Optimism Turns to Doubt

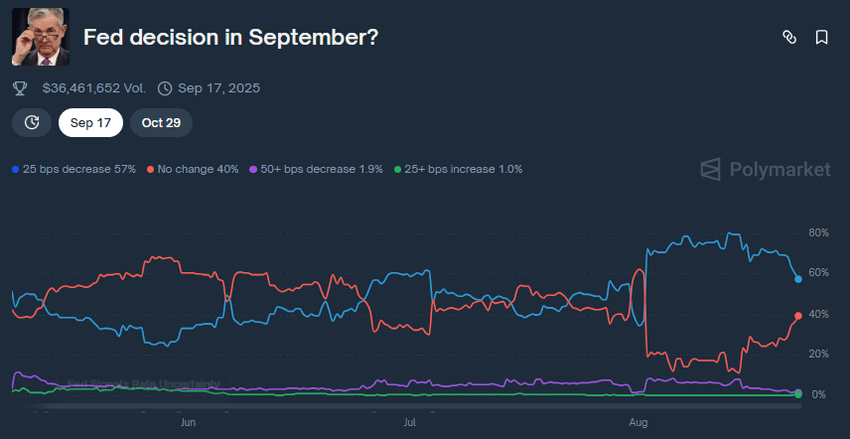

The once-strong belief that the Federal Reserve would deliver a September rate cut is quickly fading. Prediction platforms like Polymarket and Kalshi are showing declining confidence, even though the majority still leans toward expecting a cut.

The latest FOMC meeting minutes have dampened those hopes. The Fed kept rates unchanged at 4.25%–4.5% in July, despite some internal dissent. Notably, Fed Governors Christopher Waller and Michelle Bowman both favored a 25 basis point cut, but they were outnumbered.

With just 27 days until the next meeting, markets are shifting away from certainty. The debate now is less about if a cut will happen and more about when.

Source: Polymarket

Trump Pressures Powell, But Markets Aren’t Convinced

President Donald Trump continues to hammer Fed Chair Jerome Powell, demanding swift and aggressive cuts. He has argued that lower rates are necessary to ease debt obligations and fuel growth.

Yet, the Fed appears cautious, balancing political pressure with mixed economic signals.

For the crypto industry, which has long pinned hopes on monetary easing, optimism is slipping. Rate cuts are still viewed as bullish for Bitcoin and Ethereum, but faith in a quick policy shift is clearly waning.

Economic Signals Fuel Recession Fears

Recent economic data has further clouded the outlook. The US Jobs Report showed weakness that raised recession concerns, though no hard downturn has materialized. Meanwhile, US stocks slipped into the red, reflecting investor anxiety.

Paradoxically, rising economic uncertainty may actually limit the Fed’s ability to use rate cuts effectively. As some economists warn, even if Powell moves to lower rates later this year, the impact could be muted.

Crypto Braces for Prolonged Uncertainty

For crypto investors, the picture is complicated. A September cut could provide a short-term lift, but the sector has already adjusted to multiple cycles of rising and falling expectations throughout 2025.

At this point, the industry isn’t betting on monetary policy alone. Some believe crypto could outperform traditional finance if volatility increases. Others argue that worsening global uncertainty, from AI disruptions to geopolitical shocks, could weigh on every asset class.

The Bottom Line

The Fed’s cautious stance leaves markets — and crypto — in a holding pattern. Optimism for September has slipped, but the stakes for the next FOMC meeting remain high.