Stablecoins Become Venezuela’s Lifeline

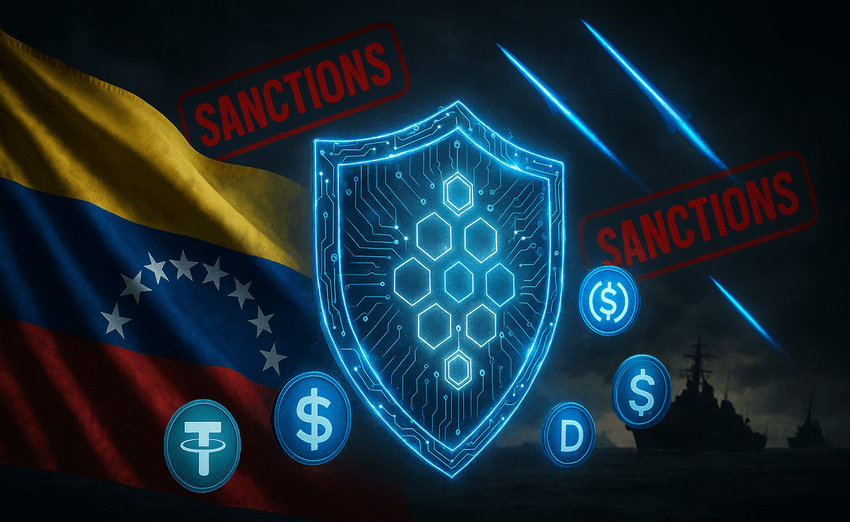

Venezuela’s dependence on U.S. dollar–pegged stablecoins is deepening amid mounting war threats, economic sanctions, and runaway inflation. The fragile South American nation, long battered by political turmoil, could see its crypto reliance soar as tensions with the United States intensify.

Earlier this week, the U.S. Department of Defense deployed its most advanced aircraft carrier to the Caribbean near Venezuela. The move followed President Donald Trump’s warning of possible military strikes against drug cartels allegedly operating within the country.

Venezuelan President Nicolás Maduro dismissed the accusations, urging Trump to “refrain from starting a war.” But as geopolitical risk climbs, so does financial instability - and for millions of Venezuelans, stablecoins like Tether (USDT) have become the only reliable shield against economic collapse.

A Dollar Alternative Amid Economic Breakdown

Years of triple-digit inflation have rendered the bolívar nearly worthless, forcing citizens and even government entities to transact in crypto. With U.S. dollar reserves drying up, stablecoins now play a critical role in day-to-day commerce, savings, and cross-border trade.

The Venezuelan government has also embraced stablecoins - particularly USDT - to facilitate oil trade with strategic allies such as Russia. The two countries reportedly formalized a new partnership this week, further cementing crypto’s role in circumventing sanctions and preserving liquidity.

According to The New York Times, President Maduro has effectively “rewired Venezuela’s economy to stablecoins,” making it the first nation to manage a significant share of its public finances using digital assets.

Venezuela Among Latin America’s Top Crypto Nations

Despite its political and economic woes, Venezuela ranks fourth in Latin America for overall crypto adoption, receiving $44.6 billion in digital assets between July 2024 and June 2025, according to Chainalysis.

The country trails only Brazil, Argentina, and Mexico, each with far larger populations. The report underscores how sanctions, hyperinflation, and capital controls have pushed millions of Venezuelans toward crypto as a matter of survival.

From Citizens to Politicians - Everyone Uses Crypto

One of the most high-profile users of crypto is María Corina Machado, the former Venezuelan presidential candidate and recent Nobel Peace Prize laureate, who said she uses Bitcoin to protect her assets from government seizure.

Her story underscores a broader truth: for both citizens and political figures, crypto represents freedom and protection in a collapsing financial system.

Since Maduro came to power in 2013, over 8 million Venezuelans have fled the country, escaping hunger, medicine shortages, and repression. Many who remain rely on USDT and Bitcoin to store savings, pay for essentials, and send money abroad - a decentralized lifeline amid authoritarian control.

Stablecoins at the Center of Venezuela’s Survival

As geopolitical tensions rise and U.S. sanctions tighten, stablecoins have evolved from a niche asset to a national necessity in Venezuela. Whether to buy groceries, trade oil, or protect wealth, crypto has become the backbone of an economy living on the edge.

If the situation escalates further, analysts warn Venezuela could become a test case for large-scale stablecoin dependence - where blockchain replaces the banking system, and digital dollars keep a nation afloat under siege.