AFT Pushes Back Against Crypto Market Structure Bill

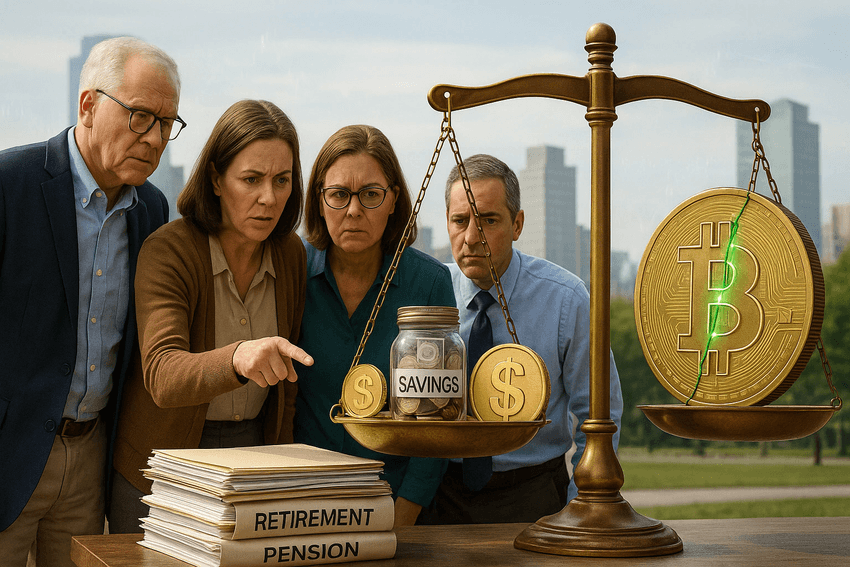

The American Federation of Teachers (AFT) has stepped directly into Washington’s crypto policy fight, warning senators that a proposed market structure bill could endanger the retirement security of millions of U.S. workers. In a letter sent to Senate Banking Committee leaders, the union said the legislation poses “profound risks” to financial stability and pension safety.

The union specifically criticized the Responsible Financial Innovation Act, a Senate bill modeled in part on the House’s CLARITY Act, arguing that lawmakers are attempting to treat digital assets as if they were ordinary, low-risk financial products.

AFT represents 1.8 million educators, healthcare workers, and public-service employees, many of whom rely on long-term pensions and 401(k)s for retirement.

Union Says Pensions Could Be Exposed Indirectly

While neither the CLARITY Act nor the Senate’s draft explicitly forces retirement plans to hold crypto, the AFT insists the regulatory changes could open the door indirectly, pushing pensions toward risks they were never designed to absorb.

This echoes warnings from the AFL-CIO, which in October argued that the Senate’s proposal would “increase workers’ exposure” by normalizing digital assets across financial markets. The labor group said the bill could destabilize a retirement system with more than $6.5 trillion in public pension assets.

The concern is simple: if crypto becomes embedded in mainstream financial products, retirement funds could be pulled in - even if they never buy tokens directly.

Pension Funds Avoid Crypto for a Reason, AFT Argues

The AFT emphasized that most pensions currently avoid crypto entirely because of extreme volatility, repeated exchange failures, and a lack of tested regulations. By approving a market-structure regime that treats crypto more like traditional securities, the union says lawmakers may inadvertently give the appearance of safety where none exists.

Their argument: crypto remains uniquely unstable, and creating a looser regulatory environment increases the chances it leaks into retirement portfolios via ETFs, funds, derivatives, and institutional products.

Meanwhile, Trump Pushes for Crypto in 401(k)s

The Senate’s legislative debate comes as President Donald Trump is attempting to reshape retirement rules through executive action. In August, he ordered the Department of Labor to re-evaluate restrictions on digital assets in 401(k) plans and other defined-contribution accounts.

Major financial institutions are already moving in that direction.

- Morgan Stanley now allows advisers to recommend crypto-linked funds for retirement clients.

- Michigan and Wisconsin state retirement systems have indirect crypto exposure through ETFs.

This growing institutional acceptance is exactly what unions fear - a future in which crypto exposure becomes unavoidable.

Senate Timeline Remains Unclear

Sen. Cynthia Lummis said this week that an updated version of the market-structure bill may be released soon, with the potential for a markup hearing before Congress adjourns for the holidays. But no final date has been set.

Given the strong pushback from two of America’s largest labor unions, lawmakers will likely face intense political friction before any crypto market-structure rules reach a floor vote.