Cookie DAO

Cookie DAO is building a data layer for Web3 marketing. It tracks wallet activity and social posts, then scores users with AI to help projects find and reward real contributors—not bots. Through tools like Cookie Snaps, campaigns can target actual supporters and reward them with tokens. It’s a shift from paying ad platforms to directly rewarding your own community. Think of it as MarketingFi infrastructure for crypto teams.

Airdrop farming steps

Step-by-Step Guide to Farming Cookie DAO

Sign Up: Visit the Cookie.fun platform and sign up by connecting your X account and crypto wallet.

Create Quality Content: Post high-quality content related to Cookie DAO3r partnering projects like Spark on X, focusing on meaningful engagement to earn Snaps points.

Earn Snaps Points: Accumulate Snaps by posting content that gains traction and aligns with the platform’s quality metrics, such as sentiment and impact.

Unlock Rewards: Reach milestones (e.g., 10 Snaps to unlock invites) to access rewards like tokens, airdrops, or leaderboard rankings.

Project Review

Problem Solved

Cookie DAO is building a new kind of marketing infrastructure for Web3. Their main idea is simple: instead of paying Web2 platforms like Google or Meta for ads that may or may not reach real users, Web3 projects should reward actual community members for real engagement. Cookie DAO makes this possible by tracking both on-chain activity (wallet behavior, protocol use) and off-chain activity (social posts, engagement), using AI to evaluate and score it. This allows projects to directly reward users who provide value—through tweets, content creation, referrals, or protocol usage—rather than paying centralized ad platforms.

Cookie DAO offers tools for projects to run campaigns, filter out bots, measure results, and distribute rewards in a way that’s fair and transparent. Users, in turn, earn points and potentially tokens by supporting the projects they care about. It’s a “MarketingFi” model: marketing as a decentralized, incentive-driven system that benefits users, not just platforms.

By aligning incentives between projects and communities, Cookie DAO intends to solve a substantial problem within the crypto market: how to grow real userbases without wasting budget. The result is a smarter, more efficient way for Web3 teams to build awareness, and a new opportunity for users to earn by being active contributors.

