Beijing Prepares to Lift Crypto Freeze

In a dramatic policy reversal, China is preparing to legalize yuan-pegged stablecoins before the end of August, according to a report from Reuters. If approved by the State Council, this would mark the end of a 12-year ban on crypto operations in the country, including the sweeping 2021 crackdown that outlawed mining and trading.

Officials are reviewing a proposal that not only defines the roles of domestic regulators but also sets benchmarks for using the yuan in international transactions. The plan includes strict safeguards for capital flow monitoring and cross-border compliance.

A high-level meeting is scheduled this month to discuss the yuan’s global role, with senior officials expected to speak publicly for the first time about how stablecoins can operate in China without undermining state control.

Dollar Dominance Drives Policy Shift

The timing reflects Beijing’s mounting concern over U.S. dollar-backed stablecoins, which now dominate international payments. Chinese exporters have increasingly turned to dollar-pegged tokens, putting pressure on Beijing to offer an alternative.

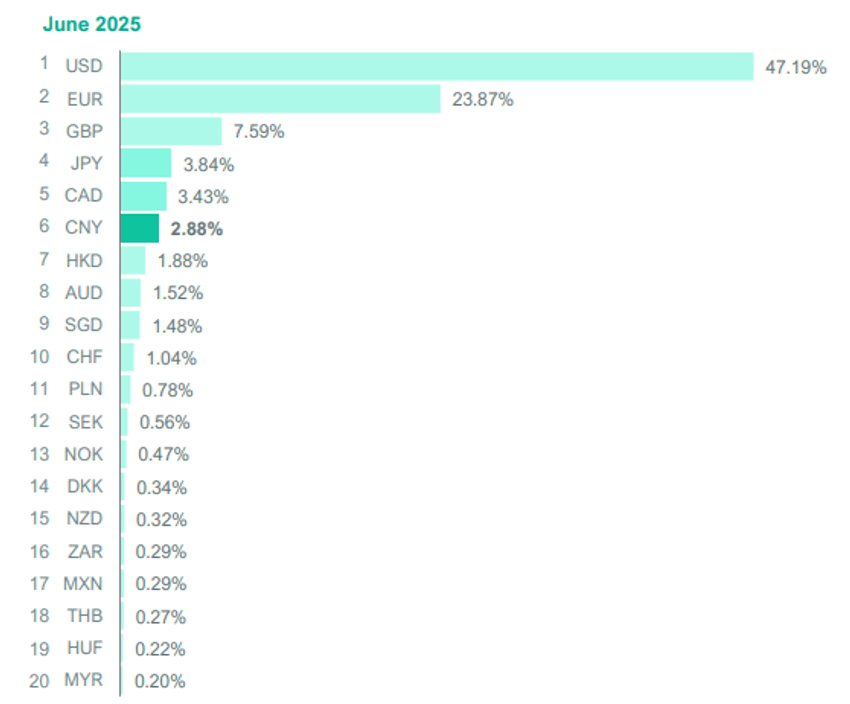

Despite being the world’s second-largest economy, the yuan’s global presence remains limited. According to SWIFT data from June, the yuan made up just 2.88% of global payments, compared with the dollar’s massive 47.19% share.

His comments highlight how Beijing views stablecoins as a tool to chip away at U.S. dominance in global trade while avoiding fully opening its capital account.

Source: Swift

Hong Kong and Shanghai Take the Lead

The rollout strategy designates Hong Kong and Shanghai as testing grounds for the stablecoin initiative. Both regions are already preparing infrastructure, with Hong Kong’s stablecoin ordinance taking effect on August 1, making it one of the few jurisdictions worldwide with clear fiat-backed crypto rules.

Meanwhile, Shanghai is developing an international hub for the digital yuan and recently hosted a meeting to examine how local governments should manage stablecoins. The PBOC will serve as the lead agency overseeing enforcement and technical standards.

Global Stage: The SCO Summit

Beijing is expected to showcase its stablecoin ambitions at the Shanghai Cooperation Organisation (SCO) Summit in Tianjin from August 31 to September 1. Officials are likely to use the gathering to promote yuan-based payment systems and explore cooperation with other nations.

Currently, U.S. dollar-pegged stablecoins account for more than 99% of the $247 billion global stablecoin market, according to the Bank for International Settlements. The dominance has alarmed Beijing, especially as stablecoins increasingly power daily international transactions.

Regional Race to Stablecoins

China isn’t alone in this race. South Korea is finalizing a won-based stablecoin framework, while Japan is exploring its own models. Analysts expect the market to balloon. Standard Chartered projects stablecoins will reach $2 trillion in value by 2028, making early adoption crucial for nations aiming to shape the digital finance landscape.

For President Xi Jinping, the legalization of yuan-pegged stablecoins is about more than just crypto. It represents a strategic play to globalize the yuan—without ceding control over capital movement.