Lisk Airdrop

Lisk aims to create an interconnected and user-friendly blockchain base layer, delivering seamless experiences, shared liquidity, and low-cost transactions. It has been on the market for a while (established in 2016 as a L1 project) and in November 2024, Lisk transitioned to an Ethereum Layer 2 network and initiated a four-month airdrop campaign, that will distribute 15 million LSK tokens to drive engagement.

Airdrop farming steps

Step-by-Step Guide to Farming Lisk Airdrop

Visit the Lisk Airdrop Protal: Navigate to https://portal.lisk.com/airdrop and connect your EVM-compatible wallet, such as MetaMask.

Add Lisk Mainnet to Your Wallet: When you access the Airdrop Portal, your wallet will prompt you to switch to the Lisk Mainnet. Approve the network change to connect automatically or add the network manually following this guide.

Verify Your Profile on Guild: Click the Verify with Guild button and sign in to Guild using the same wallet you used to access the airdrop portal. Return to the Lisk portal after signing in to Guild and meeting the eligibility criteria.

Earn Points by Completing Tasks: Complete Platform Tasks, Educational Task and Engagement Tasks to earn points. The more points you accumulate, the more LSK tokens you receive at the end of the campaign period.

Complete Partnership-Driven Super Tasks: Lisk has partnered with Oku.Trade, Ionic, Creo Engine, Angle Protocol, Soccersm, and Momint. Each partner will host a two-week period with unique “Super Tasks” that provide immediate rewards. Unlike the points-based tasks, Super Tasks allow you to unlock LSK tokens immediately.

Get a Referral Code: Boost your rewards by sharing a referral code with others. You will earn 10% of the total points of each friend you have referred.

Follow Lisk's Social Networks: Connect with Lisk on social media and join their communities on Discord and Telegram to stay in the loop on all the latest updates and opportunities.

Project Review

Problem Solved

Lisk began as a general L1 blockchain that sought to establish itself among other chains as a good alternative for people to build and use dApps. In November 2024 it pivoted to being an Ethereum L2, again with a similar goal of providing a cost-effective and scalable platform for any kind of dApps.

However, Lisk appears to be leveraging existing Layer 2 technologies rather than introducing groundbreaking innovations in the Ethereum L2 space. Its integration with Optimism's OP Stack and focus on real-world use cases like payments and stablecoins position it as a practical, application-driven solution rather than a trailblazer in Layer 2 technology.

Lisk’s strategy seems centered on adoption within high-growth markets, particularly in regions like Africa and Southeast Asia, where blockchain technology can address underbanking and high remittance costs. This focus aligns with their broader mission of driving Web3 adoption in areas with immediate needs, a market-driven rather than tech-centric approach.

Key ecosystem partnerships, such as those with Circle for stablecoins, LayerZero for cross-chain interoperability, and Velodrome for liquidity, reinforce this practical orientation. These integrations enhance Lisk’s ecosystem but are not unique when compared to other L2 solutions offering similar functionality. Its participation in the Optimism Superchain further positions it as part of a collaborative L2 ecosystem rather than a standalone leader.

Tokenomics

Initially, the LSK token was designed as a utility token to secure the network through staking and pay transaction fees on the Layer 1 blockchain. With Lisk’s transition to a Layer 2 solution on Ethereum, the token's purpose has shifted. It will now serve governance functions via the Lisk DAO, allowing holders to vote on key network decisions. Additionally, it will offer staking rewards, enabling holders to earn yields while locking tokens for governance participation. Future utilities may include transaction fee payments and staking with decentralized sequencers.

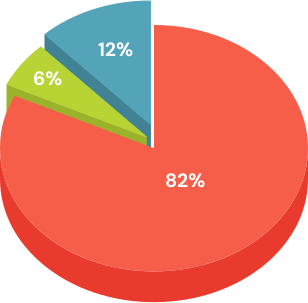

The tokenomics now feature a fixed supply model capped at 400 million LSK tokens, replacing the prior inflationary structure. Around 70% of tokens will be allocated to community initiatives, such as airdrops, liquidity programs, and ecosystem funding, distributed gradually over several years. The team has reserved a smaller portion for incentives and a strategic investor fund.

The majority of tokens will be controlled by the community through the DAO, ensuring decentralized governance. A community vote will decide whether to burn 100 million LSK tokens or allocate them to the DAO Fund. This approach balances decentralization with strategic allocations for ecosystem growth, while reducing reliance on inflation for network security.

Perspectives

Lisk's early success in its 2016 ICO, raising 14,000 BTC (worth about $5M at the time), highlights its strong initial backing. Even if only 1% of those funds were retained, the treasury would still hold over $12M at current prices. Combined with the project’s own token allocations, this suggests a potentially robust financial position. However, there’s no transparent public record of their current holdings, leaving uncertainty about the resources they have available.

Their persistence through market cycles and the recent pivot to a Layer 2 solution indicate that they have the financial and operational capability to continue building. That said, history shows that funding alone doesn’t guarantee success (one could look at EOS as one example). Lisk’s failure to gain significant traction as a Layer 1 (L1) raises questions about their ability to differentiate and capture market share. Their L2 strategy feels more reactive than innovative, as they aim to align with established trends like Optimism’s Superchain rather than defining new ones.

