A Blockchain Revolution in La Paz

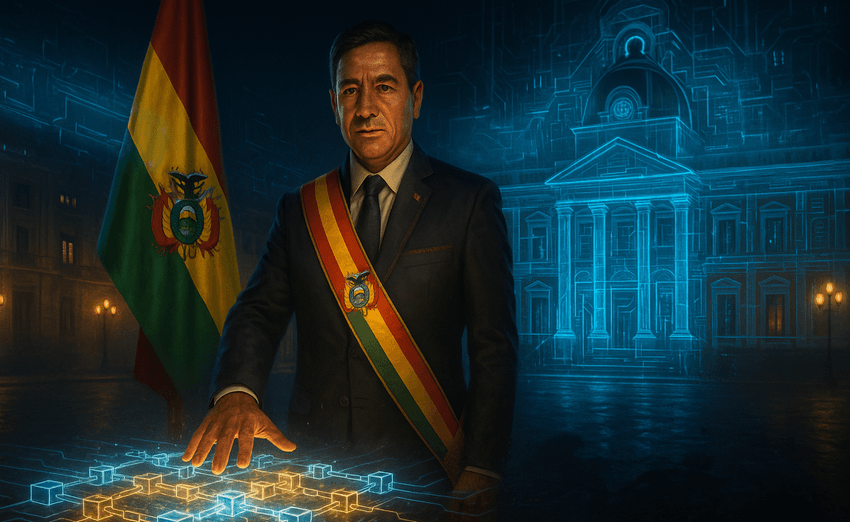

Bolivia’s President-elect Rodrigo Paz is turning to blockchain technology as his administration’s main weapon against corruption and economic instability.

After defeating Jorge Quiroga with 54.5% of the vote, Paz will officially take office on November 8, inheriting a country facing fuel shortages and a U.S. dollar crunch, according to the Associated Press. His reform agenda includes a pair of groundbreaking digital initiatives - both centered on transparency and modernization.

Blockchain Procurement to End Bribes and Backroom Deals

Paz’s first initiative is the integration of blockchain and smart contracts into public procurement processes. The move aims to remove human discretion from state purchases, ensuring transparency and traceability in how government contracts are awarded.

The plan is part of the Partido Demócrata Cristiano’s 2025 government platform, which pledges to use automated smart contracts to verify bidding procedures and eliminate loopholes that enable graft.

In Bolivia - where corruption scandals have long plagued ministries and municipal governments - a public, immutable record of contracts could be a game-changer. Each transaction would be timestamped, transparent, and publicly auditable, preventing manipulation by corrupt officials.

Crypto Assets to Strengthen Bolivia’s Currency Reserves

The second pillar of Paz’s blockchain agenda is a crypto-inclusive foreign-exchange stabilization fund, designed to shore up Bolivia’s reserves amid a persistent U.S. dollar shortage.

The initiative would allow citizens to declare crypto assets as part of an asset-regularization drive, helping the government broaden its taxable base and convert declared holdings into usable foreign currency when needed.

While Paz’s approach remains pragmatic - he’s not advocating Bitcoin adoption or state reserves in BTC - the move could legitimize crypto assets within Bolivia’s financial system for the first time.

From Crypto Ban to Blockchain Ally

Bolivia’s stance on digital assets has shifted dramatically in recent years. In June 2024, the Banco Central de Bolivia lifted its ban on crypto transactions, paving the way for regulated trading through licensed platforms.

By the end of that year, the country’s monthly crypto trading volumes doubled, signaling rising adoption. Local institutions such as Banco Bisa launched USDT custody services, while state-owned oil firm YPFB began exploring crypto payments for energy imports.

By September 2025, major companies - including Toyota, Yamaha, and BYD - started accepting USDT payments in Bolivia, reflecting a growing appetite for digital currencies.

Partnering with El Salvador and Building Trust

In a symbolic move, Bolivia’s central bank signed a memorandum of understanding with El Salvador in July, describing crypto as “a viable and reliable alternative to fiat.” The partnership focuses on policy collaboration and technology sharing to modernize Bolivia’s payment systems and enhance financial inclusion.

By mid-2025, the central bank reported $46.8 million in monthly crypto trading volumes and $294 million year-to-date, confirming the country’s transformation into one of Latin America’s emerging crypto hubs.

Rodrigo Paz’s upcoming presidency could now cement that position - using blockchain not as a buzzword, but as a practical instrument for reform.