Arkham Airdrop

Arkham is a blockchain intelligence platform aimed at deanonymizing blockchain activity and linking on-chain addresses to real-world entities. Using proprietary AI, it provides tools for transaction analysis, portfolio insights, and entity profiling. The recent addition of Arkham Exchange integrates trading and intelligence, offering a comprehensive platform for traders.

Airdrop farming steps

Step-by-Step Guide to Farming Arkham Airdrop

Register: Visit https://auth.arkm.com/register and create an account.

Complete KYC: Complete your account verification to gain access to all platform features.

Set up 2FA: Navigate to the Security page in your account and set up the two-factor authentication.

Deposit: Make a crypto deposit to be able to trade on the Arkham Exchange and start earning points.

Trade: Users can earn Arkham points based on their trading volume on Spot and Perpetuals. The bigger the volume, the bigger the airdrop reward.

Refer Friends: Navigate to the User Dashboard to track your progress and access a referral link. You will get 15 points for each referral.

Project Review

Problem Solved

Arkham addresses a critical limitation in blockchain transparency: while blockchain data is inherently public, it is unprocessed and pseudonymous, rendering it practically unusable for actionable insights. Arkham’s core mission is to deanonymize this data and link blockchain addresses to real-world entities. By doing so, it empowers users with detailed intelligence on entities, including transaction histories, portfolio analysis, and behavior patterns.

Extension of the Core Concept

Arkham has expanded its capabilities with the introduction of the Arkham Exchange, integrating trading functionality directly into its intelligence platform. This extension transforms Arkham from a purely analytical tool into an omniplatform for traders and researchers. It provides a seamless workflow, allowing users to analyze data, make decisions, and execute trades without needing external platforms. Features like customizable dashboards, network analysis, and multi-chain integration further enhance the platform's utility.

Unique Selling Points

Ultra AI Engine: A proprietary system for data synthesis that aggregates and attributes blockchain transactions at scale.

Entity-Based Analytics: Unlike general transaction tools, Arkham provides detailed profiles of entities, making intelligence highly actionable.

Intel-to-Earn Model: The decentralized Arkham Intel Exchange incentivizes users to contribute intelligence, creating a scalable, user-driven ecosystem for blockchain data.

Tokenomics

ARKM is the native utility token driving the Arkham ecosystem, initially designed to power the "intel-to-earn" model. It facilitates economic activities on the Arkham Intel Exchange, including bounties and auctions. Users post ARKM as bounty rewards for intelligence needs, with hunters submitting findings for verification. Sellers can also auction intelligence, allowing market forces to determine its value. Beyond the exchange, ARKM is used for direct rewards in the DATA program, incentivizing submissions such as address labels, new entities, and high-priority intelligence that train Arkham’s Ultra AI.

The tokenomics also extend to the Arkham Exchange, where ARKM provides fee discounts for trades, further embedding the token in platform activity. Arkham is currently running a campaign where users earn points for engaging with the exchange, which will be converted into ARKM tokens upon completion. This strategy aligns token distribution with user participation, driving adoption and liquidity.

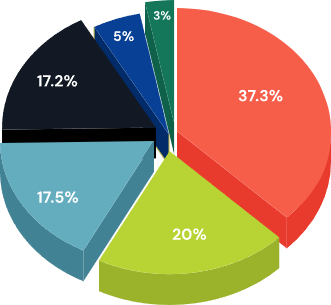

ARKM's total supply of 1 billion tokens is allocated as follows: 37.3% for ecosystem incentives and grants, 20% for core contributors, 17.5% for investors, 17.2% for the foundation treasury, 5% for Binance Launchpad, and 3% for advisors. Token releases are scheduled over multiple years to ensure balanced distribution and align stakeholder interests with long-term platform growth.

Perspectives

Arkham's integration of blockchain intelligence with trading capabilities positions it uniquely in the crypto ecosystem. However, its approach to deanonymizing blockchain transactions has sparked significant controversy. Critics argue that Arkham's platform could incentivize the exposure of individuals' identities, potentially compromising privacy and security within the crypto community.

The platform's "intel-to-earn" model, which rewards users for sharing information, has been labeled as a "snitch-to-earn" system by detractors. This perception poses challenges to user trust and platform adoption. Additionally, technical issues, such as the exposure of user emails through invitation code links, have raised concerns about data security and user privacy.

Despite these challenges, Arkham's proprietary Ultra AI and the Arkham Exchange offer innovative solutions for blockchain analysis and trading. The platform's success will depend on its ability to address the concerns of users and maintain a competitive platform for its users.

Founders and Team

Arkham was founded in 2020 by CEO Miguel Morel who previously co-founded Reserve Protocol, a platform for creating and managing asset-backed currencies. Morel brings years of experience as a technology entrepreneur, with expertise in strategic management, recruitment, fundraising, and business development across diverse global markets such as East Asia, South America, West Africa, and the Middle East.

