Lummis Takes Another Swing at Crypto Tax Gridlock

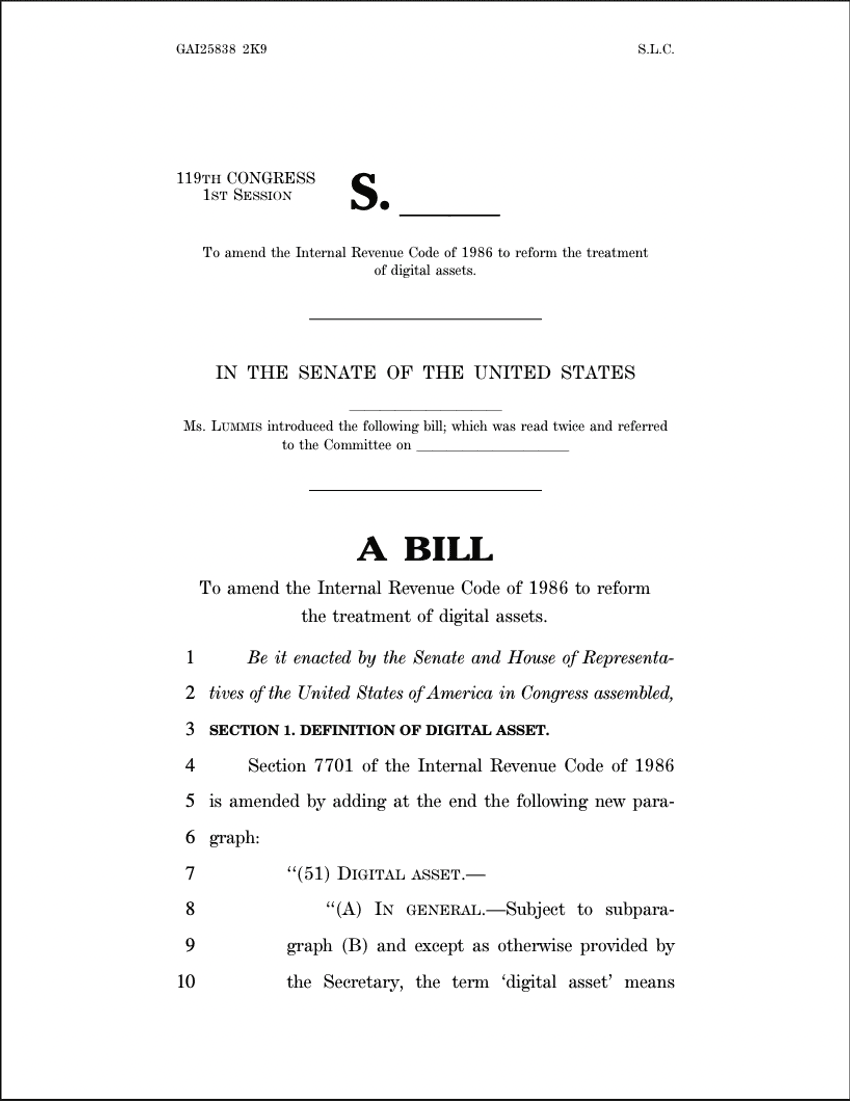

Senator Cynthia Lummis isn’t done battling what she calls a “broken system” choking crypto adoption in the U.S. On Thursday, the Wyoming Republican introduced a new crypto tax reform bill, reviving proposals she previously tried to insert into broader legislation. While the earlier bundle flopped, Lummis is now betting on a standalone approach.

The bill targets the “outdated tax codes” that she says are stifling U.S. innovation in blockchain and Web3.

Lummis said in a statement, encouraging the public to weigh in. By welcoming feedback, she’s signaling openness to tweak the proposal before aiming it at the President’s desk.

JUST IN: ?? Senator Lummis introduced new legislation to ease taxes on Bitcoin $BTC and crypto assets pic.twitter.com/vZY36oAEPm

— BlockNews (@blocknewsdotcom) July 3, 2025

JUST IN: ?? Senator Lummis introduced new legislation to ease taxes on Bitcoin $BTC and crypto assets pic.twitter.com/vZY36oAEPm

— BlockNews (@blocknewsdotcom) July 3, 2025

A $300 Exemption to Make Crypto Spending Sane

One of the bill’s headline features is a $300 exemption on small crypto transactions—a fix aimed at ending the reporting nightmare that plagues everyday crypto use. Whether it's buying coffee with Bitcoin or splitting a bill in Ethereum, under current rules, every micro-transaction could trigger a capital gains calculation.

“The current rules just don’t make sense in the real world,” the proposal notes. Lummis argues that this simple threshold is enough to make crypto practical for consumers—without giving up tax oversight entirely.

That $300 carve-out could finally remove the chill factor that’s stopped people from using crypto as actual currency. It’s a common-sense adjustment that many in the industry say is long overdue.

The tax code shouldn't punish Americans for using new technology. My bill fixes the broken rules around bitcoin and digital assets. MORE ⬇️ https://t.co/1Wo6zjY8wY

— Senator Cynthia Lummis (@SenLummis) July 3, 2025

The tax code shouldn't punish Americans for using new technology. My bill fixes the broken rules around bitcoin and digital assets. MORE ⬇️ https://t.co/1Wo6zjY8wY

— Senator Cynthia Lummis (@SenLummis) July 3, 2025

Relief for Miners and Stakers Also on the Table

Lummis isn’t just aiming at consumers. Her bill also plans to scrap the double taxation miners and stakers currently face. Right now, they’re taxed first when they receive crypto as income, and again when they sell it.

The new framework would delay tax liability until the assets are actually sold or exchanged, which Lummis says aligns with the way real-world assets like stocks or property are treated. That’s a move industry insiders have long called for, arguing that current tax rules punish people for participating in network security and blockchain operations. Lummis said:

A Fresh Shot After Earlier Defeat

Earlier this week, Lummis tried attaching this same tax relief language to a much larger legislative package - the so-called “One Big Beautiful Bill Act”, backed by Donald Trump. But it failed to make the cut during the amendment process. No vote. No mention. No luck.

Now, by repackaging the proposal as a standalone bill, Lummis is taking a sharper, more focused approach. That could give it a better chance at survival in a sharply divided Congress, where bipartisan support for crypto tax reform has been growing quietly behind the scenes.

The Bigger Fight: Crypto Innovation vs. IRS Red Tape

Lummis’s latest move underscores a broader theme: Washington is still playing catch-up to crypto’s growth. While countries like Switzerland, Singapore, and even the UK are fine-tuning their regulatory frameworks, the U.S. remains bogged down in 1980s-style tax code gymnastics.

If passed, Lummis’s bill could finally push U.S. tax policy into the 21st century and unlock day-to-day crypto adoption without the IRS breathing down everyone’s neck. Still, the road ahead is uncertain—and industry advocates will be watching closely.