A Major Win for U.S. Crypto Policy

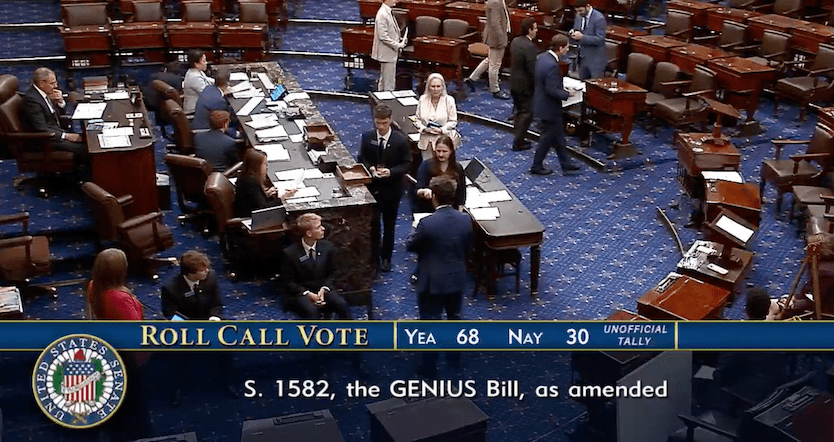

In a historic vote on Tuesday, the U.S. Senate passed the GENIUS Act, marking a pivotal moment in the country’s push to regulate stablecoins. The bill cleared the chamber by a 68-30 margin, just weeks after its introduction by Senator Bill Hagerty of Tennessee.

Despite previous delays due to Democratic concerns over Donald Trump’s ties to stablecoin issuer World Liberty Financial, the bill passed without any amendments addressing those connections.

Source: US Senate

Trump Ties Sparked Tensions But Didn’t Block the Bill

In May, the GENIUS Act initially failed a procedural vote, largely due to Trump’s connection to the USD1 stablecoin launched by World Liberty Financial, where members of his family are listed as co-founders.

Still, Tuesday’s vote showed growing bipartisan support, even though Democrats were divided on whether to hold up the legislation over potential conflicts of interest. The Trump administration’s pro-crypto stance, combined with Republican control of the House, suggests the bill may have momentum in the lower chamber, though not without resistance.

A Door Opens for Corporate Stablecoin Ambitions

If the GENIUS Act is signed into law, it would establish a clear regulatory framework for payment stablecoins, potentially sparking a wave of corporate token issuance. According to reports, Apple, Google, Airbnb, and even X (formerly Twitter) are exploring the possibility of launching their own tokens.

What About the CLARITY Act?

As the GENIUS Act heads toward the House of Representatives, attention is now turning to the CLARITY Act, another crucial crypto bill. This legislation aims to define market structure for digital assets, with versions already passed through House Agriculture and Financial Services Committees.

But Democrats continue to raise concerns about Trump’s deep crypto ties, which may cause additional delays or trigger proposed changes. Meanwhile, consumer advocates are fiercely criticizing the legislative push.

The Bigger Picture

With the GENIUS Act advancing and the CLARITY Act not far behind, crypto regulation in the U.S. is gaining unprecedented momentum. However, the broader conversation still involves political power plays, regulatory fears, and legacy finance interests.

The fact that no language was added to restrict Trump-affiliated projects highlights the political tightrope being walked in D.C. As the House prepares its vote, the crypto community—and the markets—will be watching closely.