Figma Bets Big on Bitcoin Ahead of Public Debut

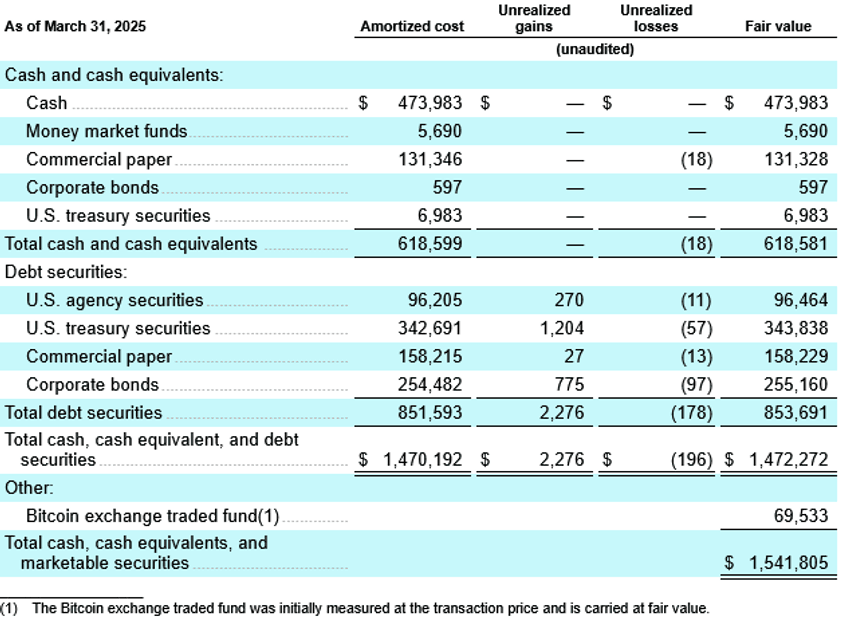

Design platform Figma has just filed to go public - and it’s not entering the market empty-handed. According to a regulatory filing submitted to the SEC, the company disclosed $69.5 million worth of Bitcoin ETFs on its balance sheet and another $30 million in USDC that it plans to convert into Bitcoin soon.

This move officially places Figma in the growing list of tech firms adding crypto to their treasuries, a trend that’s gaining serious momentum in 2025. The company filed to list on the New York Stock Exchange under the ticker “FIG”, signaling not just a financial pivot but also a philosophical one: embracing Bitcoin as a strategic corporate reserve asset.

Details of the Bitcoin Holdings

Figma’s Bitcoin play began in March 2024, when it invested $55 million into the Bitwise Bitcoin ETF (BITB). By the end of Q1 2025, that position had appreciated to $69.5 million, netting the firm an unrealized gain of 26% in just one quarter.

But the firm isn’t stopping there. On May 8, 2025, Figma’s board greenlit a $30 million allocation to Bitcoin. The company purchased 30 million USDC - a dollar-pegged stablecoin - and confirmed its intention to convert the stablecoin holdings into BTC at a later date.

Bitwise CEO Hunter Horsley praised the move, highlighting how Figma has dedicated roughly 5% of its corporate treasury to Bitcoin, calling it a “forward-thinking” allocation that’s increasingly popular among public companies.

From Adobe Block to Bitcoin Bet

This IPO and crypto pivot follow the collapse of a $20 billion acquisition deal by Adobe. Originally announced in 2022, Adobe’s bid to buy Figma was blocked by EU and UK regulators over monopoly concerns and valuation skepticism.

When the deal was formally called off in December 2023, Adobe had to pay $1 billion in termination fees - cash that now appears to have helped fund Figma’s bold entrance into the Bitcoin game.

Rather than being absorbed by a tech titan, Figma has chosen to chart its own course - and crypto is now part of the roadmap.

Figma Bitcoin Holdings. Source: SEC Filings

A Growing Corporate Trend Toward Crypto Treasuries

Figma is far from alone. Earlier this week, Strategy (formerly MicroStrategy) revealed it had acquired another $531 million in Bitcoin, pushing its total to a jaw-dropping 597,000 BTC.

Likewise, Japan’s Metaplanet just purchased 1,005 BTC for $108 million, leapfrogging Cleanspark to become the fifth-largest corporate Bitcoin holder globally.

And it’s not just Bitcoin anymore - some companies are also turning to Ethereum. Mining firm BitMine Immersion Technologies recently raised $250 million to initiate an ETH-focused treasury strategy, marking a broader shift in how companies approach digital assets.

Figma’s IPO Could Spark More Corporate Crypto Holdings

With its IPO in motion and a sizable crypto position already in place, Figma may set a precedent for other mid-sized tech firms heading to public markets. The combination of Bitcoin ETFs and stablecoin-based purchasing strategies gives firms flexibility, transparency, and potentially lucrative upside.

As corporate America continues warming to crypto as a treasury tool, Figma’s move may soon become the norm - not the exception.