Inside MARA’s $2 Billion Equity Program

On March 28, MARA Holdings filed with the U.S. Securities and Exchange Commission (SEC) to confirm its new at-the-market (ATM) equity program. The initiative allows the company to issue up to $2 billion in common stock through investment banks like Barclays, Cantor Fitzgerald, BMO Capital Markets, and BTIG.

Proceeds from this offering will primarily be used to purchase Bitcoin and maintain corporate liquidity. This replaces MARA’s previous $1.5 billion ATM program from October 2023.

The shift highlights MARA’s preference for acquiring Bitcoin directly rather than relying solely on mining, especially in a post-halving environment where mining costs have surged.

Institutional Demand Surges: Coinbase Prime Inflows

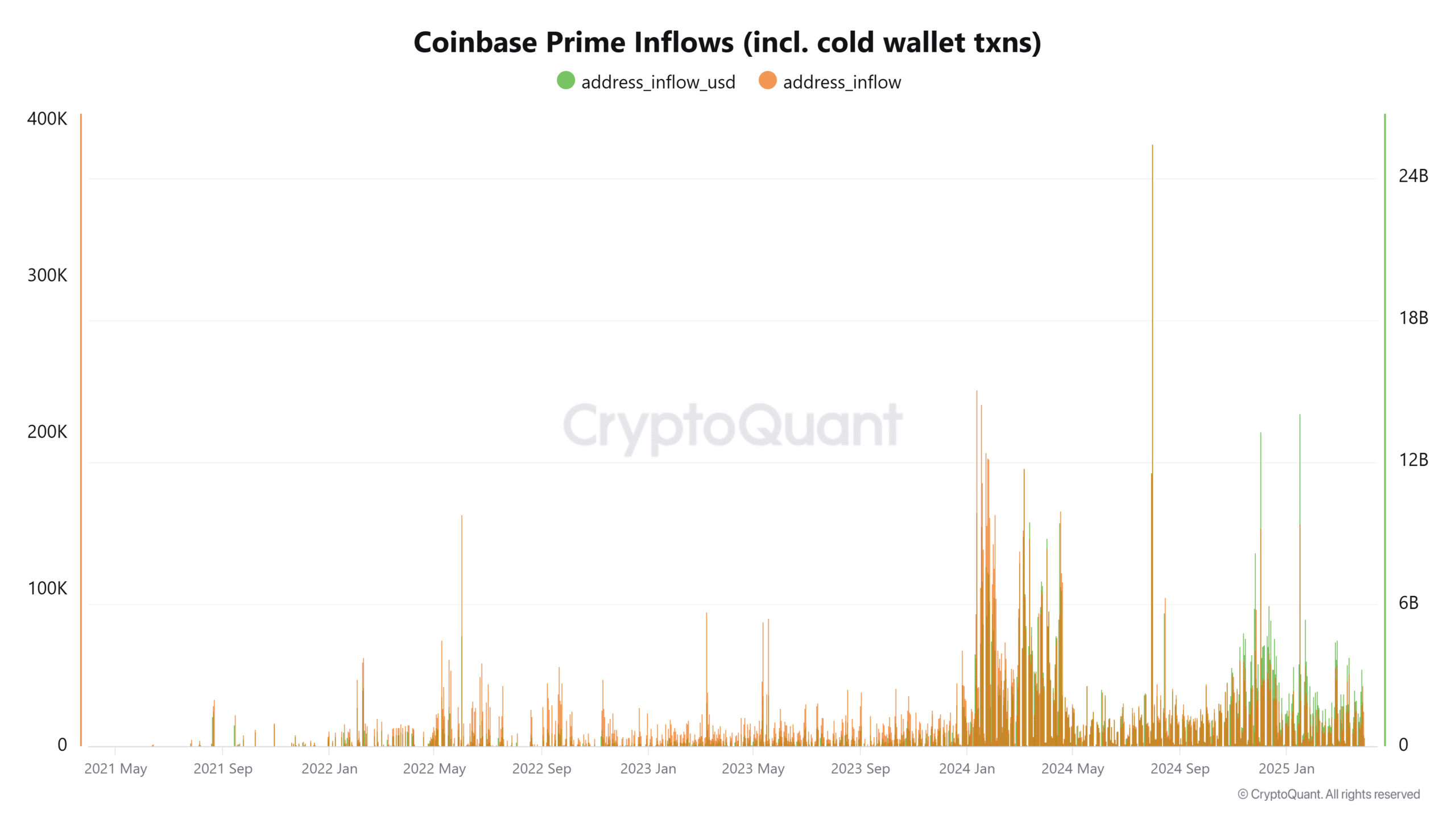

One indicator supporting MARA’s decision is the rising inflows into Coinbase Prime, a platform used by institutions for large-scale BTC transactions. Recent CryptoQuant data reveals multi-billion-dollar BTC inflows into Coinbase Prime, signaling significant over-the-counter (OTC) purchases. Such trades allow institutions to accumulate Bitcoin discreetly, reducing market slippage and volatility.

Source: CryptoQuant

MARA’s Expanding BTC Reserves

Currently, MARA holds 46,376 BTC, valued at approximately $3.9 billion, making it the second-largest publicly held Bitcoin treasury after MicroStrategy. CEO Fred Thiel previously announced MARA’s transition to a "full HODL" strategy, opting to accumulate Bitcoin rather than selling mined BTC. The latest stock offering aligns with this long-term vision.

A Strategic Bitcoin Bet

By leveraging corporate financing to expand its BTC holdings, MARA solidifies its position as a major institutional player in the Bitcoin economy. As institutional accumulation grows, MARA’s bet on Bitcoin could pay off significantly in the long run.