Historic Debut for Solana Staking ETF

Wall Street just marked a first for crypto staking products. The REX-Osprey Solana Staking ETF (ticker: SSK) made a historic debut on July 2, becoming the first crypto staking ETF available to U.S. investors. It hauled in $12 million in inflows and clocked $33 million in trading volume on its first day trading on the Cboe BZX Exchange.

According to Bloomberg ETF analyst Eric Balchunas, the ETF’s launch was well above average, with $8 million traded in the first 20 minutes alone. This opening outpaced recent launches of Solana and XRP futures ETFs, but still lagged far behind the $4.6 billion seen during the launch of spot Bitcoin and Ethereum ETFs in early 2024.

$SSK ended day with $33m in volume. Again, blows away the Solana futures ETF and XRP futures ETFs (or the avg ETF launch) but it is much lower than the Bitcoin and Ether spot ETFs. pic.twitter.com/t6LkQwDXLc

— Eric Balchunas (@EricBalchunas) July 2, 2025

$SSK ended day with $33m in volume. Again, blows away the Solana futures ETF and XRP futures ETFs (or the avg ETF launch) but it is much lower than the Bitcoin and Ether spot ETFs. pic.twitter.com/t6LkQwDXLc

— Eric Balchunas (@EricBalchunas) July 2, 2025

Earning Rewards Without the Tech Headache

What makes SSK unique is its dual offering: it gives spot exposure to Solana (SOL) and simultaneously distributes staking rewards to shareholders. This lets investors earn passive yield without directly managing wallets or navigating the technical complexities of on-chain staking.

The ETF’s success shows growing appetite for yield-bearing digital asset products, especially as staking becomes a mainstream investment tool. It’s a major leap for traditional investors who want in on the DeFi ecosystem without leaving the comfort of regulated finance.

The Legal Tightrope with the SEC

The road to approval wasn’t smooth. The Securities and Exchange Commission (SEC) initially raised regulatory concerns, primarily questioning whether the ETF qualified as an “investment company” under U.S. law. But REX-Osprey navigated around this by crafting a clever legal structure.

Instead of using the traditional 19b-4 exchange rule change process, the fund was approved under the Investment Company Act of 1940, which requires it to invest at least 40% of its assets in other exchange-traded products, mostly non-U.S. domiciled.

This workaround - what NovaDius Wealth Management President Nate Geraci called a “regulatory end-around” - allowed the ETF to get to market while sidestepping SEC objections that have blocked several spot Solana ETF filings.

Solana’s Market Moves and ETF Ripple Effect

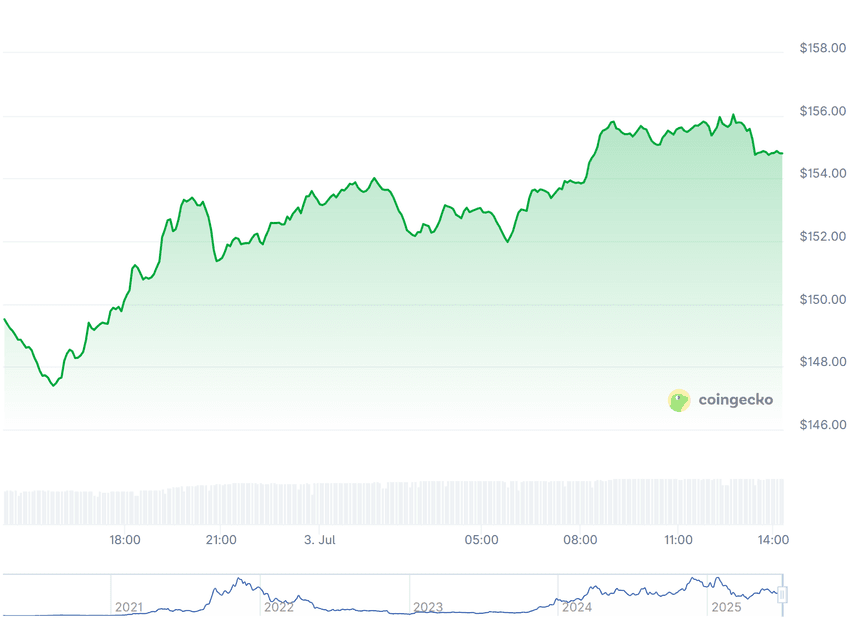

Following the ETF launch, Solana’s price jumped 4%, trading just above $150, although its performance still trails other top altcoins. SOL is currently down 48% from its January high, but has shown signs of resilience, rising 5% in the past week.

Meanwhile, Solana CME futures saw a spike in interest — with open interest surging to $167 million, indicating institutional traders are eyeing Solana more seriously post-ETF launch. The rise in futures activity underscores the ETF’s broader impact on market dynamics and investor confidence.

Solana (SOL) Price

What’s Next for Solana ETFs?

With the REX-Osprey fund blazing the trail, spot Solana ETFs could follow soon. Bloomberg analysts have placed a 95% likelihood that the SEC will greenlight such products by end of 2025 - and this early staking ETF may serve as a proof-of-concept.

Anchorage Digital, the ETF’s staking and custody provider, plays a pivotal role in managing the fund’s on-chain activities. Co-founder Nathan McCauley hailed the launch as “a defining moment for digital assets.” If institutional interest continues to climb, this moment could mark a turning point for staking-based ETFs in the United States.