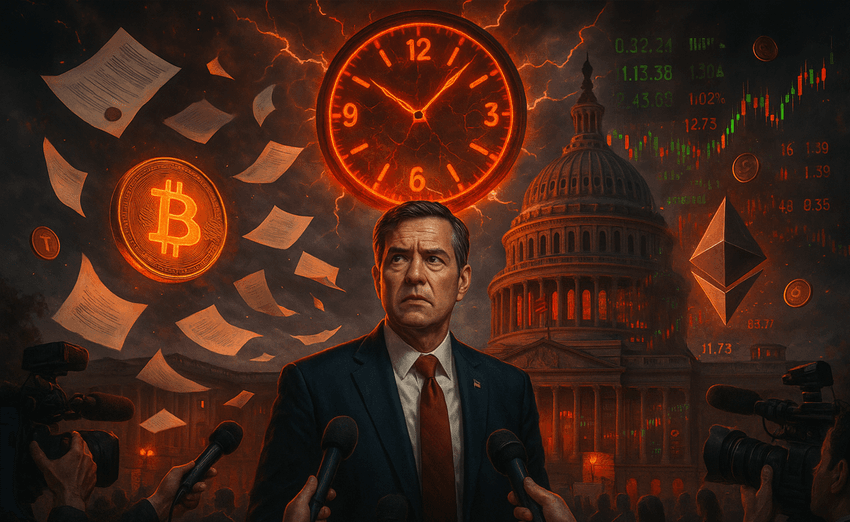

Clock Ticking for U.S. Crypto Legislation

Republican Senator Thom Tillis of North Carolina has issued a stark warning that Congress is running out of time to pass comprehensive crypto legislation before the 2026 midterm elections.

Tillis, a member of the Senate Banking Committee, told Bloomberg this week that if lawmakers don’t act by early 2026, efforts to regulate digital assets could be “dead on arrival.”

His remarks come as Washington struggles to find bipartisan consensus on key issues like market structure, stablecoin oversight, and jurisdiction between the SEC and CFTC.

Partisan Gridlock Threatens Reform Momentum

The Senator’s comments reflect growing frustration within both the crypto industry and Congress. Despite momentum behind digital asset regulation, deep partisan divides have stalled progress.

The Financial Innovation and Technology for the 21st Century Act (FIT21) - passed by the House in July - remains stuck in the Senate Banking Committee, where Tillis serves. The bill seeks to clarify oversight roles between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), aiming to bring long-awaited regulatory clarity for crypto exchanges and token issuers.

However, mounting political distractions - including a partial government shutdown that began on October 1 - have thrown multiple bills off track, including the CLARITY Act, which would define how digital assets are classified and expand investor protections.

Political Turbulence Adds to Uncertainty

Tillis’s warning also comes amid leadership deadlock in both chambers. House Speaker Mike Johnson has struggled to maintain unity, holding key floor sessions hostage while debates over healthcare and social spending dominate Washington.

Meanwhile, Senator Cynthia Lummis, a longtime crypto advocate, has pushed for her Responsible Financial Innovation Act, but even she admits the bill may not become law until 2026.

At the same time, turnover at financial agencies like the SEC and Treasury adds further unpredictability, leaving the crypto industry without a clear roadmap heading into next year.

Industry Urges Congress to Act Before It’s Too Late

Crypto leaders are now ramping up lobbying efforts in Washington, warning that continued inaction could push innovation and investment overseas.

Kristin Smith, former CEO of the Blockchain Association, said the U.S. risks losing its leadership role to regions with established frameworks like the EU’s MiCA regulation.

Companies like Coinbase and Ripple have intensified their outreach, arguing that regulatory uncertainty is driving firms to friendlier jurisdictions such as Dubai, Singapore, and Europe.

Yet consumer advocates and several Democratic lawmakers remain wary, citing the collapses of FTX and Celsius as cautionary tales. They’re calling for stronger investor protections and prudential standards before approving any sweeping crypto reforms.

Race Against the Political Calendar

With election season fast approaching, policy experts warn that Congress’s legislative window is closing quickly. If lawmakers fail to pass key crypto bills by early 2026, reform may be delayed for years.

The next few months could determine whether the U.S. solidifies its position as a global leader in digital asset innovation - or cedes ground to faster-moving nations.