Arkham was established as a cryptocurrency intelligence platform but the company has continually expanded its offerings, including a centralized spot trading and perpetuals exchange as its latest feature.

Funding

Investors: Peter Thiel, Sam Altman, Geoff Lewis, Tim Draper, Coinbase, and Digital Currency Group.

Investor: Binance Labs.

Arkham has raised a total of $12 million through its Seed and Series A funding rounds, attracting prominent investors such as the founders of Palantir and OpenAI, as well as Binance Labs, which strategically invested in the platform's native token, $ARKM. The company also conducted a public token sale via Binance’s Launchpad, raising $2.5 million with the sale of 50 million $ARKM tokens.

Beyond its fundraising efforts, Arkham generates revenue through multiple streams. Its Intel Exchange charges a 2.5% maker fee on submitted bounties and a 5% taker fee on bounty payouts and successful auction bids. Additionally, the platform offers subscription-based access to its advanced analytics tools, providing users with premium data insights for a recurring fee. Arkham’s native token, $ARKM, plays a pivotal role in the ecosystem, facilitating transactions and contributing to the platform's financial model through token-related activities.

This multifaceted revenue approach, combining transaction fees, subscription services, and token utility, underpins Arkham’s operational sustainability and supports its growth ambitions.

Community

Over its five years of operation, Arkham has built a substantial community, including 1.6 million followers on X (formerly Twitter) and over 38,000 members in its Discord server. The team actively engages with its audience through consistent social media updates and operates dedicated Telegram channels in multiple languages, such as Chinese, Turkish, and Spanish. This multilingual approach reflects their commitment to fostering a global user base.

Community sentiment is generally positive, with much of the current discourse focused on Arkham's ongoing points campaign. However, the project has faced some controversy surrounding its Intel Exchange. Critics within the community have labeled the platform as "dox-to-earn," referencing its bounty system that rewards users for uncovering the real-world identities behind wallet addresses. Despite this pushback, Arkham maintains its vision of integrating personal identity with blockchain interactions and exposing fraudulent activities to prevent crises like the FTX and Alameda collapses.

Competitors

Arkham operates in a niche with few but strong competitors like Chainalysis, Nansen, and Elliptic. The business model in this sector often leads users to choose one platform rather than subscribing to multiple, as overlapping features and cost considerations dominate decision-making. This dynamic makes the competition particularly intense despite the limited number of platforms.

Arkham’s approach is unique in offering a user-driven intel marketplace and a trading exchange tied directly to its analytics platform. Competitors like Chainalysis and Elliptic focus more on investigative analysis, catering to compliance and regulatory needs, while Nansen emphasizes wallet profiling and social signals. While Arkham’s model provides a distinct edge with its "intel-to-earn" system and trading integration, it lacks the investigative depth of platforms like Chainalysis and Elliptic.

As Arkham ventures into trading with its exchange, it faces a different set of challenges and competitors. The trading market is highly saturated, with numerous established platforms offering extensive liquidity and infrastructure. Arkham's strategy hinges on integrating its intelligence platform with trading, allowing users to act on insights directly. While this concept is promising, questions remain about why Arkham opted to develop its own trading platform instead of partnering with an established one. Successfully managing these challenges while maintaining focus on its intelligence platform will be critical for Arkham's long-term success.

Conclusion

Arkham stands out in the emerging blockchain intelligence niche by addressing the gap between raw blockchain data and actionable insights. Its proprietary Ultra AI, entity-based analytics, and "intel-to-earn" model provide users with tools to deanonymize blockchain activity and uncover valuable market opportunities. The recent integration of trading functionality with its analytics platform through the Arkham Exchange positions it as a comprehensive solution for traders and analysts.

However, the project's strengths come with challenges. While Arkham’s user-driven intel marketplace and unique approach have established a foothold in a competitive yet sparsely populated niche, its focus on deanonymization has sparked privacy concerns and controversy within the community. Furthermore, its foray into the trading exchange market introduces risks, as it must compete with established platforms while addressing resource and scalability demands.

Arkham’s success hinges on its ability to balance these challenges while capitalizing on its strengths. It must address user concerns about privacy and trust, navigate regulatory scrutiny, and maintain focus on its intelligence platform amidst the development of its trading exchange. If executed effectively, Arkham has the potential to solidify its role as a leader in blockchain intelligence while redefining how users engage with crypto markets.

Other Details

The Arkham Points program allows Arkham Exchange users to earn points based on their spot and perpetual trading volume during the first 30 days of trading. After this period, the program will conclude, and accumulated Arkham Points can be converted into the platform's native token, $ARKM.

Arkham VIPs have additional earning opportunities, gaining points for referring or inviting new users and nominating new VIPs to the platform. Eligible Arkham VIPs who open an exchange account and deposit at least $100 will receive a 10% bonus on their accumulated Arkham Points.