Grayscale Moves to Convert Large Cap Crypto Fund into an ETF

Grayscale has officially filed a Form S-3 with the U.S. Securities and Exchange Commission (SEC) to convert its Digital Large Cap Fund into a publicly traded exchange-traded fund (ETF). Filed on April 1, the ETF proposal comes amid growing demand for diversified crypto exposure in a regulated format.

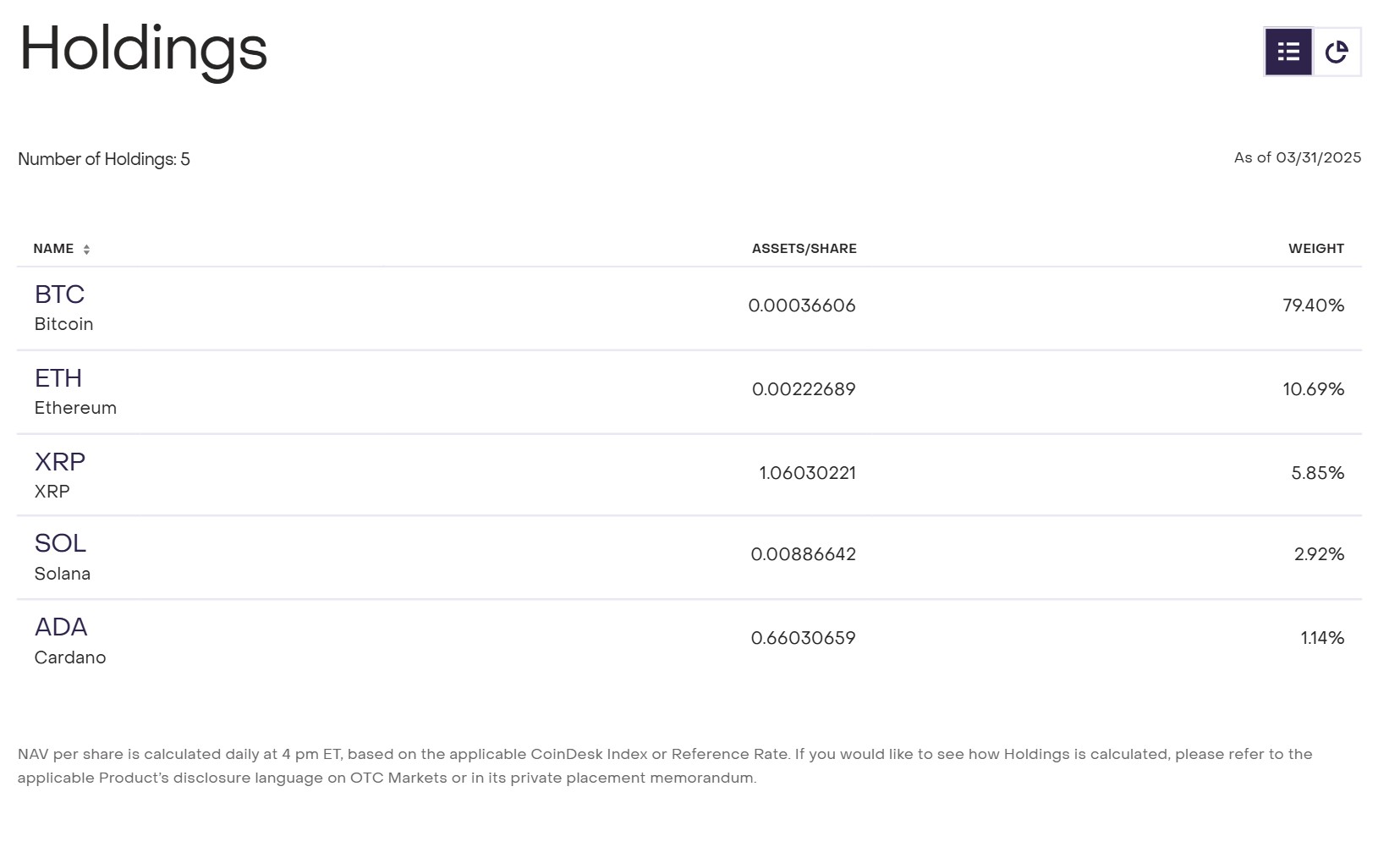

The fund currently manages over $600 million in assets, tracking a basket of leading cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- And now Ripple (XRP)

Though the fund was originally launched in 2018, it has only been available to accredited investors—until now.

Source: Grayscale.com

NYSE Arca Seeking to List the Fund

The move follows an earlier application by NYSE Arca on October 29, requesting permission to list the fund on its exchange. If approved, this would mark another step forward in the mainstreaming of digital asset ETFs. Grayscale’s filing aims to meet SEC requirements for ETF conversion and could pave the way for retail investors to gain exposure to multiple crypto assets through a single product.

Index Crypto ETFs Gaining Steam in the U.S.

Grayscale’s filing arrives as crypto index ETFs attract increasing interest following the successful launch of spot Bitcoin and Ethereum ETFs in the U.S. earlier this year. While Hashdex and Fidelity were the first to offer BTC/ETH-only index funds, Grayscale’s product would be among the first to include major altcoins like SOL, ADA, and XRP. Industry observers view index ETFs as the next logical evolution, mirroring how traditional investors gain exposure to the S&P 500.

“This will be the same in crypto,” said Katalin Tischhauser, head of research at Sygnum Bank.

A Softer Regulatory Environment Under Trump

Analysts also attribute this wave of filings to a regulatory pivot under President Donald Trump, whose administration has encouraged a friendlier stance toward digital asset products. The SEC has already begun acknowledging more ETF applications and expanding its consideration to staking, altcoin exposure, and other features that signal a more open regulatory climate.