Strategy Reports Massive Bitcoin Losses—but Ramps Up BTC Strategy

Strategy Inc., formerly known as MicroStrategy, is leaning deeper into its Bitcoin-maximalist playbook, announcing plans to raise another $21 billion via common stock offerings. This bold move comes right after the company reported a Q1 2025 loss of $5.8 billion, driven by the sharp drop in Bitcoin’s price during the quarter. The loss translates to $16.49 per share, yet it hasn’t deterred the firm’s leadership. Executive Chairman Michael Saylor confirmed on X that the capital raise will support further BTC acquisitions, continuing the company’s long-standing strategy of using equity to fund Bitcoin purchases.

$MSTR announces BTC Yield of 13.7% and BTC $ Gain of $5.8B year-to-date, doubles capital plan to $42B equity and $42B fixed income to purchase bitcoin, and increases BTC Yield target from 15% to 25% and BTC $ Gain target from $10B to $15B for 2025. https://t.co/LgeMEd6Dr5

— Michael Saylor (@saylor) May 1, 2025

$MSTR announces BTC Yield of 13.7% and BTC $ Gain of $5.8B year-to-date, doubles capital plan to $42B equity and $42B fixed income to purchase bitcoin, and increases BTC Yield target from 15% to 25% and BTC $ Gain target from $10B to $15B for 2025. https://t.co/LgeMEd6Dr5

— Michael Saylor (@saylor) May 1, 2025

Bitcoin Losses Won’t Stop the Buying Spree

Despite Bitcoin’s price dip, Strategy now holds around 554,000 BTC, valued at nearly $53 billion at current market rates. The company has aggressively issued equity to grow its holdings, already raising $20.9 billion under its at-the-market (ATM) equity offering program. The average purchase price for Strategy’s Bitcoin holdings stands at $68,459, as of April 28. The company has just $128 million left in common shares to issue under the current program, but the new $21 billion offering aims to expand its buying power even further.

In a press statement, CEO Phong Le highlighted the firm’s position in the global Bitcoin treasury movement:

Record Equity Execution and Soaring Share Price

Even amid losses, Strategy’s equity strategy has delivered results.

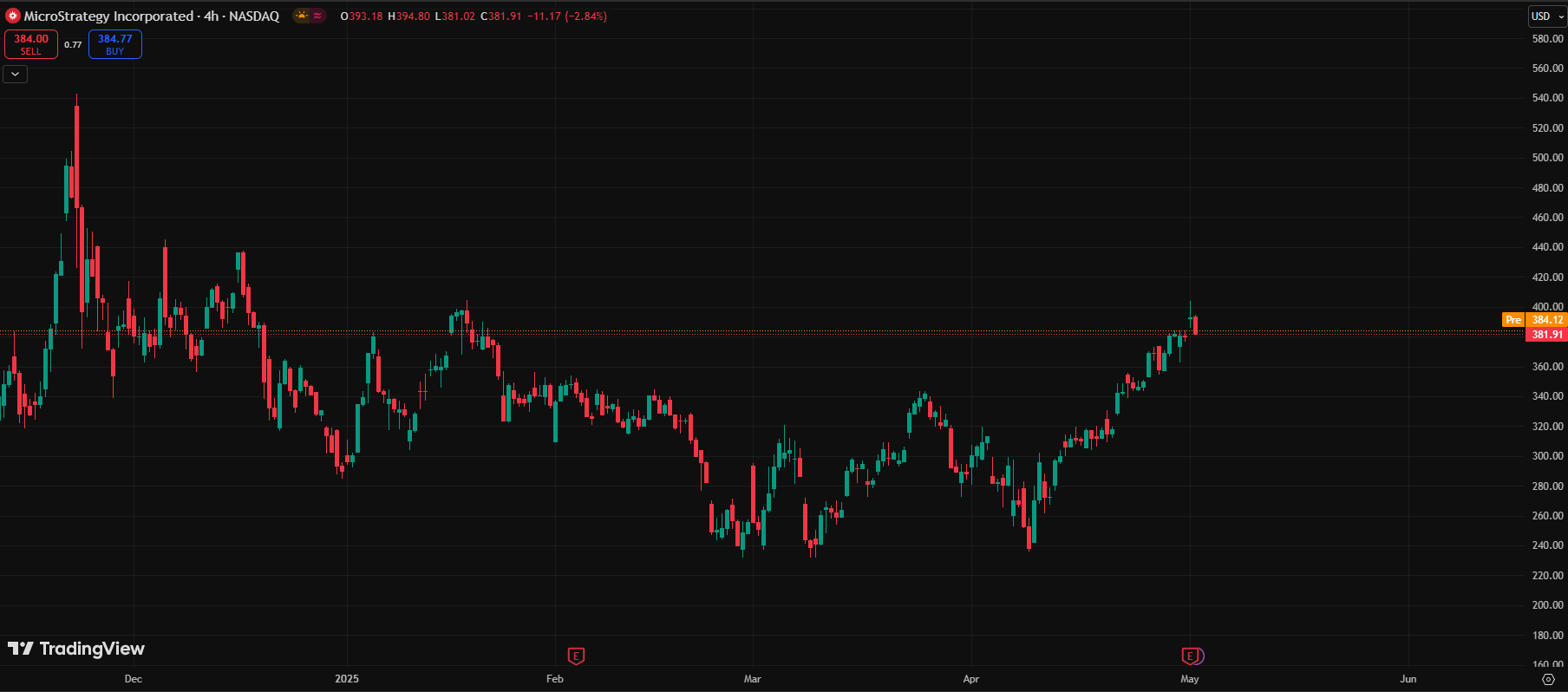

The company's Q1 revenue dropped 3.6% year-over-year to $111 million, but its subscription services revenue grew sharply, up 61.6% to $37.1 million. Strategy shares (MSTR) closed the day at $381.60, slightly up on the day, and came close to hitting $404, thanks to tech sector momentum driven by strong Meta and Microsoft earnings.

Source: TradingView

Bitcoin Price Climbs After Q1 Slump

Bitcoin itself has rebounded strongly since the start of Q2. As of the latest data, BTC trades at around $96,600, showing a 2.1% daily gain and a 13% rise over the last month, recovering from the post-inauguration price slump earlier this year. While Strategy’s big BTC bet remains high-risk, the company clearly believes long-term accumulation outweighs short-term volatility.