Arbitrum Airdrop

Arbitrum is a top Layer-2 ecosystem built for scale, speed, and developer freedom. With growing adoption, major updates like Stylus, Orbit, and a decentralized sequencer are pushing the tech forward. If you're exploring where to spend time in crypto for the next wave of rewards, Arbitrum should be on your radar.

Airdrop farming steps

Step-by-Step Guide to Farming Arbitrum Airdrop

Set Up Your Wallet: Ensure you have an Ethereum wallet (like MetaMask) configured with Arbitrum. You’ll need a bit of ETH on Arbitrum for gas fees.

Visit Layer3: Go to the Layer3 platform and sign in by connecting your Web3 wallet.

Find Arbitrum Quests: Browse the Layer3 dashboard for Arbitrum-related campaigns or quests. Click on a quest to see the description, requirements, and rewards. Each quest will outline a series of tasks you need to perform.

Execute On-Chain Actions: Follow the step-by-step instructions for each task. These may include performing a swap or interacting with protocols. Perform each action and complete the transaction in your wallet.

Verify Completion: Layer3 will usually auto-detect on-chain completions by reading the blockchain. After each task, return to the quest page – there may be a “Verify” or the task might automatically show as completed once the transaction is confirmed on Arbitrum.

Complete all Quest Steps: Continue until you have done all tasks listed in the quest. A progress bar or checklist on Layer3 will show which steps are done. Once all are checked off, the quest status will update to completed.

Stay Active and Informed: New Arbitrum quests are added regularly, often in collaboration with Arbitrum ecosystem projects. Check Layer3’s quests page frequently for updates. Also, follow Arbitrum’s and Layer3’s social channels, they often announce when a big quest or campaign with a prize pool is live.

Project Review

Problem Solved

Arbitrum has already proven itself as a top-tier Ethereum Layer-2 with consistently good numbers in TVL, usage, and ecosystem activity. The current phase is no longer about basic scalability but about expanding developer access, improving user experience, and creating infrastructure that supports long-term adoption. Like every L1 and L2, Arbitrum is now in a fight to attract and retain developers and users through tooling, performance, and incentives.

Recent upgrades reflect this shift: Stylus allows smart contracts to be written in Rust, C, and C++, broadening developer access beyond Solidity. Orbit lets teams launch their own customizable chains in the Arbitrum ecosystem. Fast withdrawals, adaptive gas pricing, and future decentralized sequencing all point toward a more flexible, performant, and modular architecture. The goal is to make Arbitrum chains easier to build on, faster to use, and more aligned with what devs want. Whether that’s enough to stand out amid dozens of similar platforms is the ongoing challenge.

Tokenomics

Arbitrum’s native token ARB is a governance token – not used for gas fees (Arbitrum transactions are paid in ETH). ARB holders govern the protocol’s upgrades and treasury on Arbitrum One and Nova (the two separate chains of Arbitrum), voting on proposals that shape the network’s future. The token launched in March 2023 with a fixed initial supply of 10 billion ARB. Up to 2% annual inflation is allowed, but new tokens can be minted only if the Arbitrum DAO votes for it (the earliest such mint could occur was after March 2024).

There is currently no automatic burn or fee-to-token mechanism on Arbitrum, ETH gas fees are used to pay sequencers and L1 costs, with no ARB being burned by protocol design.

