Purpose XRP ETF Launches June 18 on Toronto Stock Exchange

Purpose Investments, one of Canada’s leading asset managers, has officially received final approval to launch the Purpose XRP ETF, making it the first XRP exchange-traded fund in North America. Starting June 18, the fund will trade under the tickers XRPP (CAD-hedged), XRPP.B (CAD), and XRPP.U (USD) on the Toronto Stock Exchange.

According to the company, this new fund offers direct exposure to spot XRP and will be eligible for registered investment accounts like TFSAs and RRSPs—making it both accessible and tax-efficient for Canadian investors.

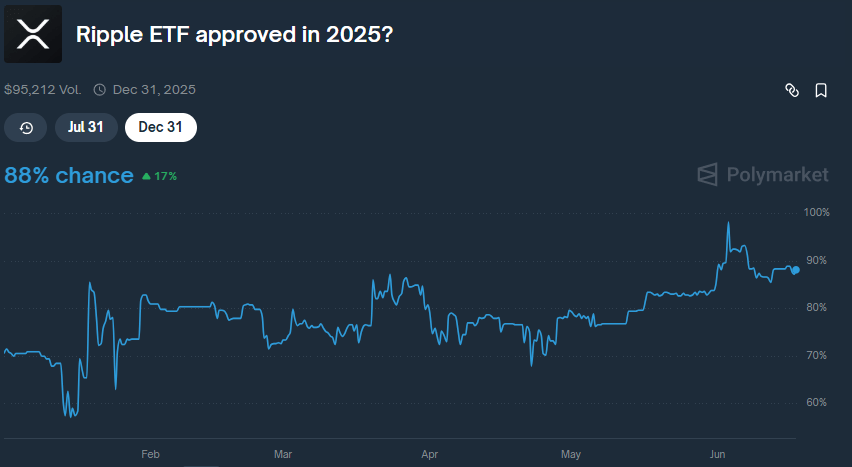

Source: Polymarket

A Transparent Way to Bet on XRP Growth

The ETF is designed to provide an easy, regulated gateway to XRP, which is the native token of the XRP Ledger—a decentralized blockchain tailored for fast and cost-effective cross-border payments.

Som Seif, CEO of Purpose Investments, has emphasized that this fund gives investors a familiar and regulated way to participate in XRP’s growth while reinforcing Canada’s leadership in crypto asset management.

He also noted that the fund will hold long-term Ripple assets, aimed at serving both retail and institutional investors looking for safe exposure to the XRP ecosystem.

XRP Leads Altcoins in ETF Filing Momentum

Interest in XRP ETFs is booming globally. According to Kaiko, XRP now has more ETF filings than any other altcoin, surpassing Solana, Dogecoin, and Litecoin. On Polymarket, odds for a U.S. spot XRP ETF approval surged to 98% in early June before dipping slightly to 88% this week.

The Canadian approval may further pressure U.S. regulators to move faster. As it stands, the U.S. Securities and Exchange Commission (SEC) has been slow to respond to Grayscale, Franklin Templeton, Bitwise, ProShares, and CoinShares—all of which have filed spot XRP ETF applications this year.

U.S. Regulatory Bottlenecks Hold Back Progress

The SEC is expected to review Franklin Templeton’s application by June 17, while ProShares has a firm deadline of June 25, after which no further delays will be allowed. Meanwhile, the Ripple vs. SEC case continues to cast a long shadow over XRP’s regulatory status.

Although a $50 million settlement was reached in March, Judge Analisa Torres temporarily rejected a motion to amend the judgment in May. A second joint motion filed on June 12 seeks to lift XRP’s sales ban to institutions and reduce the originally proposed $125 million fine.

The court has given the SEC a June 16 deadline to submit a procedural status report to the U.S. Court of Appeals.

Canada’s Crypto Edge: First to Launch, First to Lead

Canada is once again ahead of the U.S. when it comes to regulated crypto ETFs. The country was also the first to approve Bitcoin and Ethereum spot ETFs, and now it's leading with XRP.

With this launch, Purpose Investments is capitalizing on the rising institutional demand for Ripple-related exposure and the momentum generated by Trump’s return to the White House and the resignation of SEC Chair Gary Gensler.

As the U.S. continues to stall, Canada is taking the reins, positioning itself as a global hub for compliant digital asset investment vehicles.