IBIT Hits Historic Milestone in Just 341 Days

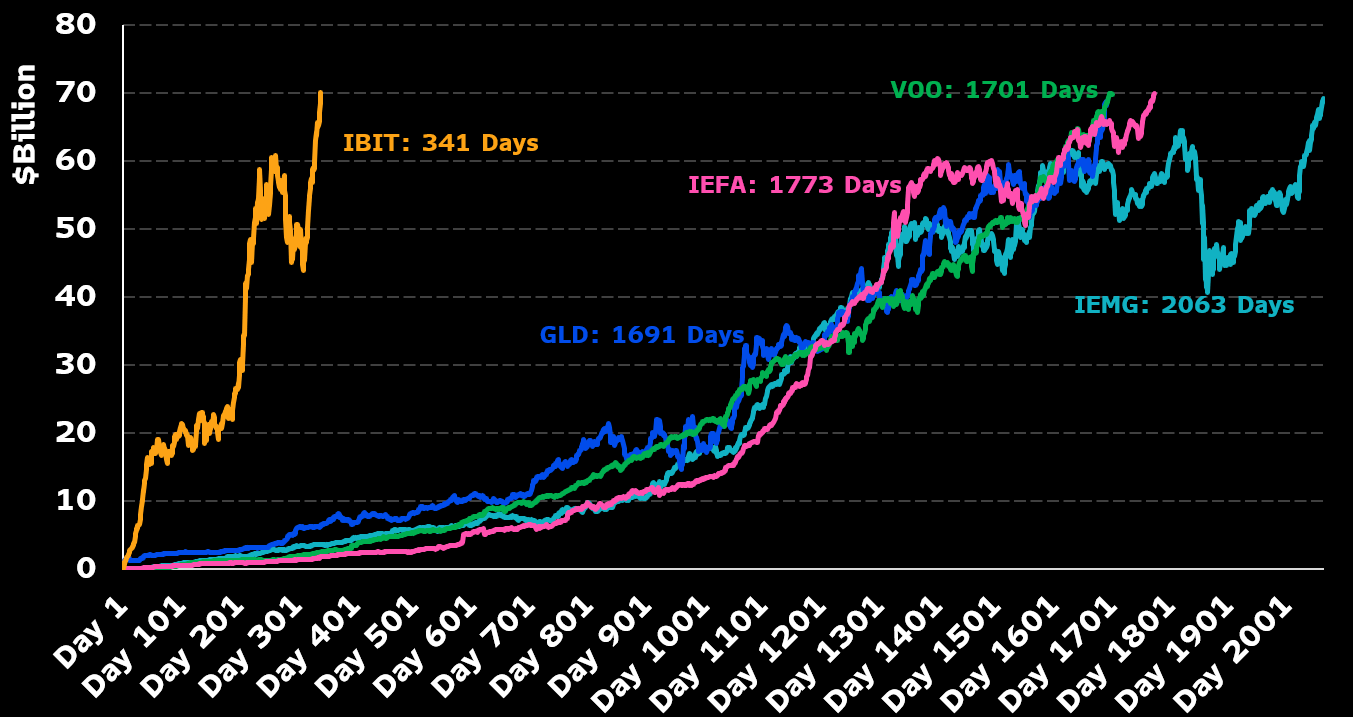

BlackRock’s IBIT, the firm’s spot Bitcoin ETF, has officially become the fastest-growing ETF in history, surpassing $70 billion in assets under management in just 341 days. The achievement was confirmed by Bloomberg’s ETF analyst Eric Balchunas, who pointed out that the previous record—held by SPDR Gold Shares (GLD)—took 1,691 days to reach the same milestone.

BlackRock launched IBIT in January 2024, and it has since become the clear leader among crypto ETFs. Its closest competitor, Fidelity’s spot Bitcoin ETF, currently holds just $31 billion—less than half of IBIT’s size. What’s more, IBIT has seen 34 consecutive days of inflows, showing consistent demand even as the broader market grows cautious.

Source: Eric Balchunas

Bitcoin Supply Tightens as IBIT Gathers Holdings

Since its launch, IBIT has quickly absorbed a significant slice of the total Bitcoin supply. According to Arkham Intelligence, the fund currently holds 2.8% of all circulating BTC, meaning that nearly 3 out of every 100 bitcoins now sit inside BlackRock’s ETF vaults—held on behalf of clients, not the firm itself.

This scale of institutional accumulation is reshaping Bitcoin’s market dynamics, as large entities like BlackRock exert increasing influence over liquidity, price trends, and investor access.

The previous ETF benchmark, GLD, is still the largest physically backed gold ETF with around $100 billion in assets, but it’s been around since 2004. By comparison, IBIT’s rapid climb highlights just how quickly demand for regulated crypto exposure is rising.

Market Data Warns of Rising Risk for New Entries

Despite the bullish narrative around IBIT’s success, market indicators are flashing caution for new investors. One such metric, the 60-day Realized Cap Variance (RCV), has now exited the “buy” zone, suggesting that low-risk accumulation periods are over.

The RCV has crossed the 0.3 threshold, entering a neutral-to-elevated risk range. Though this isn’t yet a sell signal, it indicates that Bitcoin’s price momentum is getting hot, and new buyers may be chasing rather than timing the market well.

Analysts warn: “The earlier accumulation zone — when Bitcoin was relatively cheap and the momentum was building — is over.” While 30-day momentum remains positive, keeping the market just shy of a sell alert, any reversal could change that quickly.

To trigger a full sell signal, three factors need to align: RCV above +1, negative 30-day momentum, and a downward trend. These conditions haven’t emerged yet—but with Bitcoin prices elevated, smart money is beginning to scale back rather than pile in.

Macro Uncertainty Fuels Demand, But Sentiment Is Cooling

IBIT’s rise has also been aided by macro uncertainty, particularly linked to U.S. trade policies under President Donald Trump, which have driven both gold and Bitcoin performance in recent weeks. This kind of market fear often drives investors toward non-traditional, inflation-hedging assets, especially in ETF form.

Still, traders aren’t diving in like it’s early 2024. The current phase is being described as “risk-elevated but not overheated.” The smart move now, according to many analysts, is to watch the charts, look for momentum shifts, and consider profit-taking—not chase momentum-driven highs.