Musk and Trump’s Political Fallout Just Torched The Markets

A very public and very messy rift between Donald Trump and Elon Musk is now sending shockwaves across Wall Street and the crypto world. On June 5, a dramatic exchange between the two high-profile figures spiraled into market-wide uncertainty, hammering both Tesla stock and Bitcoin within hours.

The drama kicked off during a White House meeting with German Chancellor Olaf Scholz. Trump, visibly frustrated, made his feelings clear about Musk. “I’m very disappointed in Elon,” Trump said. “I’ve helped Elon a lot.” That comment lit the fuse.

JUST IN: ?? President Trump says he's "very disappointed" with Elon Musk. pic.twitter.com/7btyEBGYqc

— Watcher.Guru (@WatcherGuru) June 5, 2025

JUST IN: ?? President Trump says he's "very disappointed" with Elon Musk. pic.twitter.com/7btyEBGYqc

— Watcher.Guru (@WatcherGuru) June 5, 2025

Musk fired back almost immediately on X (formerly Twitter), posting a pointed response:

Without me, Trump would have lost the election, Dems would control the House and the Republicans would be 51-49 in the Senate.

— Elon Musk (@elonmusk) June 5, 2025

Without me, Trump would have lost the election, Dems would control the House and the Republicans would be 51-49 in the Senate.

— Elon Musk (@elonmusk) June 5, 2025

A Tweet, a Crash, and a Market Meltdown

But Musk didn’t stop there. He responded “Yes” to a viral post calling for Trump’s impeachment — an incendiary move, though mostly symbolic, as Republicans currently control both chambers of Congress. The optics, however, were enough to jolt investor confidence.

Bitcoin dropped to $100,783 on Thursday before recovering to just above $102,700. Coinglass data reported over $869 million in liquidated Bitcoin longs in just 24 hours, as volatility returned with a vengeance. The broader crypto market took a 5% hit, bleeding red in sync with traditional equities.

Source: TradingView

The $TRUMP memecoin, once riding high on the alliance between the former president and the tech billionaire, slipped 10% following the exchange. Analysts now say Musk’s influence in both crypto and policy circles makes this feud especially disruptive.

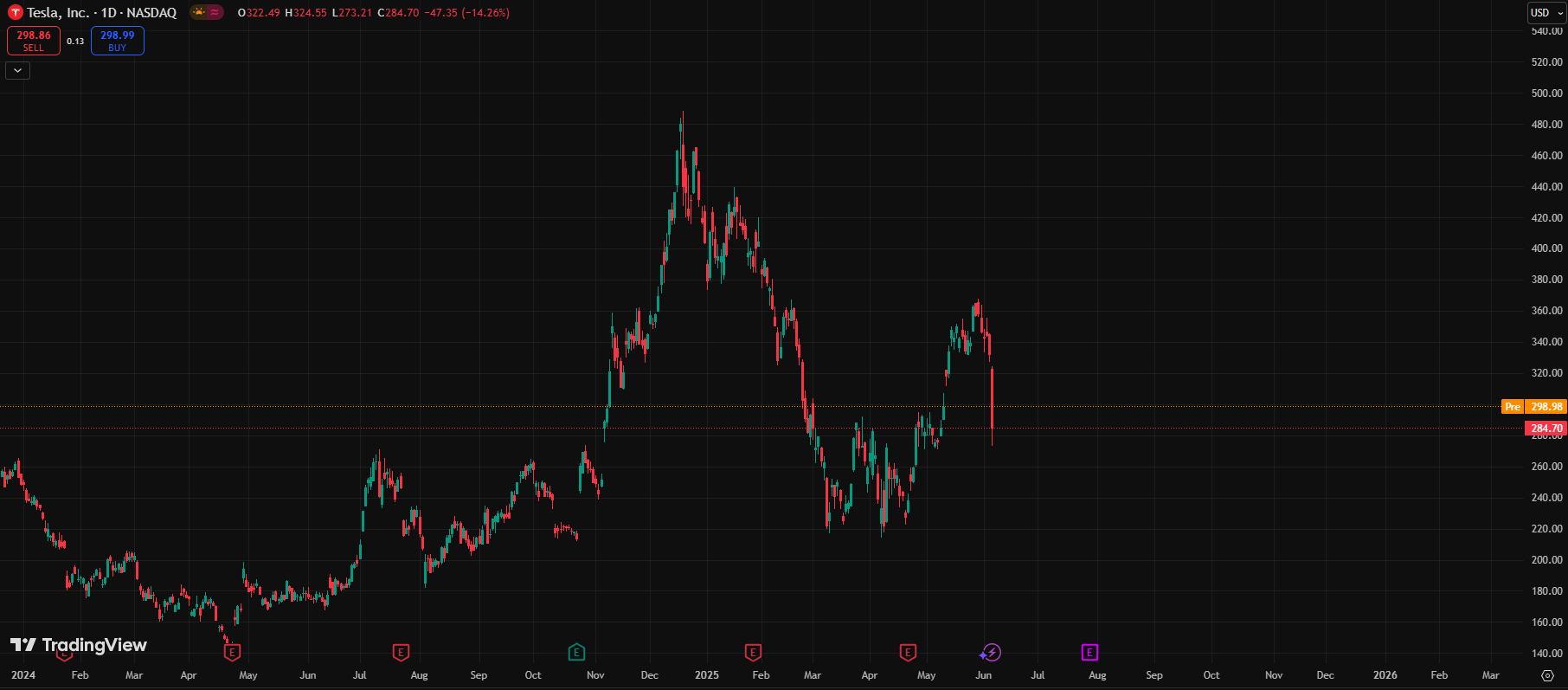

Tesla’s Nightmare: -14% in a Day, and Still Falling

Tesla bore the brunt of Wall Street’s reaction. The stock tanked 14% in a single session on Thursday and is now down 33% from its price on Trump’s January Inauguration Day. It’s not just about drama — investors fear the fight could cost Tesla dearly in the form of lost subsidies and cancelled government contracts.

Source: TradingView

The tensions had been brewing for a week, with Musk publicly criticizing Trump’s new domestic spending bill. Behind the scenes, Tesla had benefited enormously from federal EV incentives — and now, with the bromance over, that flow of capital may be in jeopardy.

Until now, Musk was an informal but powerful adviser to Trump, representing U.S. interests abroad and helping guide key tech policies. His exit from that circle creates a vacuum — and no one knows who’ll fill it.

Musk’s Political Moves

To add more fuel to the fire, Musk has teased the launch of a new political movement, potentially aimed at breaking the two-party mold. Investors fear that such a step could not only deepen the feud with Trump but also drag the broader tech and crypto sectors into more regulatory uncertainty.

The conflict has become more than just a public spat — it’s a case study in how personality-driven politics can derail markets. For now, crypto traders and Tesla shareholders alike are caught in the crosshairs, waiting to see which domino falls next.

Is it time to create a new political party in America that actually represents the 80% in the middle?

— Elon Musk (@elonmusk) June 5, 2025

Is it time to create a new political party in America that actually represents the 80% in the middle?

— Elon Musk (@elonmusk) June 5, 2025