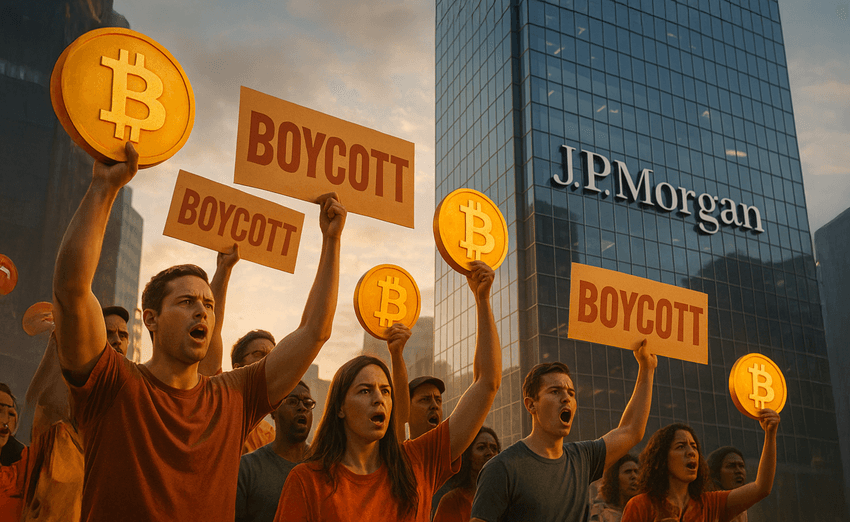

JPMorgan Faces Boycott Calls Amid Index Shake-Up

The Bitcoin community and supporters of Strategy - one of the largest BTC-treasury companies - erupted in anger on November 23, calling for a full-scale boycott of JPMorgan. The uproar began after a leaked report revealed that MSCI, one of the world’s most powerful index providers, plans to remove crypto-heavy treasury companies from its stock indexes starting January 2026.

MSCI indexes are massively influential, steering billions in passive capital from pension funds, ETFs, and institutional allocators. Removal often triggers forced sell-offs, shrinking liquidity and damaging valuation.

According to insiders, JPMorgan shared this information first in a research note, intensifying the backlash against the banking giant

Response to MSCI Index Matter

— Michael Saylor (@saylor) November 21, 2025

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

This year alone, we’ve completed…

Response to MSCI Index Matter

— Michael Saylor (@saylor) November 21, 2025

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

This year alone, we’ve completed…

Bitcoin Advocates Mobilize Against the Banking Giant

The leak immediately sparked outrage, leading prominent crypto figures to rally for a boycott. Real-estate tycoon and Bitcoin advocate Grant Cardone claimed he struggled to withdraw $20 million from JPMorgan, alleging obstruction and vowing legal action.

Responding to Cardone, long-time BTC voice Max Keiser encouraged him to “take down JPMorgan” and move his capital into Strategy and Bitcoin instead.

Industry analysts warned that if MSCI goes forward with its plan, fund managers tracking MSCI indexes will be forced to divest holdings, potentially triggering broad sell pressure that could ripple across the entire digital-asset market.

JUST IN: Large numbers of users are allegedly rushing to close accounts at JP Morgan following a premeditated attack on $MSTR shareholders. pic.twitter.com/396wK1ToGi

— The ₿itcoin Therapist (@TheBTCTherapist) November 23, 2025

JUST IN: Large numbers of users are allegedly rushing to close accounts at JP Morgan following a premeditated attack on $MSTR shareholders. pic.twitter.com/396wK1ToGi

— The ₿itcoin Therapist (@TheBTCTherapist) November 23, 2025

Strategy’s Nasdaq Milestone Now in Jeopardy

Strategy - the BTC-treasury firm at the center of the controversy - was added to the Nasdaq 100 in December 2024, a move that granted it access to billions in passive investment inflows.

That achievement is now at risk. The proposed MSCI policy would classify any company holding over 50% of its balance sheet in crypto as ineligible for index inclusion.

Affected companies would face a brutal choice:

- Shrink their crypto holdings to remain listed,

or

- Lose access to passive capital from some of the world’s biggest funds.

Michael Saylor Pushes Back on MSCI Policy

Strategy founder Michael Saylor responded sharply to the leaked proposal, stressing that Strategy is not a fund or trust, but a “Bitcoin-backed structured finance company.”

He emphasized that applying fund-style rules to active crypto-treasury companies is misguided, and warned that forcing such firms to unwind their BTC positions could spark widespread market instability.

Industry Fears Market Shock if MSCI Pushes Ahead

Analysts caution that the MSCI rule change could trigger:

- Automated stock sell-offs

- Reduced liquidity for crypto-treasury firms

- Downward pressure on Bitcoin and related assets

The uncertainty surrounding the potential policy shift has already ignited debate across the industry, with Bitcoin supporters accusing JPMorgan and MSCI of attempting to undermine crypto-native firms through regulatory and indexing pressure.