Japan Prepares Its Most Ambitious Crypto Reform in Years

Japan’s Financial Services Agency (FSA) is preparing a landmark overhaul of the country’s crypto regulatory framework, proposing to classify digital assets as “financial products” under the nation’s Financial Instruments and Exchange Act. The move marks one of Japan’s most significant steps toward creating a structured, investor-protection-focused digital asset market, especially as global regulators sharpen their stance.

According to a report from Asahi Shimbun, the FSA plans to treat major cryptocurrencies-including Bitcoin and Ether-with the same rigor applied to securities and investment products, a shift that would impose stricter rules, deeper transparency, and far heavier oversight on exchanges and issuers than ever before.

Mandatory Disclosures and Insider-Trading Rules Target Exchange Transparency

Under the proposal, all exchanges operating in Japan would be required to provide detailed disclosures for 105 approved cryptocurrencies-from issuance structure to blockchain mechanics to volatility characteristics.

The FSA is also preparing to introduce insider-trading regulations for crypto for the first time in the country’s history. Individuals or entities with access to non-public listing information, delisting decisions, or issuer stress would be legally barred from trading those assets.

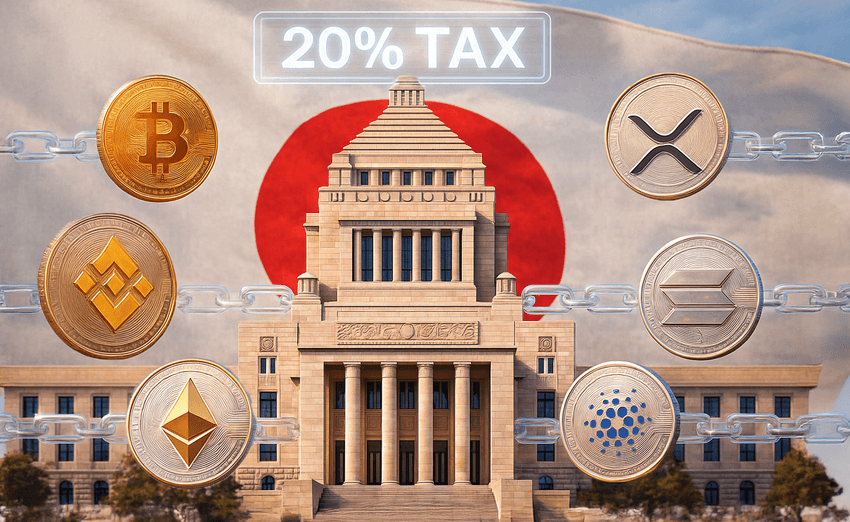

Japan’s High Crypto Tax Burden May Soon Fall to 20%

One of the most significant reforms is the FSA’s push to cut Japan’s notoriously high crypto taxes. Under current rules, crypto gains are treated as miscellaneous income, meaning top-tier traders can be taxed up to 55%-the harshest among major economies.

The new plan would tax gains on the approved 105 tokens at a flat 20% rate, aligning crypto with the tax structure used for stocks and investment trusts.

For traders and institutional investors, this represents a massive shift, potentially unlocking higher liquidity and new market participation in Japan’s evolving digital asset sector.

Japan Considers Letting Banks Hold Bitcoin

In a parallel development, the FSA is weighing whether to allow Japanese banks to directly hold Bitcoin and other cryptocurrencies. Currently, banks are effectively barred from holding digital assets due to volatility risk.

The regulator is also exploring whether banking groups should be allowed to register as licensed crypto exchanges, enabling them to offer trading and custody services under a single regulatory umbrella.

Industry leaders view these discussions as a sign that Japan may be preparing for a future where traditional finance and blockchain markets converge more closely than ever before.

What Comes Next: Timeline and Legislative Path

The FSA intends to submit the crypto-related legal revisions to Japan’s main parliamentary session in 2026. The reforms would give the regulator expanded authority to monitor, classify, and discipline crypto markets, while harmonizing local rules with global best practices emerging in regions such as the EU, the U.S., and Singapore.

For Japan’s fast-growing digital asset sector, the package signals a clear regulatory direction, blending investor protection, institutional integration, and long-term market growth.