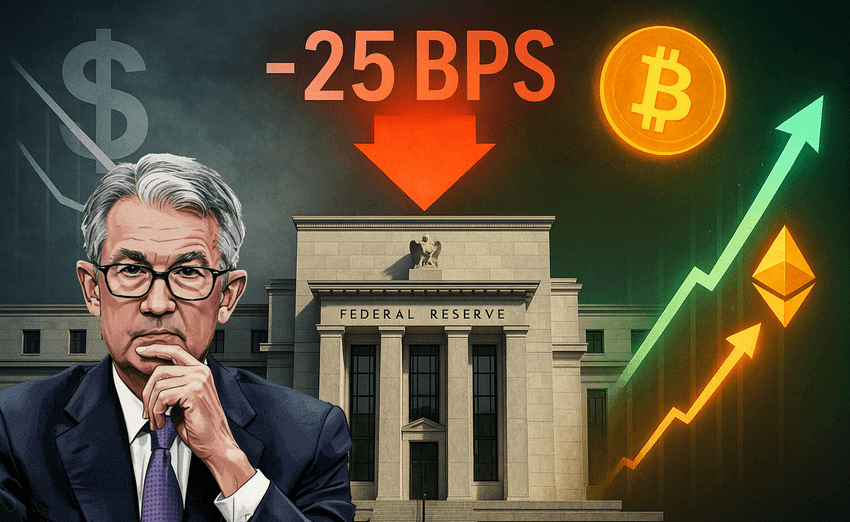

Fed Moves Ahead With Another Cut

The Federal Reserve has lowered interest rates by 25 basis points (bps), shifting the benchmark federal funds rate to 4%–4.25% after a vote of 11–1 at Wednesday’s Federal Open Market Committee (FOMC) meeting.

This marks the Fed’s fourth straight trim since September 2024, and officials signaled at least two more cuts before year-end.

Trump’s Pressure and Political Undertones

President Donald Trump has repeatedly pressed the Fed for deeper cuts, even floating the idea of removing Chairman Jerome Powell. Just two days ago, Trump posted on Truth Social that the Fed should cut “bigger than [Powell] had in mind.”

While the Fed stuck with a modest move, analysts argue the real impact lies in the next 100bps of cuts.

Crypto Market Watches for Liquidity Boost

Lower rates typically push investors out of bonds and into risk assets like cryptocurrencies. At press time, Bitcoin hovered around $116,000, down 0.6% in 24 hours, while Ethereum ticked up to $4,491.

September is historically one of the weakest months for crypto, but sentiment is shifting.

Stablecoins and Institutional Flows in Focus

Beyond Bitcoin and Ethereum, stablecoins may see a renewed surge in demand.

He emphasized that 35% of USDT holders use it as a savings vehicle, while 63% of transactions involve USDT, underscoring its role as a key DeFi gateway.

Meanwhile, Will Beeson, co-founder of Uniform Labs, suggested that falling rates may blunt debates around yield-bearing stablecoins.

A Dovish Shift Meets Crypto Optimism

The Fed’s dovish turn is already colliding with crypto’s bullish undercurrents. On Tuesday, the Senate confirmed Stephen Miran, a crypto-friendly former strategist at Hudson Bay, to the Fed Board. He was the lone voice pushing for a 0.5% cut instead of 0.25%.

The Fed is also set to host a conference next month on stablecoin business models and tokenized financial services, signaling that digital assets are no longer a sideshow in monetary policy.

For now, the Fed has cracked the door wider for liquidity—and crypto traders are watching closely to see whether the next 100bps becomes the true catalyst for an explosive rally.