Pyongyang’s Digital Lifeline

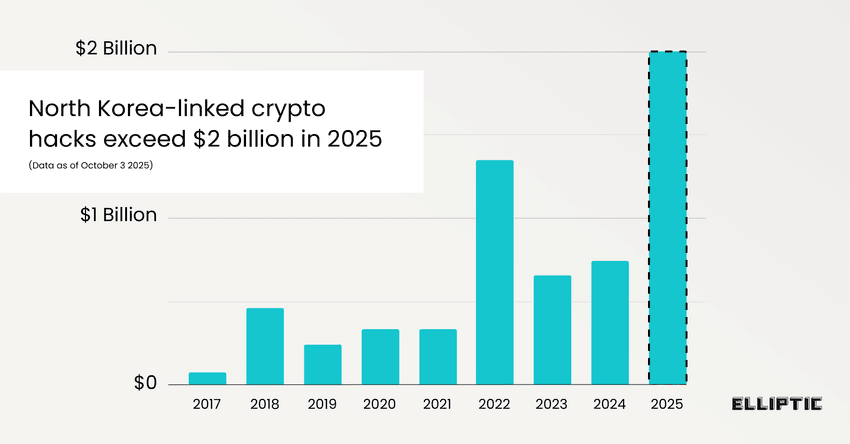

In a staggering escalation of state-backed cybercrime, North Korean hackers have stolen over $2 billion in cryptocurrencies in 2025, according to a new report from blockchain analytics firm Elliptic. The amount marks the largest annual crypto theft total ever recorded, with three months still left in the year.

Elliptic’s findings suggest that crypto hacking has become central to North Korea’s financial survival, allowing the regime to bypass international sanctions and fund its nuclear weapons and missile programs. Since 2017, the firm estimates, Pyongyang’s hackers have stolen more than $6 billion worth of digital assets globally.

The Bybit Breach: A $1.46 Billion Wake-Up Call

The year’s staggering figure is dominated by the Bybit exchange hack in February, which saw $1.46 billion stolen in one of the largest single crypto breaches in history. That single attack accounted for nearly two-thirds of all losses so far in 2025.

Elliptic’s investigation also linked North Korean groups to other high-profile intrusions at LND.fi, WOO X ,and Seedify, as well as more than 30 smaller hacks on decentralized finance (DeFi) platforms and trading venues.

This year’s total nearly triples 2024’s $700 million and surpasses the previous record of $1.35 billion in 2022, when the infamous Ronin Network and Harmony Bridge exploits dominated headlines.

Source: Elliptic

The Human Factor: Crypto’s Weakest Link

Elliptic’s report highlights a major shift in Pyongyang’s hacking strategy: instead of only targeting major exchanges, hackers are now preying on individuals — especially wealthy crypto investors and company executives.

As crypto prices have soared in 2025, these private wallets and custodial services have become prime targets. Many lack multi-layered security systems, leaving them vulnerable to phishing, social engineering, and impersonation scams.

From fake investor calls to cloned exchange login portals, attackers are refining tactics to bypass authentication systems and trick victims into revealing credentials — often under the guise of legitimate support requests or partnership inquiries.

A Global Threat to Financial Stability

The implications of these attacks stretch far beyond crypto circles. Analysts warn that stolen assets are being funneled into North Korea’s military projects, destabilizing global financial systems in the process.

Western intelligence agencies have urged tighter international coordination to track and freeze illicit funds before they’re laundered through mixers, bridges, or DeFi protocols. But tracing the flow of stolen crypto remains a cat-and-mouse game, with Pyongyang’s hackers often using advanced obfuscation tools to mask their tracks.

2025: The Year of the Cyber Arms Race

With three months remaining, analysts fear the $2 billion milestone may not be the final total. Elliptic predicts more attacks before year-end, reflecting the increasing sophistication and aggressiveness of North Korea’s cyber units.

The report concludes that unless governments and blockchain firms implement stronger international safeguards, state-sponsored theft could become a permanent fixture of the crypto economy — and a core funding pillar for rogue regimes.

As the crypto market continues to recover and expand, one thing is clear: the digital battlefield is no longer theoretical — it’s already here.