Bitcoin Crowned a Millennium-Level Disruptor

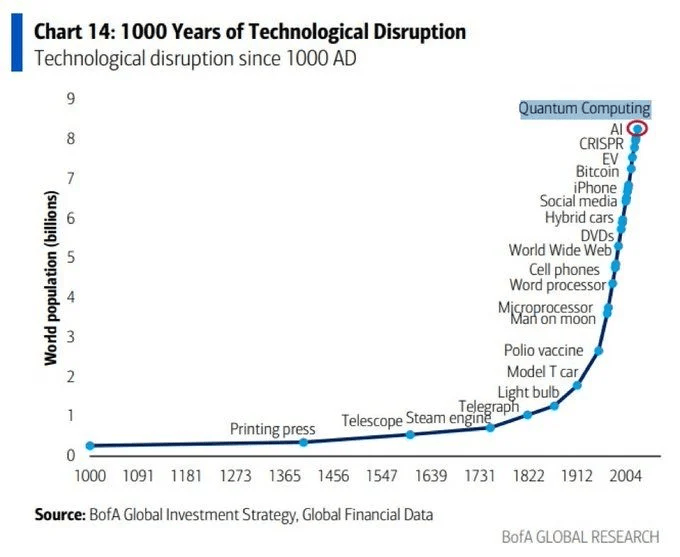

Bank of America Global Research has placed Bitcoin in elite historical company, listing it alongside inventions like the printing press, electricity, and the World Wide Web in its latest “1,000 Years of Disruption” chart. The visual data comes from BofA Global Investment Strategy and Global Financial Data, measuring how technological breakthroughs have accelerated population growth and societal change.

Bitcoin is plotted near the steepest ascent in the chart—alongside quantum computing and AI—marking its global monetary disruption as one of the defining forces of the 21st century. The report positions Bitcoin not merely as a volatile asset, but as a systemic innovation reshaping the very fabric of financial systems.

Source: BofA Global Investment Strategy, Global Financial Data

More Than Just a Digital Coin

According to the chart’s message, Bitcoin stands apart from speculative tech. Its ability to create decentralized, peer-to-peer value transfer—without banks, governments, or financial intermediaries—is a core reason it's being taken seriously by Wall Street heavyweights.

Alongside milestones like the microprocessor and electric vehicles, Bitcoin is now seen as a pillar of future infrastructure, a stark contrast to how it was perceived just five years ago.

Wall Street Awakens as Institutions Warm Up

Although Bank of America has yet to offer Bitcoin purchases directly on its platform, CEO Brian Moynihan signaled a willingness to embrace crypto once regulation is in place. During the World Economic Forum in Davos, Moynihan suggested that BofA is ready to flip the switch.

This echoes a broader pivot by major financial players who have begun to treat digital assets as long-term infrastructure, not a fad. Under President Trump’s crypto-friendly regulatory tone, institutional adoption has gained serious momentum.

Bitcoin's Growing Legacy in Global Finance

Bitcoin’s inclusion on BofA’s chart is more than symbolism—it signals the gradual normalization of digital currencies at the highest echelons of finance. What began as a fringe tech experiment now shares a pedestal with the inventions that shaped modern civilization.

This kind of validation from a top-three U.S. bank points to an incoming wave of institutional support, once the regulatory environment is clarified. The comparison to the printing press is no coincidence: just as Gutenberg’s invention democratized information, Bitcoin could be the democratizer of money.

What Happens Next?

As crypto regulations advance and institutional players line up, Bank of America’s acknowledgment of Bitcoin’s place in the pantheon of historic disruptors is a powerful signal. Bitcoin is no longer just a tech phenomenon—it’s financial infrastructure in waiting. With global regulatory frameworks slowly forming, we could soon see major banks like BofA begin integrating crypto more deeply into their offerings.