Litas Airdrop

Litas is a blockchain crowdfunding platform that makes real-world investments accessible to crypto users. It lets cryptocurrency holders invest in tokenized real-world assets and small businesses, bridging the gap between DeFi and traditional funding. Standout features include income-backed token buybacks, a play-to-earn mining game, and a compliant, user-friendly ecosystem integrating crypto with fiat finance.

Airdrop farming steps

Step-by-Step Guide to Farming Litas Airdrop

Create a Litas Account: Visit https://wallet.litas.io/ and click on "Register" to create an account.

Participate in the Mining Game: Click on "Mine" in the dashboard and then click on "Activate Miner" to get 1.00 DLT every hour.

Get Upgrades (Optional): You can use your DLT coins to increase your DLT mining speed, or to reduce the frequency of your claiming time.

Refer Friends: Click on "Invite Friends" to generate a referral link. Each active user you invite increases your DLT mining speed by an additional percentage per hour.

Stay Tuned: Follow the project's X and join their Discord for information on the TGE event.

Project Review

Problem Solved

The Litas project targets clear gaps between traditional finance and decentralized finance. While Web3 startups have a multitude of channels for raising funds in a decentralized manner, real-world small businesses do not have the same mechanisms available to them. Traditional investors, meanwhile, are wary of crypto’s volatility, and existing crowdfunding platforms usually impose high fees and regulatory friction. This leaves many viable businesses underfunded and crypto holders with limited real-world investment options.

Litas’s platform addresses these challenges by acting as a bridge between crypto investors and SMEs. It enables cryptocurrency holders to invest in business ventures, while a partnered financial institution converts the pooled crypto into fiat loans for the businesses. This way, businesses receive funding in a familiar currency without directly handling crypto, and crypto investors gain exposure to real-world asset returns. Litas’s value proposition includes tokenizing real-world assets for low-cost investor entry, automating income-backed token buybacks from project profits, and providing intuitive tools under a compliant framework.

In short, Litas offers a streamlined path for crypto capital to flow into traditional ventures, benefiting both sides of the market.

