Berachain Airdrop

Berachain is an EVM-identical Layer 1 blockchain utilizing a Proof-of-Liquidity consensus mechanism that secures the network through liquidity. The project maintains a playful tone, blending meme culture with a serious commitment to blockchain development. This balance has cultivated a passionate, cult-like community eagerly awaiting the mainnet launch and potential airdrops, underscoring that despite its humor, Berachain is far from a joke.

Airdrop farming steps

Step-by-Step Guide to Farming Berachain Airdrop

Visit bArtio: Navigate to https://bartio.faucet.berachain.com, accept the Terms of Service and connect your wallet address to the bArtio test network.

Claim faucet: Click on the faucet icon from the top right and claim testnet BERA tokens.

Visit the Berachain DEX: Navigate to https://bartio.bex.berachain.com, accept the Terms of Service and connect your wallet.

Swap tokens: Click on “Swap Tokens” and swap BERA for HONEY or other available tokens.

Provide liquidity: Click on "View Pools" and provide liquidity to earn BGT rewards.

Mint Honey: Navigatge to https://bartio.honey.berachain.com and exchange USFT, DAI or STGUSDC stablecoins for Berachain's stablecoin HONEY.

Visit BEND: Navigate to https://bartio.bend.berachain.com, supply assets and borrow HONEY. Users can earn BGT tokens for borrowing and lending.

Trade on BERPS: Navigate to https://bartio.berps.berachain.com and engage in leverage trading with short and long trades. Go to "Vaults" and stake HONEY to receive BGT emissions.

Visit BGT Station: Navigate to https://bartio.station.berachain.com, engage in Berachain's governance and deposit in gauges to earn BGT.

Project Review

Problem Solved

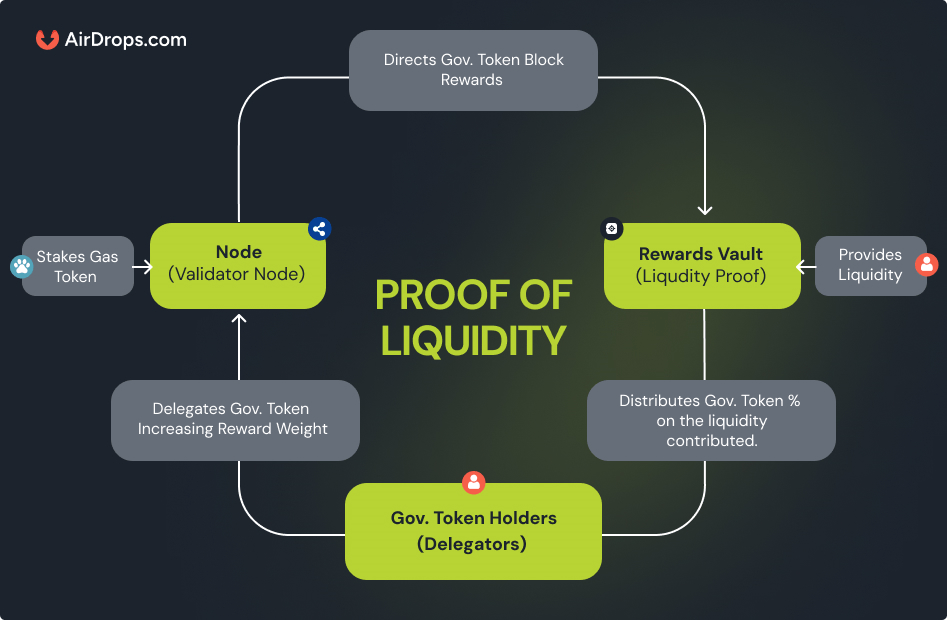

Berachain solves the problem of misaligned incentives between validators, protocols, and liquidity providers in traditional Proof-of-Stake systems. In PoS, validators earn most rewards while protocols and users don’t have much reason to collaborate with them.

Berachain’s Proof-of-Liquidity (PoL) fixes this by creating a system where validators distribute governance tokens ($BGT) to liquidity providers, rewarding them for adding liquidity to the ecosystem. Validators and protocols work together because protocols can offer incentives to validators to direct more $BGT toward their liquidity pools.

This approach solves two key issues:

1. Incentivizing Liquidity: Instead of diluting their own tokens, protocols can use Berachain’s $BGT to reward liquidity providers, keeping token supplies intact.

2. Decentralizing Stake: Liquidity providers can choose which validators get more rewards, encouraging validators to support the ecosystem and preventing stake centralization.

By aligning these incentives, Berachain creates a more collaborative and liquid blockchain ecosystem.

Tokenomics

Berachain has a tri-token structure that includes $BERA, $HONEY, and $BGT, each serving distinct roles. $BERA is the native token used for gas fees in transactions. $HONEY is a stablecoin backed 1:1 by $USDC. $BGT, the governance and staking token, is soulbound, meaning it cannot be purchased or transferred. It is only earned by providing liquidity to Berachain’s core protocols or governance-approved contracts.