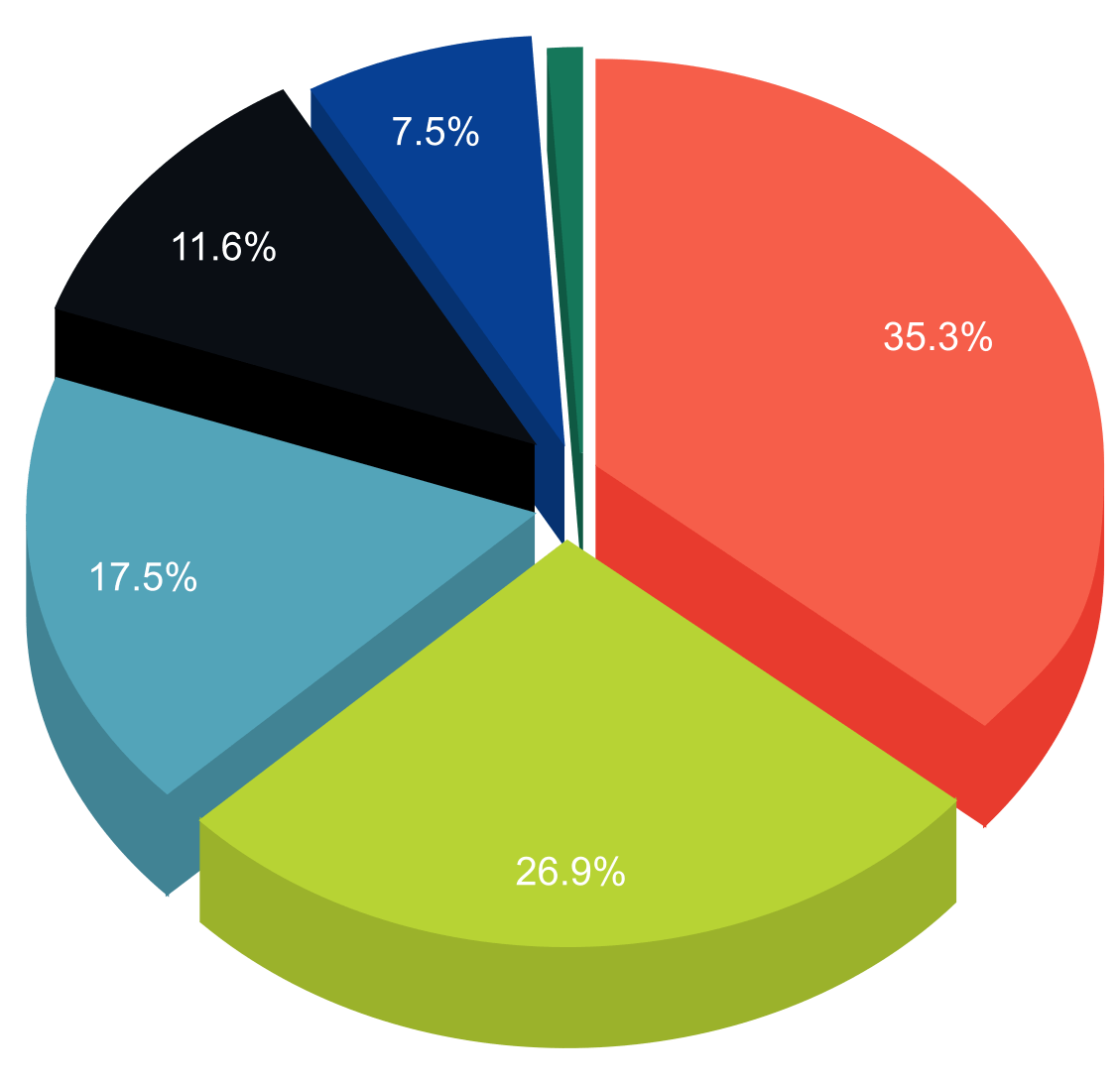

The initial allocation of ARB was designed to put a sizable share in community hands. 11.62% (1.162 billion tokens) were airdropped to individual Arbitrum users, and another 1.13% went to the treasuries of popular Arbitrum-integrated DAOs. The Arbitrum DAO Treasury itself received the largest allocation (35.28%, or 3.528 billion ARB) which is collectively controlled by ARB voters for grants and ecosystem development.

On the other side, investors received 17.53% and the team (Offchain Labs and advisors) got 26.94%, both of which are on 4-year lockups with a 1-year cliff. The Arbitrum Foundation was allocated 7.5% for operational and administrative use (also vesting over 4 years). This means that while roughly half of the supply is eventually going to insiders (team, advisors, investors, foundation), those tokens are locked initially, and the circulating supply started much smaller.