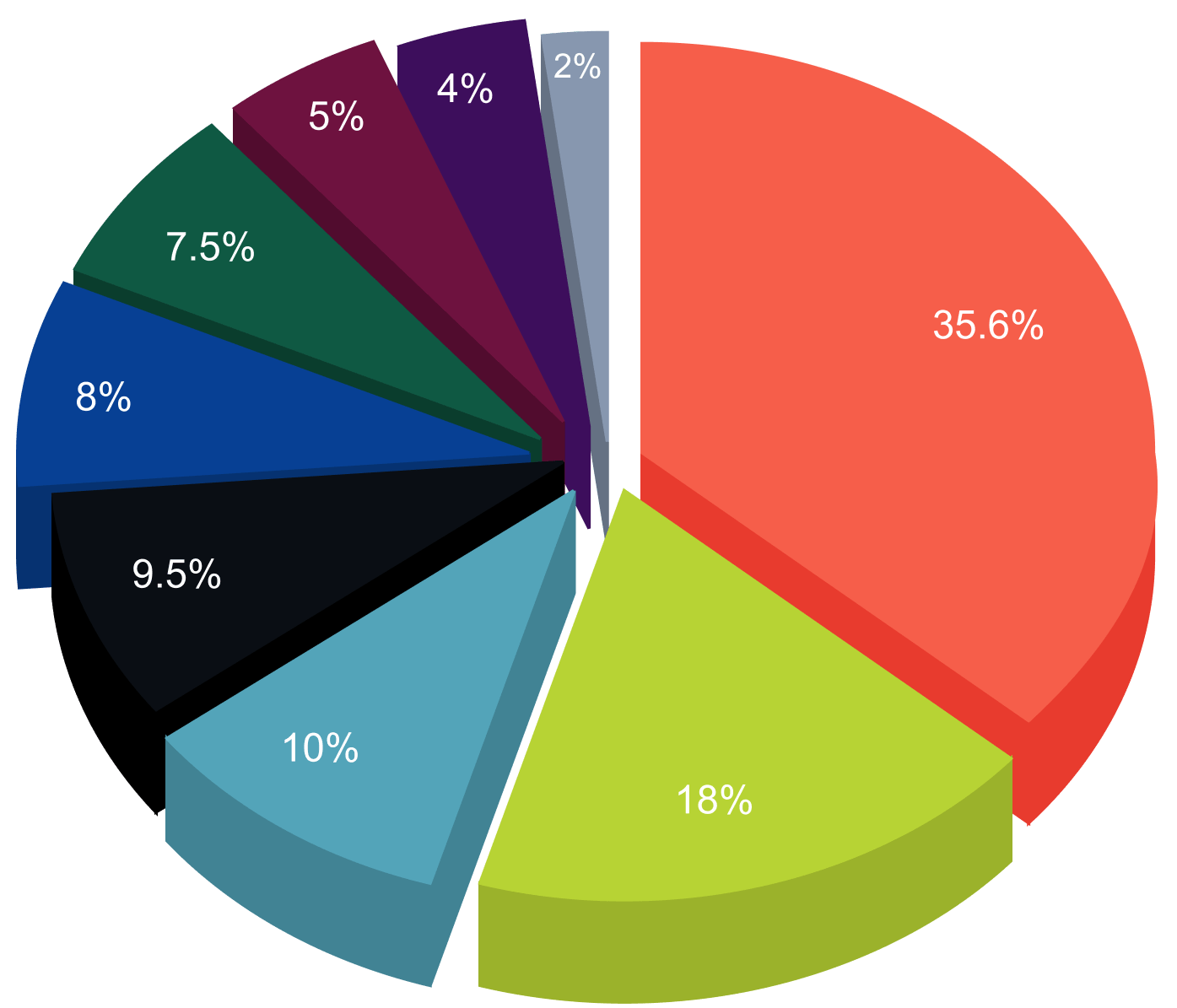

Tokenomics

Supply & Allocation: The native token $COOKIE powers the entire ecosystem. Total supply is 1 billion tokens and distribution is designed to balance investors, team, and community incentives. ~35% went to private/VC rounds with vesting, ~4.8% in public sales, and 9.5% to the team (locked with long-term vesting). Crucially, over 30% is allocated to community-driven uses: 2.5% for airdrops, 18% for staking rewards/liquidity, 10% for ecosystem incentives, plus an 8% DAO treasury. This spread mitigates centralization, although VCs still hold a significant share vested over time.

Utility & Value Flow: $COOKIE is a utility-governance token. Holders can stake it to earn rewards and unlock exclusive features. Staking $COOKIE grants access to multi-airdrop farming – partner projects using Cookie DAO’s data allocate tokens to $COOKIE stakers as rewards. This means staking $COOKIE can yield “endless airdrops” from new projects leveraging Cookie DAO. The token also grants governance rights over the Cookie DAO treasury and future platform decisions.

Fee Model & Burns: Cookie DAO generates revenue from B2B clients (analytics, affiliate fees, etc.), and 30% of those revenues are used for token buybacks/burns or added to the DAO fund. Another 20% of revenue goes to user rewards. This model aligns token value with platform growth – as more projects use Cookie DAO, holders benefit via burns (reducing supply) or direct rewards. There’s no explicit transactional burn on transfers, but the revenue-based burn and continuous demand from staking and campaign participation provide a deflationary pressure and utility-driven demand for $COOKIE.

Perspectives

Cookie DAO’s long-term vision is to become the go-to data layer for Web3 marketing and the AI-driven “InfoFi” economy. The team is positioning Cookie DAO at the intersection of AI agents, on-chain data, and community engagement – an emerging niche with vast “blue ocean” potential.

Going forward, Cookie DAO plans to expand Cookie Snaps beyond the current single-project campaigns. Future Snaps iterations may span multiple tracks (AI, DeFi, Real-World Assets) simultaneously, giving users diverse ways to earn. There’s talk of a community-led reward pool, where the community can set airdrop rules and vote on reward allocations – increasing decentralization in how marketing rewards are distributed. Integration of Snaps points with $COOKIE is on the roadmap, meaning Snap scores could eventually be convertible to tokens, used for governance, or needed to access premium data.

Cookie DAO is also building out its developer offering (Cookie Terminal API) to let other dApps tap into its data. Combined with multichain expansion (already indexing multiple chains) and bridging Web2 data (linking off-chain analytics without compromising privacy), Cookie DAO is set to grow as the Web3 equivalent of Google/Facebook Ads – but with users in control. If Web3 adoption accelerates, demand for efficient marketing and user insights will grow – positioning Cookie DAO for significant upside.

However, executing this vision will require maintaining active project partnerships and continuously innovating with AI tech so that Cookie DAO remains at the cutting edge of crypto marketing.

Founders and Team

Cookie3 is part of a broader Cookie Ecosystem, comprising of a web3 protocol providing the AI and analytics technology and Cookie DAO, the governance entity behind the $COOKIE token, powering the community of the Cookie Ecosystem.

Cookie DAO is led by a seasoned team with both Web2 and Web3 expertise. This blend of big enterprise experience and crypto focus gives the team credibility to execute. They started building Cookie DAO in late 2021 and have since delivered multiple products (analytics platform, affiliate network, Snaps campaigns) on schedule. The team’s capability is evidenced by major collaborations and integrations with 300+ dApps, and successful tech like the AI-driven scoring system. While the founders themselves are not high-profile crypto veterans, they have been transparent, engaged with the community, and backed by strong advisors.

Importantly, the team has secured top-tier investor support, indicating external confidence in their capability. They are also scaling the organization: beyond founders, Cookie DAO has a Head of BD (from Fractal), a Head of Data (from Visa), and growth managers. This robust team structure and the successful execution so far suggest the team is well-equipped to deliver on the roadmap – from technical development (AI data infrastructure) to business development (onboarding partner projects for airdrops and campaigns).

