Visa and Yellow Card Join Forces for a New Crypto Frontier

Visa is diving deep into Africa’s crypto scene, forming a game-changing partnership with Yellow Card Financial to bring stablecoin-powered payments to 20 countries across the continent. The first rollout is expected this year in an unnamed market, with more set to follow in 2026, according to a Bloomberg report.

The move signals a major shift in how traditional financial players are embracing blockchain innovation in regions where dollar access and infrastructure remain challenging. Yellow Card, a leading stablecoin exchange and payment provider, confirmed the partnership and emphasized that the focus is on USDC and other digital dollar equivalents for faster, cheaper cross-border transactions.

Yellow Card?Visa

— Yellow Card (@yellowcard_app) June 18, 2025

Yellow Card is teaming up with @Visa to enhance stablecoin settlement infrastructure in emerging markets. Together, we’ll make cross-border payments quicker and more efficient through the power of blockchain innovation.

Learn more: https://t.co/b1thwbrqLv pic.twitter.com/uyZAWbdQDj

Yellow Card?Visa

— Yellow Card (@yellowcard_app) June 18, 2025

Yellow Card is teaming up with @Visa to enhance stablecoin settlement infrastructure in emerging markets. Together, we’ll make cross-border payments quicker and more efficient through the power of blockchain innovation.

Learn more: https://t.co/b1thwbrqLv pic.twitter.com/uyZAWbdQDj

Building Bridges Between Crypto and Traditional Finance

In a public statement, Yellow Card CEO Chris Maurice highlighted the significance of Visa’s global presence:

Founded in 2016 and launched in Nigeria by 2019, Yellow Card has already processed over $6 billion in transactions. It became Africa’s first licensed stablecoin payment provider, operating in 20 countries and focusing on financial inclusion and dollar liquidity.

Maurice added that beyond cross-border payments, the deal will explore improvements in treasury management and liquidity operations, areas where stablecoins can create efficiency and cost savings.

Stablecoins Fill the Dollar Gap in Africa

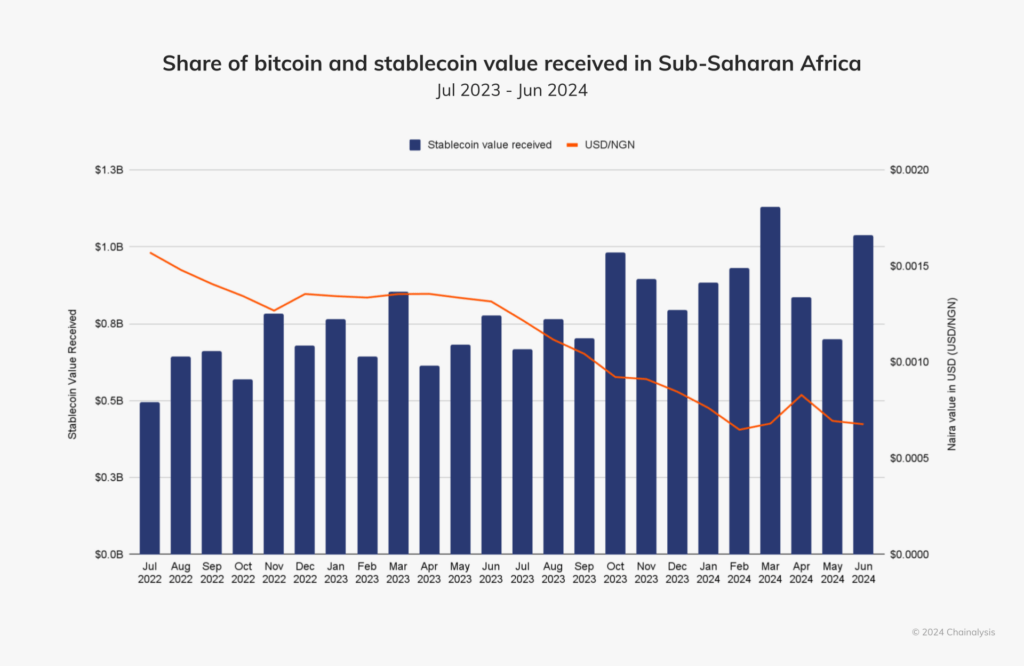

As fiat currencies across Africa continue to lose value, stablecoins like USDC have become essential tools for savings and international payments. Chainalysis data confirms that stablecoin usage is rising sharply, outpacing overall crypto growth in the region.

In Sub-Saharan Africa, stablecoins now represent 43% of total crypto transaction volume, with Nigeria alone receiving $59 billion in crypto flows last year. Notably, 85% of that volume came from transfers under $1 million, showing that stablecoins are becoming a grassroots solution—not just an institutional one

Source: Chainalysis

Regulation Is Catching Up Across the Continent

The policy landscape is evolving fast. Kenya’s Virtual Asset Service Providers Bill is being called one of the most forward-thinking digital asset frameworks in Africa. Yellow Card’s legal counsel Edline Murungi explained:

Elsewhere, countries like Mauritius, Botswana, Nigeria, and members of CEMAC have already begun drafting or enforcing crypto legislation. The momentum suggests Africa is not just adopting crypto—it’s structuring it for long-term growth.

Circle and Onafriq Boost the Stablecoin Wave

Visa and Yellow Card aren’t alone. In April, Circle partnered with Onafriq, Africa’s largest digital payments network, to expand USDC-powered cross-border payments. With over 500 digital wallets and 200 million linked bank accounts, Onafriq’s integration is positioned to massively reduce Africa’s $5 billion annual cross-border payment fees—largely caused by reliance on overseas settlement systems.

A joint report by Artemis and Dune revealed that active stablecoin wallets surged 53% in the past year, now totaling 30 million globally. Meanwhile, monthly stablecoin transfers exceeded $4.1 trillion, marking a steep rise in both retail and institutional adoption.

Africa is now becoming the ultimate stress test for whether stablecoins can truly deliver on the promise of financial access, speed, and cost-efficiency.

We’ve partnered with @circle to expand access to cross-border payments across Africa!?

— Onafriq (@Onafriq) April 30, 2025

By integrating USDC-powered settlement solutions into our network, we’re making intra-African payments faster and more efficient for individuals and organisations.

Learn more:… pic.twitter.com/EJLmY4sdoT

We’ve partnered with @circle to expand access to cross-border payments across Africa!?

— Onafriq (@Onafriq) April 30, 2025

By integrating USDC-powered settlement solutions into our network, we’re making intra-African payments faster and more efficient for individuals and organisations.

Learn more:… pic.twitter.com/EJLmY4sdoT