Stock Markets Rally

Global stocks rose for a second consecutive day on Tuesday, tracking Wall Street’s gains. Investors focused on interest rates, consumer spending, and US home construction data.

The S&P 500 climbed 0.64% to 5,675.12, the Nasdaq added 0.31%, and the Dow jumped 353 points to 41,841.63, led by Walmart and IBM.

Treasury Yields and Fed Policy

US Treasury yields edged lower as the Federal Reserve began its two-day policy meeting. The 10-year yield dipped to 4.3%, while the 2-year yield fell to 4.042%.

The Fed is expected to keep rates steady, but investors are closely watching Jerome Powell’s remarks for policy hints.

Economic uncertainty has increased with Trump’s planned tariffs, prompting the OECD to downgrade US growth forecasts.

Global Markets Follow Wall Street

Asian and European markets mirrored US gains. Hong Kong’s Hang Seng surged 2.29%, fueled by a 12.11% rise in Baidu. Japan’s Nikkei 225 gained 1.20%, and South Korea’s Kospi ended flat.

In Europe, stocks climbed amid hopes of stable monetary policies. India’s Nifty 50 rose 1.20%, and the BSE Sensex added 1.07%.

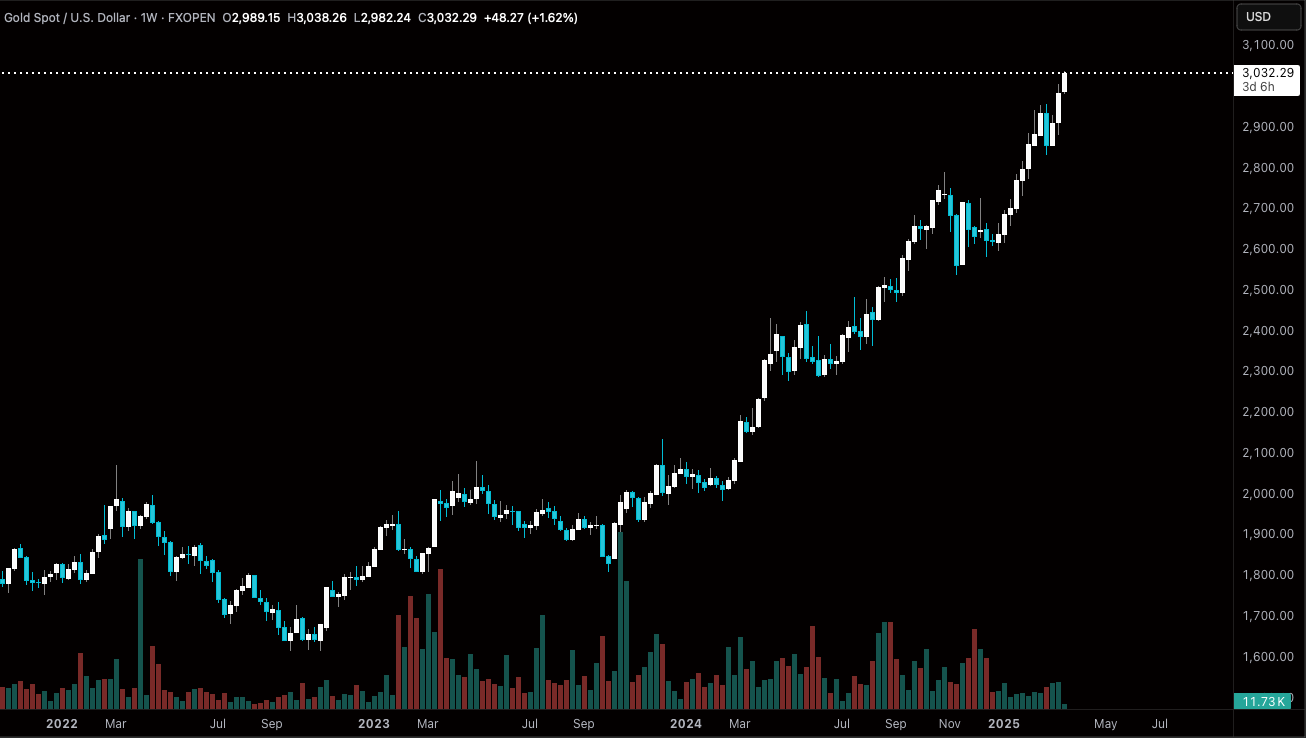

Gold Hits Record High

Gold surged past $3,032 per ounce, driven by investor demand for safe-haven assets. The metal has gained 14% this year as fears of inflation and economic instability grow.

Trump’s trade policies have increased market volatility, prompting major banks to raise gold price forecasts. Since Trump’s re-election, over $70 billion worth of gold has moved into US reserves.

Outlook

Markets remain volatile as investors await key economic data and further policy decisions. The White House’s tariff plans, set for April 2, could shape future market trends.