Funding

Lead Investors: Spartan Group

Notable Investors: LD Capital, Hartmann Capital, Orange DAO, BigBrain Holdings, Animoca Brands, Mapleblock Capital, Castrum Capital, Founderheads, Unreal Capital, Oddiyana Ventures, ChainGPT Labs

Cookie DAO has attracted significant funding and backers, giving it resources to grow. An early seed round in August 2022 brought in $3.3M led by The Spartan Group, with participation from LD Capital, Hartmann Capital, OrangeDAO, Big Brain Holdings, Jsquare and others. Including prior pre-seed rounds and later strategic funding, private investment totals ~35% of token supply and ~$5.5 million in capital.

In mid-2024, Cookie DAO also conducted public sales, raising community funds and increasing awareness. It held IDOs on Polkastarter, Bybit Web3, and ChainGPT Pad in June 2024, pricing $COOKIE around $0.025–0.029 and selling allocations to thousands of participants. The Bybit public sale raised ~$200k, and combined public round allocation was ~4.8% of supply, indicating a widely distributed token launch.

Following the token generation event (TGE) in June 2024, $COOKIE quickly gained traction: by January 2025 it secured a Binance listing and was listed on KuCoin, MEXC, Gate, and others. With these funds and listings, Cookie DAO has ample runway and liquidity to execute its roadmap. Overall, the combination of VC funding, public sales, and exchange support leaves Cookie DAO in a strong financial position to scale its platform and incentivize early adopters.

Community

Cookie DAO has rapidly built a large and active community, crucial for a marketing-driven project. On X (Twitter) it boasts over 391,000 followers, a number achieved through consistent engagement and growth campaigns. The ongoing Cookie Snaps campaign has galvanized Crypto Twitter thousands of users are tweeting quality content about Cookie DAO and its partners (like Spark) to earn SNAP points, driving a viral loop of engagement.

Beyond Twitter, Cookie DAO’s community spans Discord and Telegram with active discussion groups. Sentiment in these communities appears optimistic – many are airdrop hunters excited by the “0-cost, high-return” promise of Snaps points.

Cookie DAO’s team actively nurtures this community: they run AMAs, share transparent guides, and even meme around their mascot “Gmookie” NFT drops to keep users engaged. The Cookie Club for $COOKIE holders offers gated chats and bonuses, promoting a loyal holder base.

Overall, Cookie DAO3 community is fast-growing, globally distributed, and highly engaged, thanks to the continuous stream of campaigns and rewards. The challenge ahead will be maintaining this momentum post-airdrop. However, current indicators show a vibrant community that is effectively Cookie DAO’s competitive advantage.

Competitors

Cookie DAO operates in the emerging space between data analytics, marketing infrastructure, and community engagement in Web3. While the broader “campaign” space includes platforms like Galxe, Zealy, or Layer3, these are mostly task-based—focused on short-term quests and user farming with little behavioral depth. Cookie DAO, in contrast, leans into long-term engagement scoring using both social and on-chain signals, with AI models deciding who actually adds value.

The most comparable project is Kaito, which also uses AI to index and analyze Web3 content. Kaito focuses more on aggregating crypto information for search, dashboards, and investing use cases. Cookie DAO is different in that it turns this AI-driven insight into an incentive model: the same data stack is used to reward users (via Snaps or airdrops) and to let projects launch marketing campaigns that go deeper than click-to-earn.

In short, Cookie DAO is trying to become the default engine for decentralized marketing intelligence—offering tools not just for visibility but for targeting, rewarding, and measuring quality engagement. It’s more vertically integrated than other players and has found a unique position by combining data scoring, token incentives, and community-powered campaigns under one system. Few projects are attacking this full stack, giving Cookie DAO a clear niche.

Conclusion

Cookie DAO3s one of the few projects that’s actually trying to fix a broken part of crypto—how projects grow and reach users. Instead of spamming ads or relying on shallow campaign platforms, they’ve built a system that tracks real engagement across wallets and social platforms, then scores it using AI. That’s not just a gimmick—it’s infrastructure that could stick if enough teams start using it. The Snaps campaign with Spark is a good example: users post, get scored, and earn based on quality. It’s a smarter way to distribute rewards and build narratives around new projects.

Of course, the whole model depends on Cookie DAO continuing to attract new partners. If the campaign stream dries up, so do the incentives. But right now, they’ve got funding, exchange access, a growing community, and a working product suite. You don’t have to buy anything to participate, and if you’re consistent with content, you’re in a good spot to benefit later.

If you’re looking for a project to farm that isn’t just about task grinding, Cookie DAO is worth your time. It’s early, the system rewards actual effort, and the roadmap suggests they’re just getting started. I’d keep a close eye on how this one evolves.

Other Details

The Cookie Snaps campaign is an initiative designed to reward creators for producing high-quality content on Crypto Twitter (CT). By integrating with projects like Spark, the campaign incentivizes users to engage meaningfully with the platform, earning points (Snaps) for quality posts that resonate with the crypto community. These points can unlock rewards, including airdrops and tokens, fostering a decentralized, community-driven approach to content creation and engagement. This is the first Snaps campaign, with future campaigns likely to include partnerships with other Web3 projects, increasing the opportunity for rewards.