Overall, ARB’s tokenomics aim to balance incentivizing development (through the treasury and team allocation) with community control. Governance decisions, including token mints or fee policy changes, are made through on-chain voting, keeping the system’s evolution in the hands of token holders.

Perspectives

Arbitrum is evolving to meet the broader demands of builders in an increasingly competitive Layer-1 and Layer-2 landscape. Recent updates reflect a shift from being just a rollup to a full-stack ecosystem that supports multiple chains, not only Arbitrum One and Nova but also permissionless Orbit chains. This mirrors the emerging trend where ecosystems aim to attract developers by letting them launch custom chains with flexible rules, incentives, and governance.

The roadmap includes major upgrades like Stylus (allowing development in Rust/C/C++), Adaptive Pricing, and a decentralized sequencer—all designed to lower technical barriers, improve performance, and offer developers more creative freedom. Features like fast withdrawals, inter-chain messaging, and future ZK integrations aim to tighten the UX and make onboarding smoother.

Arbitrum is clearly playing to win developer mindshare by offering better tools, faster performance, and a modular ecosystem. That said, many competing L2s and alt-L1s are doing the same. Unless Arbitrum can introduce something uniquely valuable or easier to use than the rest, it’s likely to keep holding its strong position rather than pulling further ahead.

Founders and Team

Arbitrum was developed by Offchain Labs and led by three co-founder – Ed Felten, Steven Goldfeder, and Harry Kalodner. Ed Felten is a former Princeton computer science professor who also served as the Deputy U.S. Chief Technology Officer in the White House. He’s a respected computer scientist with expertise in security and was involved in blockchain research early on. Steven Goldfeder, now CEO of Offchain Labs, holds a Ph.D. from Princeton and co-authored the textbook “Bitcoin and Cryptocurrency Technologies” alongside Felten.

Goldfeder’s background in cryptography and cryptocurrencies helped shape Arbitrum’s design. Harry Kalodner (CTO of Offchain Labs) also earned a Ph.D. at Princeton, focusing on blockchain technology. The concept of Arbitrum actually dates back to academic research the trio published in 2018, building on ideas Felten had been discussing as early as 2015. This long research runway gave Offchain Labs a deep technical foundation to draw upon.

Beyond the founders, Offchain Labs has grown into a larger organization with engineers and researchers who have experience at top institutions. Notably, in 2022 the team acquired Prysmatic Labs (the team behind a leading Ethereum consensus client), underlining their commitment to Ethereum’s ecosystem development. This blend of academic prowess and industry experience in the core team, combined with a growing open-source contributor base, lends Arbitrum a high degree of credibility.

Funding

Lead Investors: Pantera Capital

Notable Investors: Coinbase Ventures, Compound VC, BlockNation, George Lambeth, Jake Sei

Lead Investors: Lightspeed Venture Partners

Notable Investors: Polychain Capital, Alameda Research, Pantera Capital, Ribbit Capital, Redpoint, Mark Cuban

Offchain Labs has secured substantial funding, giving Arbitrum a solid financial runway for growth. The project’s initial seed round in April 2019 raised about $3.7 million, led by Pantera Capital, an early believer in Ethereum scaling solutions. In April 2021, the team closed a Series A of $20 million, soon followed by a major Series B round in August 2021, which brought in $100 million in new capital and valued Offchain Labs at $1.2 billion (unicorn status).

In addition to venture funding, Arbitrum’s token launch in 2023 effectively capitalized the ecosystem. The Arbitrum DAO Treasury received 3.5 billion ARB tokens (over one-third of the supply), which at the time of launch represented billions of dollars in value for long-term ecosystem development. Financially, this means Arbitrum isn’t solely reliant on venture money, it has an on-chain treasury to sustain growth.

Overall, Arbitrum’s financial capacity appears strong. The venture raises in 2021 gave the core development company a multi-year runway for R&D and operations, and the high-profile investor backing provides access to strategic resources. Now that the network is live and community-owned, the large DAO treasury further ensures funds are available to bootstrap ecosystem projects, liquidity mining, or user acquisition as needed.

