Allora Airdrop

Allora Network aims to be a decentralized intelligence layer for Web3, letting applications tap into collective AI insights rather than rely on a single model. Built on Cosmos, Allora coordinates numerous machine learning models and evaluators to deliver accurate on-chain predictions. Its modular architecture, zero-knowledge proofs (zkML), and token incentives drive a continuously self-improving AI system.

Airdrop farming steps

Step-by-Step Guide to Farming Allora Airdrop

Join Allora's Discord: Go to https://discord.com/invite/allora and verify to get access to the project's channels.

Link your Discord on Matrica: Go to https://matrica.io/ and create an account or log-in. Link your Discord account.

Buy $NICK Tokens: Go to Dexscreener and purchase at least 35K $nick tokens (worth ~$8 at the time of writing).

Obtain your Discord Role: Go to the #nick-og channel on Discord and click the "Check Status" button to confirm you have received the Nick OG role (might take a few minutes to appear).

Stay Tuned for Mainnet: Monitor for mainnet updates and participate in Season 1 of Allora Prime once mainnet is live.

Project Review

Problem Solved

Modern AI services are often siloed in proprietary, opaque models controlled by a few big players. This creates trust and accessibility issues for blockchain projects seeking AI-driven features. Allora tackles this by offering an open, collaborative network where many models contribute to a shared "intelligence layer". The network’s objective-centric approach means users specify a task (like price prediction) without choosing a single model. Instead, Allora dynamically orchestrates multiple models to achieve the best result. By leveraging collective learning, peer evaluation, and zero-knowledge proofs for verification, Allora aims to deliver AI predictions that are more accurate, transparent, and trustless than centralized alternatives.

Tokenomics

Allora’s token $ALLO is yet to launch. It is used to pay for AI queries under a “pay-what-you-want” model (users tip what they want, and higher rewards attract more contributors). $ALLO also rewards participants: model workers earn tokens for accurate predictions and reputers earn tokens for valid evaluations. Both roles must stake $ALLO (with slashing for malicious behavior), giving them skin in the game. The token additionally secures the chain (via validator staking rewards) and grants holders governance rights over the protocol. Distribution details are not yet public, leaving uncertainty about how decentralized the supply will be.

Perspectives

Allora has the potential to become critical infrastructure if it delivers on its vision of continuously improving decentralized AI. It could power many on-chain applications (DeFi analytics, predictive oracles, DAO governance, even autonomous agents) by providing on-demand intelligent insights. Its complex architecture and incentive model must prove resilient and effective at scale. Allora also faces a competitive landscape in the AI-blockchain space, meaning it must execute well to attract developers and sustain usage beyond initial hype.

Founders and Team

The project is led by Allora Labs (formerly Upshot), a team with deep expertise in blockchain and AI. The company was co-founded in 2019 by Nick Emmons (CEO) and Kenny Peluso (CTO) - each with a background in machine learning and crypto. The team first gained recognition for building AI-driven predictive oracles at Upshot (including a model for NFT pricing across 400M+ assets with 95–99% accuracy), as well as for pioneering zero-knowledge ML techniques. This strong technical background and years of R&D suggest they have the skill set to execute Allora’s ambitious vision.

Funding

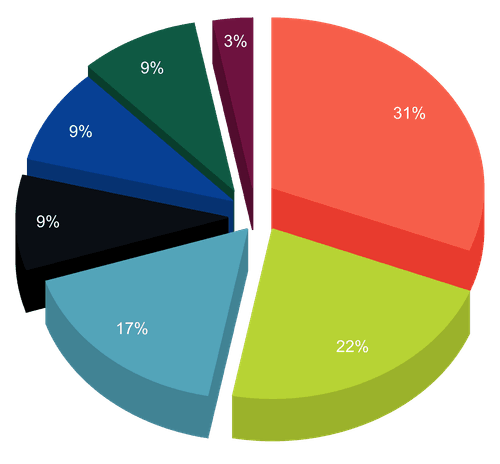

Notable Investors: Polychain Capital, Blockchain Capital, Framework Ventures, CoinFund, Delphi Ventures, Archetype, CMS Holdings

Allora Labs is well capitalized, having raised about $35 million in funding to date across multiple rounds (Seed, Series A, extended Series A, and a strategic round). Its backers include top-tier venture capital and angel investors, giving the project ample resources and industry connections to execute its roadmap. On the flip side, heavy VC involvement means insiders are likely to hold a significant portion of tokens, which could affect how decentralized the network’s ownership and governance will be post-launch.

Community

Allora has amassed a large community even before any token launch, reflecting significant interest, although, much of it is driven by airdrop speculation. The project’s X account boasts roughly 200,000 followers, and its Discord has a similar number of members. Sentiment is upbeat, fueled by testnet rewards and the anticipation of future tokens. The team has stoked growth via incentive campaigns and testnet participation rewards. This strategy has effectively built hype, though it’s unclear if the community will stay engaged long-term once the airdrop hype tapers off.

Competitors

Allora competes with projects like Bittensor, Fetch.ai, and SingularityNET. The latter two along with Ocean protocol were under a "tokenomic alliance" though Ocean has since exited, hinting at instability within that group. Unlike those networks focused on agent or marketplace ecosystems, Allora’s edge lies in its objective-based multi-model framework and verifiable outputs via zkML. Built on Cosmos, it’s modular and directly on-chain, enabling seamless integration across DeFi and prediction markets. This focus on verifiable, collaborative intelligence and strong cross-chain interoperability positions Allora as a more technically cohesive alternative in a fragmented decentralized AI field.

Conclusion

Allora is a bold bet at the intersection of AI and blockchain. It brings an ambitious design that could redefine how on-chain applications leverage machine intelligence. The project’s strengths such as the innovative architecture, strong backing, and a capable team, give it a shot at becoming a foundational “intelligence layer” in crypto. However, the road to success is far from guaranteed. Allora remains in an experimental phase and must prove that its complex collective intelligence system can deliver real-world value at scale. It faces fierce competition and the challenge of converting hype into lasting adoption. In short, Allora has immense potential but equally significant execution risk; the coming years will determine whether it truly lives up to its promise or falls short in the race to decentralize AI.

Other Details

Allora announced Season 1 of a premium staking initiative, called Allora Prime. It will reward early participants in the Allora Network as it transitions to mainnet. The mainnet is not yet live, so users cannot stake or participate in the Prime program yet. Until then, users can opt to get the "Nick OG" role on Allora's discord by purchasing a certain amount of "Nick" tokens (worth around $8 at the time of writing). This role is likely to be considered for an airdrop and for staking eligibility.

Developers and similarly skilled people can opt to participate in the project's Forge program to also get potential airdrop allocations.