Fed Leaves Rates Unchanged as Expected

The Federal Reserve kept its benchmark interest rate between 4.25% and 4.5%, a level it has maintained since December. This outcome was widely expected, with no major Wall Street analysts forecasting a change during this latest Federal Open Market Committee (FOMC) meeting. The Fed also reaffirmed it is still considering two potential rate cuts by the end of 2025, though internal resistance is growing.

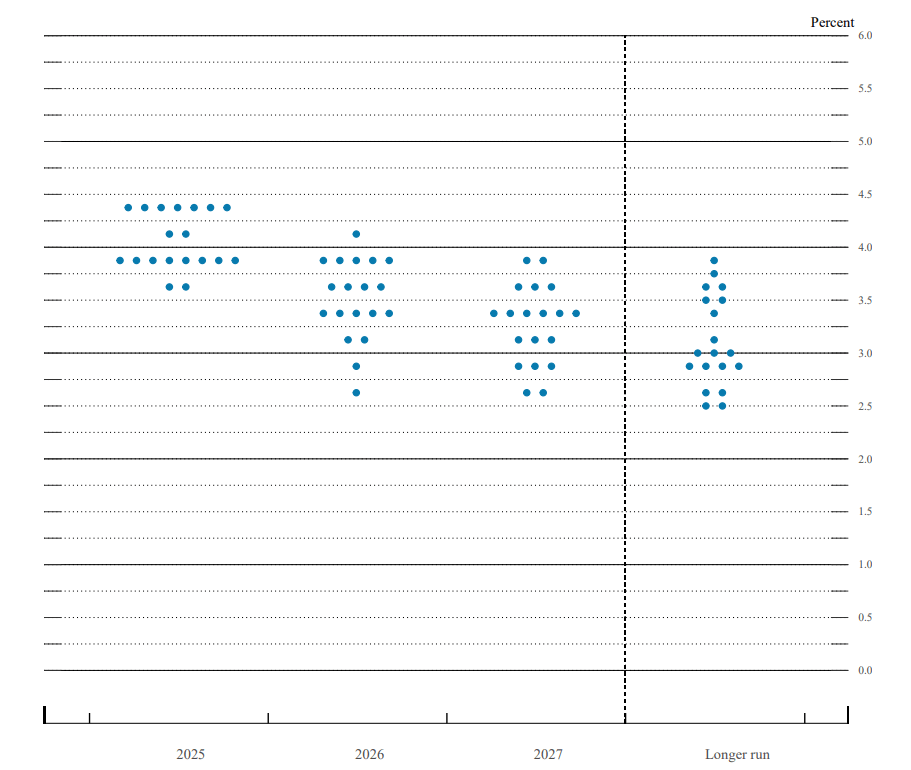

The updated “dot plot” of projections showed that seven out of 19 Fed members now oppose any cuts in 2025, up from four in March. Yet, despite this division, all members supported the policy statement, showing a unified public front.

Source: Federal Reserve

Growth Slows, Inflation Rises—Stagflation Fears Emerge

The Fed’s latest economic projections reflect a slowing U.S. economy paired with rising inflation, a classic stagflation scenario. Officials cut their 2024 GDP growth forecast to just 1.4%, down from 1.7% in March. Meanwhile, PCE inflation was revised up to 3%, and core PCE rose to 3.1%.

The unemployment forecast also ticked up to 4.5%, compared to the current rate of 4%, suggesting the labor market may weaken further. In its official statement, the Fed noted:

Powell Faces Political Heat as Trump Renews Attacks

President Donald Trump did not hold back on Fed Chair Jerome Powell. Just hours before the rate announcement, Trump called Powell “stupid” for refusing to cut rates, claiming:

Trump has made clear he views high interest rates as a burden on the national debt, which now costs $1.2 trillion annually in interest.

Trump’s return to office has raised tensions, especially as his $36 trillion debt load intersects with the Fed’s independence. Analysts say Powell is walking a tightrope: balancing economic stability against mounting political pressure from a sitting president.

Trade Policy, Not Just Rates, Adds Complexity

Though the Fed didn’t name specific reasons for its recent shift in tone, it did note that “uncertainty has come down,” even while “risks remain elevated.” One likely influence: Trump’s softened trade rhetoric and the White House’s current 90-day tariff negotiation period, which may have calmed market fears.

Still, tariffs already reinstated earlier in the year could eventually push inflation higher. Companies reportedly stockpiled goods before Trump’s “liberation day” in April, softening the initial impact. But if costs rise further, the Fed may find itself cornered.

Geopolitical Risks Ignored as Oil Prices Creep Up

One glaring omission from the Fed’s statement was any mention of the Israel-Iran conflict, which has escalated tensions in the Middle East and driven up oil prices. Rising energy costs could add fuel to the inflation fire, making rate cuts even riskier in the near term.

Yet, the Fed stayed silent on global conflict, instead keeping its focus squarely on domestic economic data. That choice suggests the central bank is playing it safe, avoiding controversial geopolitical commentary while bracing for a volatile second half of the year.