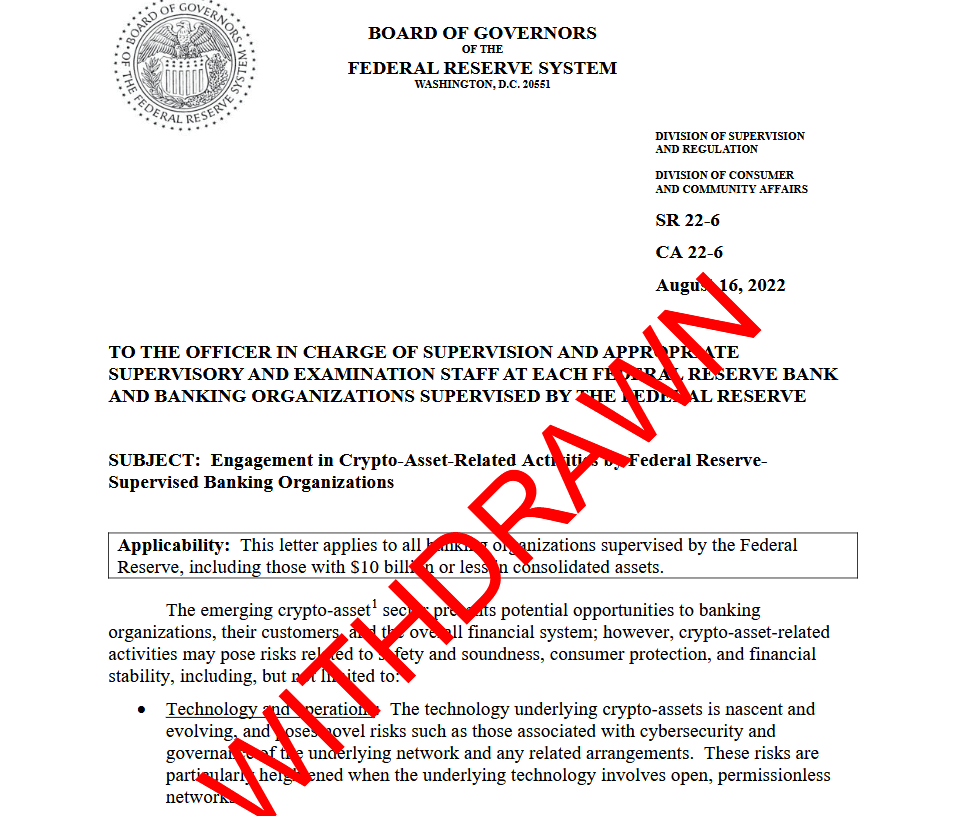

Fed Pulls the Plug on Anti-Crypto Banking Rules

In a historic policy reversal, the Federal Reserve announced it will no longer require banks to give advance notice before engaging in crypto or stablecoin activities. Instead, digital asset ventures will now be monitored just like any other traditional banking services. This move officially ends what many in the industry called "Operation Chokepoint 2.0," a set of practices that critics say discriminated against crypto businesses by cutting off their access to banking.

The decision comes after similar steps from the FDIC and the Office of the Comptroller of the Currency (OCC), signaling a unified shift in Washington's attitude toward crypto under President Donald Trump.

"The central bank is moving in the right direction," said a crypto banking advocate, reflecting the relief across the industry.

@federalreserve announces the withdrawal of guidance for banks related to their crypto-asset and dollar token activities and related changes to its expectations for these activities: https://t.co/v1MwuswOlE

— Federal Reserve (@federalreserve) April 24, 2025

@federalreserve announces the withdrawal of guidance for banks related to their crypto-asset and dollar token activities and related changes to its expectations for these activities: https://t.co/v1MwuswOlE

— Federal Reserve (@federalreserve) April 24, 2025

Source: Federal Reserve

From Crackdown to Clarity: The Fall of 'Operation Chokepoint 2.0'

Back in 2023, after the collapse of FTX, U.S. regulators issued stern warnings, labeling crypto activities as high-risk and "likely inconsistent with safe banking practices." Banks were forced to notify regulators before touching anything crypto-related. That guidance is now rescinded. For years, crypto firms complained they were denied basic banking services purely due to their connection with digital assets. This rollback is seen as a major win for financial freedom and innovation in the U.S.

What Changes — And What Doesn't

While the Fed's announcement is a breakthrough, it doesn’t solve everything. One major hurdle remains: master accounts. Crypto-focused banks like Custodia and Kraken Financial still face roadblocks in securing these crucial accounts, which provide direct access to the Fed’s services and allow banks to operate nationwide. So, while banks can now engage in crypto without fear of regulatory backlash, full integration into the U.S. banking system is still a work in progress.

A New Era for Crypto and Banking Relations

This policy shift highlights how rapidly the landscape is changing under Trump’s administration. After years of skepticism and regulatory overreach, the U.S. banking system appears poised to embrace digital assets—or at least stop treating them like a threat. Still, with Fed Chair Jerome Powell known for his independence, the industry remains cautious. But for now, the removal of these restrictions marks a turning point in crypto’s fight for legitimacy within traditional finance.