The move to focus on high-growth markets and real-world use cases might help Lisk carve out a niche, but the broader market’s competitive landscape demands more than catching up. Execution, ecosystem growth, and community engagement will be critical for Lisk to remain relevant in the Web3 space.

Founders and Team

Lisk was established in 2016 by Max Kordek and Oliver Beddows, who set up the Lisk Foundation in Zug, Switzerland, one of the first crypto foundations of its kind. Their vision was to create a modular and accessible blockchain platform that utilized JavaScript, making it developer-friendly and accessible for creating decentralized applications (dApps). In May 2016, Lisk launched its mainnet, and by 2018 it had released the Lisk SDK, which enabled JavaScript developers to create blockchain applications with ease.

Over the years, Lisk continued to evolve, implementing significant upgrades in 2021 to improve scalability, security, and cost-effectiveness. In December 2023, the Lisk Foundation transformed into the Onchain Foundation, signaling a new direction from a Layer 1 network to a Layer 2 that is focused on tackling scalability challenges, with an emphasis on emerging markets. Following the rebrand, founders Max Kordek and Oliver Beddows have transitioned to advisory roles, entrusting the majority of Lisk’s leadership decisions to COO Dominic Schwenter.

Funding

Lisk was among the pioneering projects to secure funding through an Initial Coin Offering (ICO) in 2016, raising over $5.7 million (14,000 BTC) - a significant accomplishment at the time. Although Lisk raised funding through a single crowdsale round, the substantial BTC acquired has enabled the foundation to implement a treasury strategy involving BTC-to-ETH conversion. ETH was selected for its relative stability, deflationary characteristics, and yield-generating potential, supporting the foundation’s financial plans through 2025 and beyond. This strategic approach positions Lisk for financial stability and growth within the blockchain sector.

The project is also incubated by the Onchain Foundation, however, as a non-profit organization, it is unclear whether the foundation has access to sustainable revenue streams to support Lisk's ongoing development.

Community

Since its inception in 2016, Lisk has become a well-established name in the blockchain industry, drawing a community of over 201,000 followers on X (Twitter) and 12,000 members on Discord. The community engages actively through Lisk’s forums, social media, and events, contributing to the platform’s growth and adoption. However, the overall engagement level could be considered modest for a project of Lisk’s longevity, with posts on X averaging 2,500 views. A notable exception is the recent announcement of Lisk's airdrop campaign, which garnered significant attention with 272,000 views.

Competitors

The competitive landscape for Ethereum Layer 2 solutions is highly saturated, with numerous projects vying to deliver scalability, cost-effectiveness, and developer-friendly environments. Lisk enters this space with its migration to an Ethereum L2 built on Optimism’s OP Stack, joining a well-established ecosystem. While this integration offers potential collaboration opportunities with other chains in the Optimism Superchain, these projects are also competing for developers and adoption within the same ecosystem.

Beyond Optimism-based solutions, Lisk faces strong competition from other Ethereum L2s like Arbitrum, Polygon, and Base, which already command significant developer and user bases. These platforms share the common goals of scaling Ethereum while reducing transaction costs, and many have achieved higher levels of adoption through robust ecosystems and technological advancements.

Outside the Ethereum network, broader competition includes chains like Solana, Avalanche, and countless others which all target interoperability, scalability, and dApp support within their ecosystems. Although many others operate in different architectures, their goals overlap significantly with Lisk's vision.

Lisk’s ability to differentiate will depend on how effectively it can leverage its Optimism integration and focus on specific use cases in high-growth markets. However, in such a crowded market, standing out will require more than aligning with existing trends.

Conclusion

Lisk’s transition from a Layer 1 to an Ethereum Layer 2 marks a significant pivot in its strategy, aiming to align with the broader trends in blockchain scalability and interoperability. While the project demonstrates clear strengths, such as its seemingly stable financial position, targeted focus on emerging markets, and integration within Optimism’s Superchain, its overall prospects remain mixed.

On the positive side, Lisk has positioned itself in high-growth markets like Africa and Southeast Asia, aiming to address real-world use cases such as payments and stablecoin adoption. This pragmatic approach could help the project carve out a niche. Additionally, its integration with the Optimism Superchain provides access to shared liquidity and interoperability, strengthening its ecosystem connections. These factors, combined with its treasury strategy and potential financial stability, suggest that Lisk has the resources to continue building and refining its platform.

However, Lisk faces significant challenges. The Ethereum Layer 2 market is already saturated with established competitors offering similar or superior technologies. Without clear differentiation, Lisk risks being overshadowed. Its past struggles to gain traction as a Layer 1 also raise questions about its ability to execute and attract developers in this new paradigm.

Other Details:

Lisk’s airdrop campaign begins on November 21, with an allocation of 15 million LSK tokens designated for builders, creators, and participants. Those who complete Lisk's tasks and partner challenges will earn points toward these rewards.