FSA Proposal Aims to Transform Crypto’s Legal Status

Japan’s Financial Services Agency (FSA) has dropped a game-changing proposal: reclassify cryptocurrencies as financial products under the Financial Instruments and Exchange Act (FIEA). This bold move would align crypto with traditional assets like stocks and bonds, setting the stage for a flat 20% capital gains tax—a massive drop from the current progressive tax system where rates soar up to 55%.

The proposal would not only ease the tax burden but also legitimize crypto investment vehicles such as exchange-traded funds (ETFs) in Japan for the first time. With the crypto ETF market booming in the U.S. and Europe, Japan is now gearing up to catch the wave, potentially unlocking billions in new inflows.

12 Million Accounts, $34B in Assets — Crypto Goes Mainstream

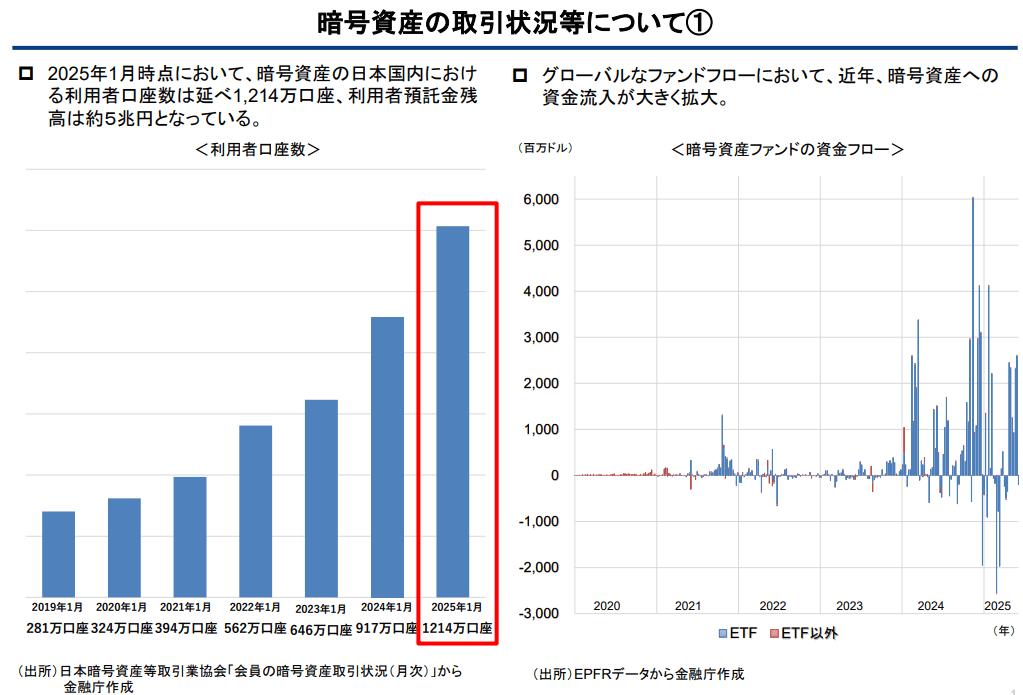

The FSA’s timing couldn’t be better. As of January 2025, over 12 million active crypto accounts were registered in Japan, holding more than ¥5 trillion ($34 billion) in assets. Crypto ownership is now outpacing traditional investments like forex and corporate bonds, especially among younger, tech-savvy investors.

According to the FSA, this rise in adoption demonstrates that digital assets are now core to retail investment portfolios. The proposed reclassification recognizes this shift and seeks to provide clarity and consistency in regulation.

Crypto adoption in Japan passes 12M accounts, fueled by ETF momentum. Source: FSA

Institutional Push

The FSA is also keen to mirror global trends. With more than 1,200 financial institutions, including Goldman Sachs and U.S. pension funds, already exposed to U.S.-listed spot Bitcoin ETFs, Japan wants a slice of the same institutional momentum.

If the proposal is passed, it would unlock the path for domestic crypto ETFs, encouraging institutional participation while creating new regulated vehicles for long-term exposure.

SMBC, Ava Labs Dive Into Stablecoins

Separately, traditional finance giants are already exploring the digital frontier. In April, Sumitomo Mitsui Financial Group (SMBC), alongside TIS Inc., Ava Labs, and Fireblocks, signed a Memorandum of Understanding to commercialize stablecoins pegged to both the Japanese yen and U.S. dollar.

The group’s roadmap includes using stablecoins to settle tokenized real-world assets like real estate, stocks, and bonds—a leap toward on-chain finance for Japan’s institutional sector.

In March, Japan’s first stablecoin license was issued to SBI VC Trade, a subsidiary of SBI Holdings, which confirmed it’s preparing to support USDC transactions domestically.

“New Capitalism” Strategy

The crypto reclassification effort is part of Japan’s wider “New Capitalism” vision, championed by Prime Minister Kishida, which seeks to revitalize the economy through innovation and investment.

By turning crypto into a regulated financial product and reducing tax barriers, Japan hopes to attract global capital, encourage fintech startups, and build a future-ready digital economy.