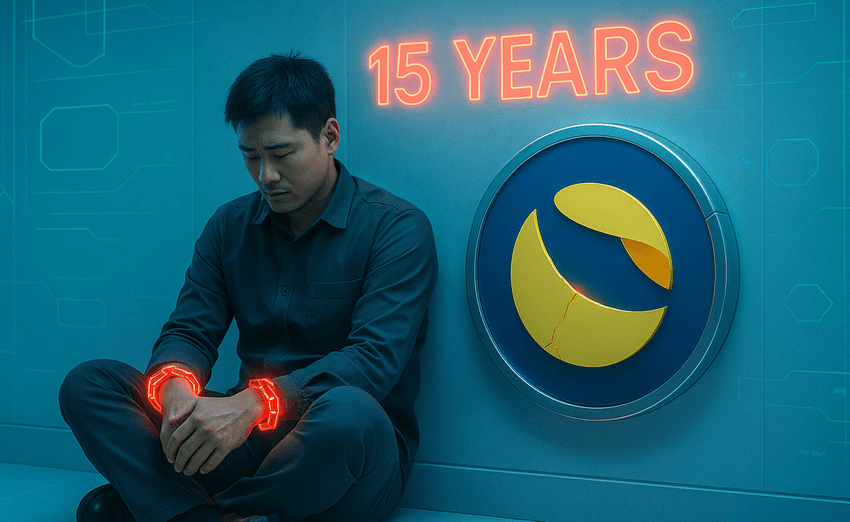

Do Kwon Receives 15-Year Sentence in Landmark Crypto Fraud Case

Terraform Labs founder Do Kwon has been sentenced to 15 years in prison by a U.S. federal court for orchestrating one of the largest crypto frauds in history. The ruling was delivered Thursday in the Southern District of New York, concluding a case tied to the spectacular collapse of the TerraUSD (UST) stablecoin and its sister token LUNA in 2022 - a meltdown that erased more than $40 billion in market value.

Judge Paul Engelmayer stated that Kwon “chose to lie” and “chose poorly” emphasizing that the deception surrounding Terra’s stability was deliberate rather than accidental. The sentence exceeds prosecutors’ earlier request of 12 years, signaling the court’s intent to make an example of high-profile crypto misconduct.

Charges Stem From TerraUSD’s Algorithmic Failure

Kwon was charged in March 2023 with multiple offenses, including wire fraud, securities fraud, commodities fraud, conspiracy, and market manipulation. In August 2024, he pleaded guilty to wire fraud and conspiracy to defraud, narrowing his exposure from a potential 135-year sentence to a statutory maximum of 25 years.

At the heart of the case was TerraUSD, an algorithmic stablecoin designed to maintain a dollar peg through automated market incentives tied to LUNA. Prosecutors argued that Kwon knowingly misrepresented the system’s resilience, despite internal warnings that the mechanism could fail under market stress.

When TerraUSD lost its peg in May 2022, it triggered a chain reaction that collapsed hedge funds, lenders, and trading firms across the crypto industry.

Defense Blamed Market Forces - Court Disagreed

Kwon’s legal team pushed for a sentence of five years, arguing that the collapse was accelerated by coordinated trading strategies from external firms exploiting design flaws. They cited academic research and blockchain analytics reports suggesting Terra was vulnerable to aggressive market behavior.

The court rejected that defense, concluding that misrepresentation and deception, not just market pressure, played a central role in the collapse.

Prosecutors also sought $19 million in forfeiture, citing personal gains tied to the fraud.

International Arrest and Extradition Battle

Kwon’s downfall extended well beyond U.S. borders. He was arrested in Montenegro in March 2024 after attempting to travel using forged documents. Both the United States and South Korea sought his extradition, triggering months of legal disputes.

In December 2024, Montenegro extradited Kwon to the U.S. He will receive credit for the 17 months already served in Montenegrin custody.

According to reports, Kwon must serve at least half of his U.S. sentence before becoming eligible for transfer to South Korea, where additional legal proceedings may still await him.

A Defining Moment for Crypto Enforcement

The sentencing marks one of the harshest criminal penalties ever imposed in a crypto-related case. Legal analysts say it sends a clear signal that algorithmic stablecoins and opaque token designs will face intense scrutiny - and severe consequences - if marketed under false pretenses.

For regulators and investors alike, the Terra collapse remains a cautionary tale of unchecked innovation colliding with systemic risk.