A Bold Pivot: Bitcoin as a Home-Buying Asset?

In a surprising shift, the Federal Housing Finance Agency (FHFA) may soon count cryptocurrency holdings — including Bitcoin (BTC) — when assessing mortgage eligibility. FHFA head Bill Pulte confirmed the move in a June 23 post on X, stating the agency would “study the usage of cryptocurrency holdings as it relates to qualifying for mortgages.”

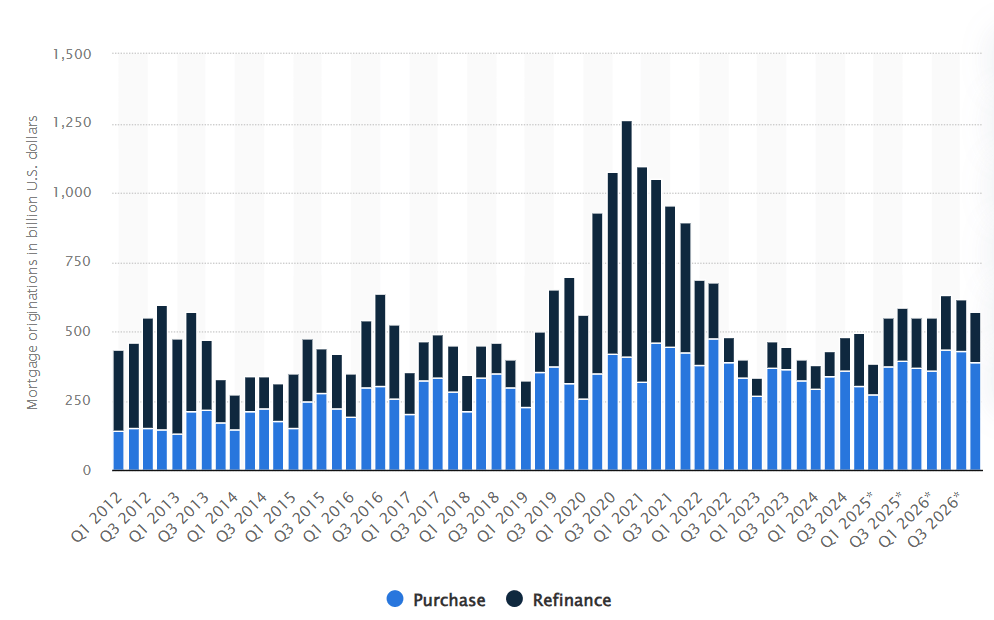

This comes as mortgage applications hit near record lows, leaving regulators scrambling for ways to reinvigorate homeownership. If successful, crypto recognition could reshape federal mortgage guidelines and unlock new lending paths for millions of Americans who hold digital assets.

Pulte’s statement reflects a pro-crypto stance at the agency level, offering potential relief amid what he called an “untenable borrowing environment.”

We will study the usage pf cryptocurrency holdings as it relates to qualifying for mortgages.

— Pulte (@pulte) June 24, 2025

We will study the usage pf cryptocurrency holdings as it relates to qualifying for mortgages.

— Pulte (@pulte) June 24, 2025

Housing Market in Crisis Mode

The backdrop for this announcement is the ongoing US housing crisis. Supply is tight, home prices remain high, and elevated Federal Reserve interest rates have deterred both new homebuyers and refinancers. Mortgage originations plummeted throughout 2024 and showed little rebound in early 2025.

A mix of lagging construction, investor hoarding, and aging homeowners staying put has kept inventory scarce. At the same time, borrowing costs are skyrocketing — a trend Pulte has blamed directly on the Fed, even calling for Chair Jerome Powell’s resignation ahead of his upcoming testimony before Congress.

The current state of the market is so strained that even qualified buyers are being priced out, prompting the FHFA to look beyond traditional assets for mortgage eligibility.

Mortgage originations from 2012 to projected Q3 2026. Source: Statista

Crypto Collateral Could Open the Floodgates

The implications are massive. If crypto is approved for mortgage qualification or down payments, borrowers could tap into a new pool of wealth. In 2024 alone, the Federal Housing Administration (FHA) backed 760,000 home loans worth $230 billion. Yet these programs currently exclude crypto as either collateral or proof of liquidity.

Until January 2025, SEC’s SAB 121 made things worse by forcing banks to count crypto holdings as liabilities. That rule has since been repealed under the Trump administration, removing a key obstacle. But other rules still block crypto-backed loans under federal programs like VA and USDA.

Mitchell Askew of Blockware said BTC’s public ledger makes it “perfect collateral” due to its traceability.

Current Crypto Loan Models and Their Risks

While the FHFA studies crypto's role, boutique lenders are already experimenting. Milo offers Bitcoin-backed mortgages, but requires borrowers to hold the full loan value in crypto. CEO Josip Rupena says many users are buying second homes or investment properties, often rejected by traditional banks.

Strike offers similar services, though it highlights volatility risks. Sharp BTC price drops can trigger margin calls or forced liquidations, threatening both borrower and lender.

That said, crypto ownership is spreading fast. According to the National Cryptocurrency Association’s 2025 report, 65 million Americans (20%) now own crypto, and 74% hold less than $50,000. The FHFA’s study could give these retail holders a shot at homeownership.

Crypto Home Loans May Be Closer Than We Think

As Washington lawmakers race to finalize crypto regulations, the FHFA’s proposal signals a broader cultural shift. Digital assets are being viewed less as speculative novelties and more as real financial tools.

Allowing crypto as collateral or down payment could reignite the housing market and give first-time buyers a new lifeline — particularly millennials and Gen Zers with savings stored in BTC rather than cash.