Historic Inflows Amid Market Turbulence

In a landmark week for the crypto market, digital asset investment products recorded $5.95 billion in inflows, the largest ever, according to CoinShares’ latest report. The massive spike, ending Friday, came as fears of a U.S. government shutdown and a Federal Reserve rate cut fueled demand for crypto exposure.

The sudden wave of institutional and retail investment helped push Bitcoin to a new all-time high above $125,000 on Saturday, highlighting renewed optimism across the market.

Bitcoin Dominates the Inflows

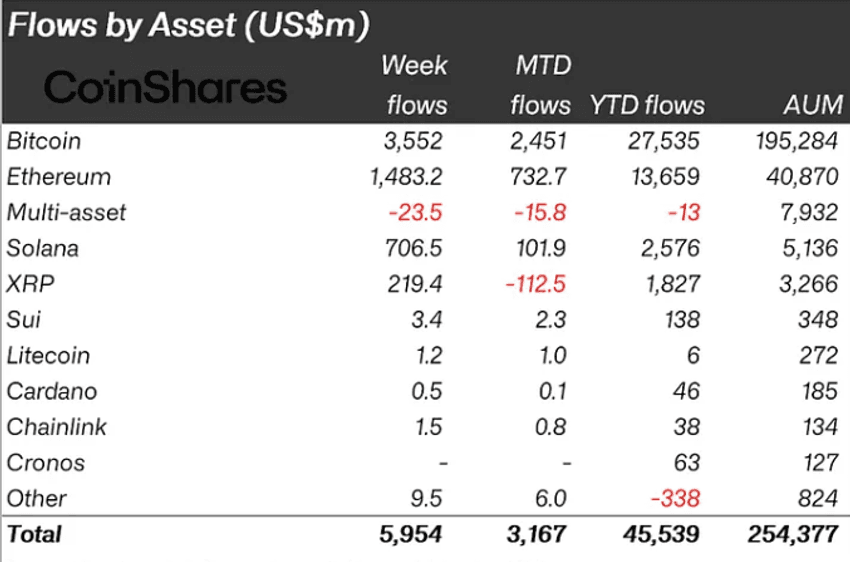

While nearly all major crypto assets saw inflows, Bitcoin led the charge with a record-breaking $3.6 billion — more than half of the week’s total. The inflows shattered the previous all-time record from July, which stood at $4.4 billion across all crypto products. Butterfill noted that despite Bitcoin’s price nearing all-time highs, investors did not flock to short products, signaling strong bullish sentiment.

Ether followed with $1.48 billion in inflows, pushing its year-to-date total to $13.7 billion — nearly triple 2024’s record. Meanwhile, Solana (SOL) saw an impressive $706.5 million, and XRP added $219.4 million, both setting personal bests.

With these inflows, total assets under management (AUM) in crypto funds hit an unprecedented $254.4 billion, officially crossing the $250 billion milestone for the first time.

Source: CoinShares

Shutdown Sparks ETF Approval Delays

The record inflows came even as the U.S. Securities and Exchange Commission (SEC) halted most operations amid the government shutdown, raising fears of delays in ETF approvals expected this October.

While the SEC retains authority over fraud and market emergencies, routine reviews and filings are now expected to face temporary hold-ups.

Eleanor Terrett of Crypto in America confirmed that the SEC’s reduced operations may slow the launch of several pending spot crypto ETFs.

Even with the uncertainty, market momentum hasn’t stopped. The crypto sector continues to expand, and institutional confidence appears unshaken.

Grayscale Pushes Forward With New Crypto ETFs

Despite the shutdown, Grayscale Investments, the second-largest U.S. crypto ETF issuer after BlackRock, announced two new Ethereum-based exchange-traded funds on Monday.

The products — Grayscale Ethereum Mini Trust ETF (ETH) and Grayscale Ethereum Trust ETF (ETHE) — mark the first U.S.-listed spot crypto ETPs to enable staking rewards alongside market exposure.

The move is being hailed as a bold step forward for crypto ETFs, offering investors a dual benefit of staking yield and price appreciation.

A Market on Fire Despite Uncertainty

With Bitcoin at record highs, institutional inflows soaring, and new ETFs breaking ground, the crypto market appears to be entering a fresh bull phase. Analysts say investors are increasingly viewing digital assets as safe-haven alternatives, particularly during periods of political and fiscal instability.

Whether the momentum will continue likely depends on how long the U.S. shutdown lasts — and how quickly regulators catch up once the lights are back on.