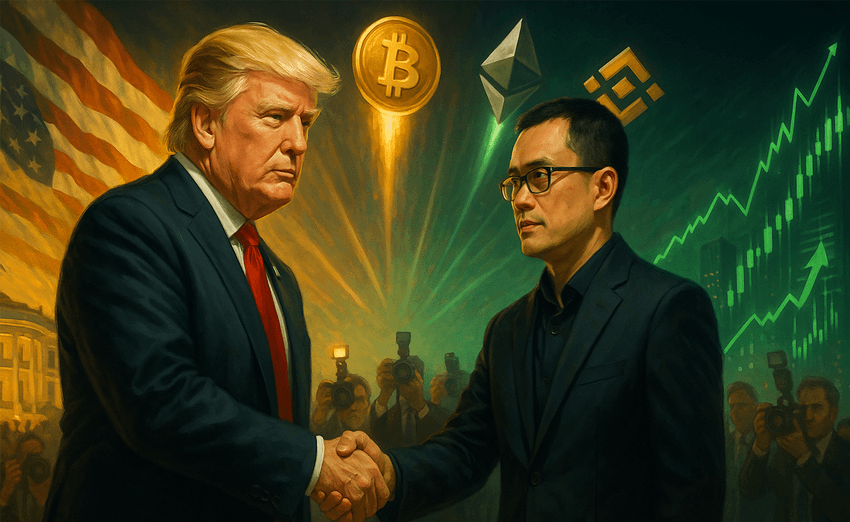

Trump Grants Full Presidential Pardon to CZ

In a stunning political and market twist, U.S. President Donald Trump has officially pardoned Changpeng “CZ” Zhao, the founder and former CEO of Binance, marking one of the most significant clemency acts in crypto history.

The move, first reported by The Wall Street Journal and later confirmed by Binance, ends months of speculation, lobbying, and behind-the-scenes negotiations aimed at securing Zhao’s release from legal restrictions.

Incredible news of CZ’s pardon today! Thank you, President Trump @POTUS for your leadership and for your commitment to make the US the crypto capital of the world!

— Binance (@binance) October 23, 2025

CZ’s vision not only made Binance the world’s largest crypto exchange but shaped the broader crypto movement.…

Incredible news of CZ’s pardon today! Thank you, President Trump @POTUS for your leadership and for your commitment to make the US the crypto capital of the world!

— Binance (@binance) October 23, 2025

CZ’s vision not only made Binance the world’s largest crypto exchange but shaped the broader crypto movement.…

The pardon was reportedly signed Wednesday, though it has not yet appeared in the Federal Register or on the White House website.

From Guilty Plea to Redemption

CZ’s legal saga began in November 2023, when he pleaded guilty to violating the Bank Secrecy Act for failing to maintain proper Anti-Money Laundering (AML) controls at Binance.

He stepped down as CEO and served a four-month prison sentence starting in April 2024, before being released in September. Since then, rumors of a pardon gained traction, especially after Zhao removed the “ex-@binance” tag from his social media bio - a move widely seen as a signal of his potential return.

SCOOP: People close to @cz_binance, the former @binance chief who spent some time in the can amid the Biden Admin's crackdown on all things crypto, say discussions inside the White House are heating up on the possibility of a pardon from @realDonaldTrump. Many Trump insiders…

— Charles Gasparino (@CGasparino) October 10, 2025

SCOOP: People close to @cz_binance, the former @binance chief who spent some time in the can amid the Biden Admin's crackdown on all things crypto, say discussions inside the White House are heating up on the possibility of a pardon from @realDonaldTrump. Many Trump insiders…

— Charles Gasparino (@CGasparino) October 10, 2025

The decision might pave the way for Zhao to rejoin Binance in an executive capacity, something previously barred under his plea agreement. If reinstated, it would mark one of the most dramatic comebacks in crypto history.

Crypto Market Reacts With Euphoria

The crypto world exploded with excitement following the announcement. Binance Coin (BNB) jumped 3.6% to an intraday high of $1,121, later stabilizing around $1,137, according to CoinMarketCap.

World Liberty Financial (WLFI) - the Trump Jr.-linked token - surged nearly 14% after the news, as traders interpreted the move as a political signal of continued pro-crypto policy support.

WLFI’s price action over the past 24 hours (Source: CoinMarketCap)

Institutions Join the Frenzy

Adding to the hype, BNB was listed this week on Coinbase and Robinhood, opening the doors to millions of new U.S. investors.

In a bold move, Applied DNA Sciences, a U.S. biotech firm, revealed it had purchased 4,908 BNB tokens, worth approximately $5.3 million - for its corporate treasury. The announcement sent its stock price soaring over 50% in Wednesday trading.

Analysts now say BNB’s growing institutional adoption, combined with CZ’s potential return, could fuel one of the biggest altcoin rallies of the year.

Trump’s Pro-Crypto Strategy

The pardon aligns with Trump’s ongoing campaign to position the U.S. as a global crypto hub, following previous pardons for BitMEX’s Arthur Hayes and Silk Road founder Ross Ulbricht.

Trump has repeatedly promised to “keep innovation on American soil”, and his latest move further cements his pro-crypto stance as he heads into the final months of his presidency.

For Binance, the moment could mark a turning point - both reputationally and strategically - as it looks to strengthen ties with U.S. regulators and re-establish itself as a trusted global exchange under a renewed leadership era.