Mining Difficulty Hits Historic Peak

Bitcoin’s mining sector, the backbone of the network, is making headlines again—this time for reaching a new record in mining difficulty. The metric, which reflects how hard it is to mine a new block, has been rising rapidly in recent weeks, hitting fresh all-time highs.

This increase is more than technical—it signals enhanced network security and competitiveness among miners. To stay profitable, miners must now ramp up their hardware capabilities. If not, smaller or less efficient operations risk shutting down.

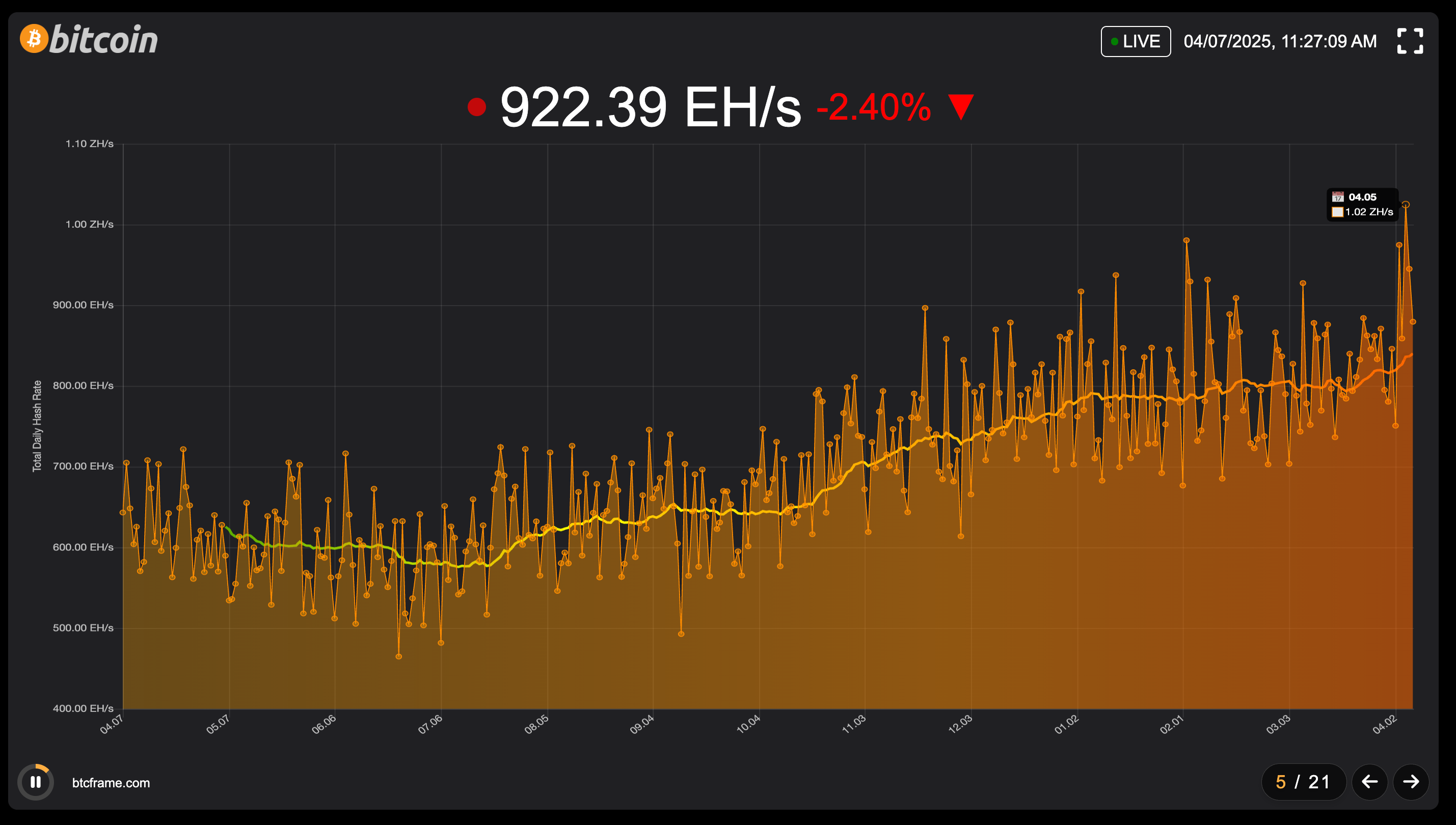

Source: BTCFrame

Fewer Coins Sold as Miners Stay Bullish

The rising difficulty has not led to increased selling. On the contrary, the Bitcoin Miner Position Index currently sits at -1.31, indicating that miners have been selling less BTC over the last year. This trend points to growing confidence in the long-term outlook of Bitcoin.

Traditionally, miner flows are a strong indicator of market sentiment. When miners are optimistic, they tend to hold onto their BTC instead of flooding the market.

Hash Rate Surges Alongside Difficulty

While difficulty has surged, Bitcoin’s hash rate hasn’t faltered—in fact, it’s risen. On April 4, it hit a record 1088.40 EH/s. This shows that miners are investing in better infrastructure to handle the increased challenge, rather than backing down.

Rising hash rate alongside difficulty generally suggests a robust and committed mining ecosystem, even amid recent bearish trends.

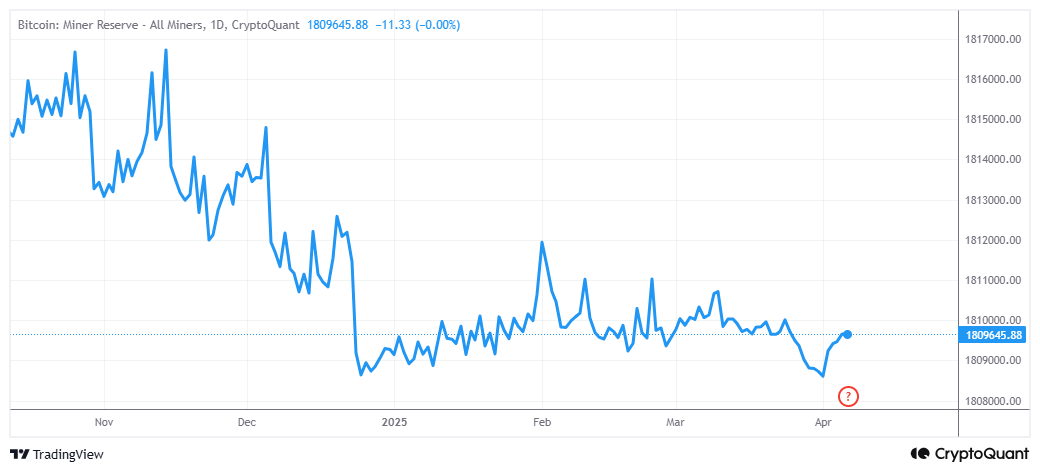

Reserves Remain Strong, Capitulation Absent

Miner reserves remain healthy, holding above 1.80 million BTC. In early April, they even edged closer to 1.81 million—well above December lows. This resilience implies miners expect further upside in the market.

A recent CryptoQuant report confirmed the trend: although some BTC has been sold, miner outflows remain relatively small. There’s no sign of widespread capitulation.

Source: CryptoQuant

What’s Next for Bitcoin Price?

Despite holding above $80,000, Bitcoin faces pressure. Some analysts warn of a potential drop below $70,000. Such a dip could shift miner behavior—but for now, the data suggests strong conviction and operational confidence in the network.

The rising mining difficulty, record hash rate, and stable reserves all reflect a bullish miner sentiment—one that could underpin Bitcoin’s next move, whether up or down.