$BGT allows users to participate in governance, delegate to validators, and decide which liquidity pools receive $BGT rewards. Staking $BGT also earns users $HONEY from fees generated by protocols.

$BGT can be burned one-way into $BERA, allowing users to convert their governance token into $BERA for gas fees or other uses within the chain.

With this model validators benefit from directing $BGT emissions to Reward Vaults that attract liquidity providers, while liquidity providers benefit from the $BGT rewards distributed by validators, thus creating a symbiotic relationship with aligned economic interests.

Perspectives

Berachain is well-positioned for its mainnet launch, backed by strong community engagement, a growing ecosystem of decentralized applications, and significant capital secured through investor partnerships. However, the real challenge lies in maintaining momentum post-launch.

To keep the community engaged and attract new users and developers, Berachain must go beyond launch-day excitement and provide a sustainable value proposition. Berachain must demonstrate that it’s not just a place for replicating existing DeFi protocols from other chains but also a platform for pioneering new types of Web3 applications. This includes, but is not limited to, gaming, social platforms, and other innovative decentralized protocols.

Founders and Team

Berachain was founded in late 2021 by a pseudonymous team that includes individuals known as Smokey the Bera, Papa Bear, Dev Bear, and Homme Bear. The team first launched an NFT collection called Bong Bears, which quickly grew in popularity and attracted more Web3 builders to the community, leading to the creation of Berachain.

While the founding team has decided to remain anonymous, the identity of the project's Head of DeFi is known. The position is occupied by Jack Melnick, who previously operated as the Head of DeFi at Polygon Labs.

Despite committing to the massive undertaking of building a blockchain competitor to Ethereum and Solana, the project and its founders continue to embrace meme culture. This mix of lightheartedness with serious development remains a key part of their identity, attracting a dedicated community while pursuing ambitious technical goals.

Funding

Notable investors: Polychain Capital (lead), Hack VC, Shima Capital, Robot Ventures, Goldentree Asset Management.

Notable investors: Framework Ventures (co-lead), Brevan Howard Digital (co-lead), Polychain Capital, Hack VC, Samsung Next, Laser Digital from Nomura Group, Hashkey Capital, Nomad Capital, Hypersphere, Arrington Capital, Cypher Capital, Tribe Capital, Rubik. Angel investors include Bo Feng (Dragonfly), Yat Siu (Animoca Brands), Antony Lewis (Temasek) and Sandeep Nailwal (Polygon).

Berachain has attracted an impressive amount of funding from many notable investors. The project has a strong community strategy and uses every opportunity to embrace the "degen" culture. Even the fundraising terms are carefully planned to match the project's ethos, an example being the Series A which closed on April 20th and raised $42 million with a valuation of $420.69 million.

Community

Berachain has cultivated an extraordinarily passionate community, with its Discord server boasting nearly half a million members and its X (Twitter) account amassing over 935k followers. This makes it one of the most popular crypto projects currently. The community’s fervor is so strong that it’s often referred to as a "cult" with members displaying unwavering belief in the project's future success.

Interestingly, even FUD posts are repurposed by the community to fuel excitement and build momentum around the project, rather than causing harm. This level of community engagement and loyalty is a key asset for Berachain, helping to generate hype and sustain interest as the project continues to develop.

Competitors

Berachain is entering a saturated market filled with Layer-1s like Ethereum, Solana, and Avalanche, as well as Layer-2 solutions like Polygon, Optimism, and Blast. While these platforms often offer similar experiences—hosting variations of, essentially, the same DeFi protocols and dApps—Berachain’s strategy differs by emphasizing economic innovation over technical performance. The project's founder has acknowledged that Berachain does not compete in the race for the highest TPS, aiming instead to provide a balanced experience with reasonable TPS and sub-two-second block times.

The real focus seems to be on its Proof-of-Liquidity consensus model, which ties security to liquidity, making it a DeFi-centric chain. By concentrating on economic sustainability and user incentives rather than solely on technical benchmarks, Berachain seeks to overcome their competition by attracting developers and liquidity providers who value long-term ecosystem growth.

Conclusion

Berachain has positioned itself for a promising future, having already overcome one of the key hurdles that many blockchain projects face—generating significant hype and attracting developer interest prior to its mainnet launch. With a robust pipeline of dapps expected to go live on day one, coupled with high projected transaction volume, the early ecosystem looks strong. The $142M raised from prominent investors provides more than just capital—it opens doors to valuable networking, strategic partnerships, and resources that can accelerate growth.

Much of the community's excitement stems from the team's unconventional meme-culture approach, which has attracted a dedicated following, as well as from anticipated airdrops and other incentives tied to the mainnet launch. However, the core challenge for Berachain post-launch will be maintaining this momentum.

The initial rewards will generate short-term engagement, but long-term success will depend on whether Berachain can prove itself as an ideal environment for DeFi protocols, gaming platforms, and other Web3 projects. Sustaining both developer interest and user activity beyond the hype phase will be critical in establishing Berachain as a key player in the blockchain space.