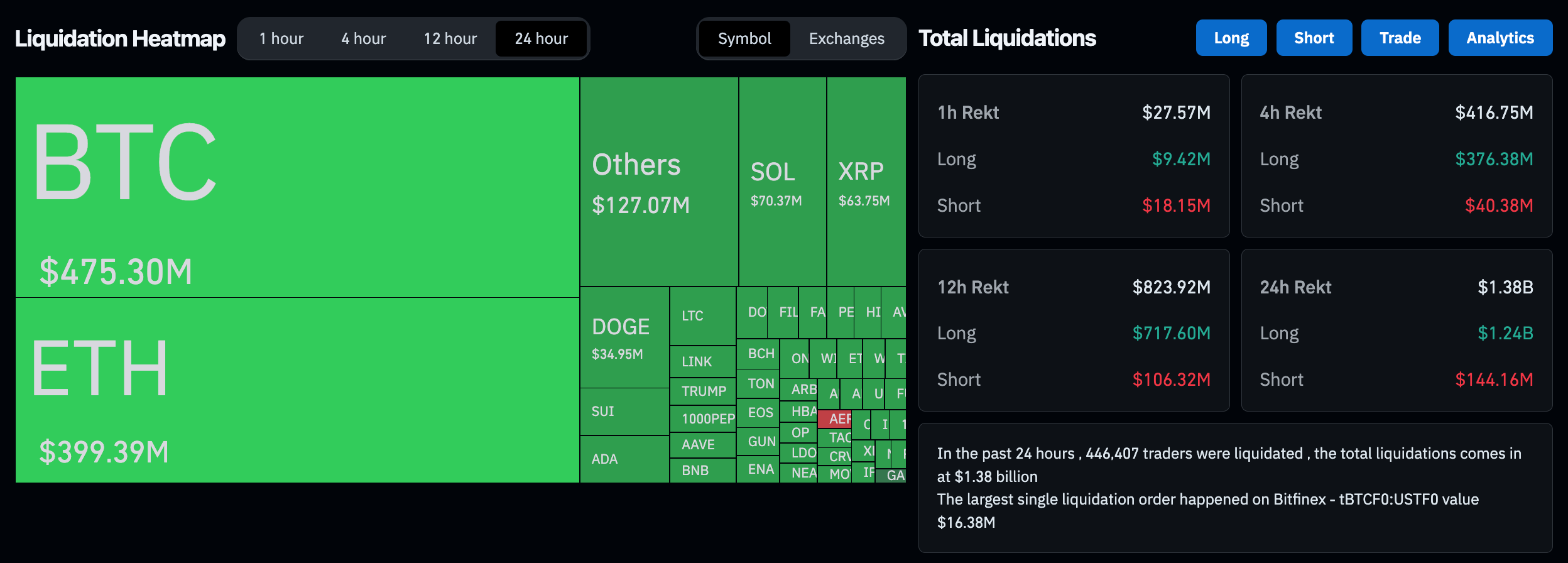

Data from Coinglass showed $1.38 billion in crypto positions were liquidated in just 24 hours—$1.2 billion from long positions. More than 446,000 traders got wiped out during the slide.

Still, optimism remains. “This is just noise,” said Gadi Chait of Xapo Bank. “Bitcoin has always been a long-term game.”

Traders are watching the $76,600 level closely, which could act as a make-or-break zone. For now, Bitcoin remains in a broader range, with bulls hoping this dip is just another bump in a long-term uptrend.

Source: Coinglass

Crypto Moves With Wall Street

Bitcoin’s price action continues to mirror major tech stocks. Analysts recorded a 0.88 correlation in March between Bitcoin and indices like the S&P 500 and Nasdaq. Last week’s Wall Street sell-off, driven by trade war fears, clearly bled into digital assets.

Ethereum fell 13% to $1,568, while XRP and Solana dropped over 12%. The correlation suggests that crypto is now deeply linked to traditional investor sentiment.

Global Markets Rattle Under Pressure

The turmoil wasn’t limited to the U.S. Hong Kong’s Hang Seng Index plunged over 10% on Monday—the steepest one-day drop since 2008. Chinese equities also took a hit following the announcement of over 50% U.S. tariffs.

Beijing responded with its own tariffs, stoking fears of a full-scale trade war. Goldman Sachs now pegs the chance of a U.S. recession at 45% within the next year.