Community

Arbitrum has built one of the largest and most active communities in the Layer-2 space. Its March 2023 ARB airdrop saw over 625,000 eligible addresses and drove record network activity. Crucially, usage has remained high post-airdrop, often rivaling Ethereum in daily transactions and active addresses. By late 2024, Arbitrum led all L2s in TVL, with $13.5 billion locked and a thriving ecosystem of DeFi, NFT, and gaming apps.

The community is not just large but engaged. Governance participation surged after the controversial AIP-1 proposal in April 2023, when the community felt the Foundation overreached in allocating tokens to itself. This pushback prompted the Foundation to revise the proposal. The episode highlighted the DAO’s maturity and the community’s commitment to accountability. Subsequent proposals passed with broad support, and governance remains active today.

Arbitrum's growth strategy emphasizes education and incentives. Initiatives like Arbitrum Odyssey and Layer3 quests have driven millions of on-chain actions by hundreds of thousands of users. These gamified experiences help onboard new users and sustain engagement. Developer and user enthusiasm remains high as of 2025. While the community expects ongoing decentralization efforts, it remains loyal and active. Arbitrum’s ability to retain users, attract builders, and foster governance makes its community a core strength.

Competitors

Arbitrum’s primary competitors are Optimism, Polygon, and Base—each building out their own ecosystems with similar scaling goals. Optimism is pushing its Superchain narrative and expanding its OP Stack. Polygon continues to iterate across multiple ZK and PoS chains with a focus on branding and performance. Base, launched by Coinbase, has grown fast by leveraging its exchange user base.

In contrast, Arbitrum is betting on modularity and decentralization. Orbit allows projects to spin up their own chains, Stylus opens up new programming options, and a decentralized sequencer is on the horizon. These updates show Arbitrum is focused on long-term infrastructure while staying developer-friendly. ZK-rollup competitors like zkSync and Starknet are still developing, but they remain relevant. Solana and other L1s are indirect threats, but Ethereum-native builders still prefer L2s for compatibility and liquidity.

Overall, Arbitrum has kept pace with its closest rivals by doubling down on tech and flexibility. But with everyone chasing the same developers and liquidity, the market will remain fiercely competitive for the foreseeable future.

Conclusion

It feels like Arbitrum is not flashy, and not always loud, but consistent and quietly dominant. It’s already won a big chunk of market share, and instead of chasing short-term hype, the team seems focused on deep infrastructure plays like Orbit chains, Stylus, and a decentralized sequencer. These aren’t crowd-pleasers for your average degens, but they do speak directly to developers—and that’s who Arbitrum is clearly trying to win over.

But let’s be real: competition is brutal. Optimism has its Superchain narrative, Base has Coinbase muscle, and Polygon is slinging out zk flavors like candy. Everyone’s fighting for the same pie—liquidity, devs, and sticky users. Arbitrum's edge might be its modular design and pace of execution, but unless they roll out something the others can’t easily copy or undercut, they may just maintain their decent position rather than extend it.

Still, if you're betting on Ethereum’s L2 thesis long-term, it’s hard not to have Arbitrum in the conversation. They’ve got money, talent, traction, and a real roadmap. Not the most thrilling moonshot play—but definitely one of the few L2s actually shipping things that matter.

Other Details

The Arbitrum airdrop occurred on March 23, 2023, distributing 1.162 billion ARB tokens (11.62% of the total 10 billion ARB token supply) to eligible users of the Arbitrum network. The project is currently collaborating with Layer3—a gamified platform that incentivizes users to engage with blockchain ecosystems like Arbitrum through quests, earning rewards such as NFTs, tokens, or points that may qualify users for future airdrops. The platform has been instrumental in past Arbitrum airdrops, as completing Layer3 quests related to Arbitrum (e.g., Arbitrum Adventure) helped users meet eligibility criteria for the 2023 ARB airdrop.

The Layer3 reward campaigns are already well established and we're into season 3 of Arbitrum's rewards. We cannot expect large sums but participating in quests is a good way to get your foot in the ecosystem and explore more Arbitrum-based projects that will have airdrops of their own.