Tokenomics

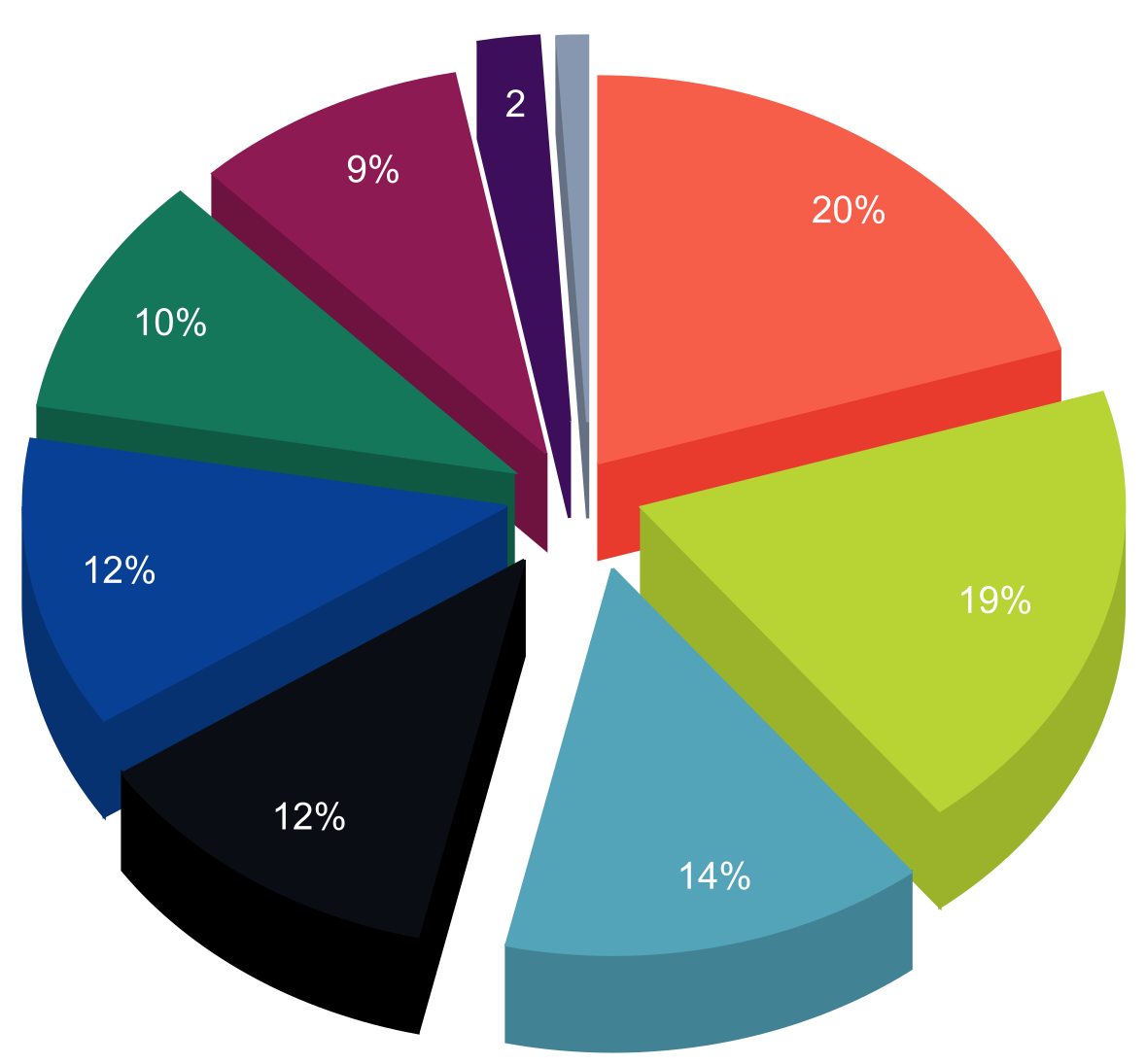

The LITAS token is designed with multiple utilities: holders can access platform features, participate in governance, earn rewards for engagement, and benefit from revenue-backed buybacks. The total supply is fixed at 100 million tokens, allocated across various stakeholders. Early funding rounds (seed, private, public) together account for 19% of the supply, while 10% was reserved for exchange liquidity.

The team holds 14% with a strict vesting schedule (no tokens at launch, a 6-month cliff, and 24-month linear release), ensuring long-term commitment. A large portion is earmarked for community and ecosystem growth, including 20% for staking rewards to incentivize users over five years and 9% for marketing efforts.

Litas’s token model emphasizes sustainable value. Businesses that raise funds through the platform are required to use a portion of their revenue to buy back LITAS tokens from the market and send them to a burn wallet. This deflationary mechanism, mandated by compliance requirements, ties token value to real-world performance. The tokenomics thus aim to distribute ownership widely over time and align incentives for long-term holders. Importantly for airdrop seekers, a significant allocation is dedicated to community rewards (e.g., staking and referral programs), signaling potential token distributions to active early users.

Perspectives

Litas’s roadmap outlines an ambitious growth plan, but many of the key features remain unproven. As of now, the core idea—enabling crypto-backed crowdfunding for real-world businesses—has not yet launched. Despite this, the team is already planning a series of real-world ventures like a crypto bar and sauna, and aims to operate its own blockchain by early 2026. These are bold moves, especially given that the foundational platform still needs to prove product-market fit. It's unclear whether the blockchain component is even under development at this stage, which raises questions about feasibility and focus.

While it's encouraging to see a team thinking ahead about growth and ecosystem expansion, the core platform's success should be the priority. Launching multiple complex initiatives in parallel increases the risk of underdelivering across the board. The project’s long-term prospects will ultimately hinge on whether the crowdfunding and token buyback model delivers tangible results for both businesses and token holders. Until then, the roadmap should be viewed as an outline of intention rather than a guarantee of execution.

Founders and Team

Litas is led by a team with a blend of traditional finance and blockchain expertise. The project’s founder is Tomas Zubrickas, an experienced entrepreneur who has spent around a decade in business consulting. Joining him is co-founder Gustas Klišauskas, a Web3 developer skilled in Solidity and web development, reflecting strong in-house blockchain development capabilities.

Three other C-suite members are mentioned in the project documentation, although only by their first names, therefore, their identities could not be verified. According to the project's litepaper, CEO of Litas is Marijus, who brings a background in banking and prior success in scaling fintech ventures, while CTO Erlandas has over 15 years of software development experience specializing in fintech solutions.

The CCO role is occupied by Aurimas, known as a crypto Key Opinion Leader with a strong sales and strategy background. The broader team further includes specialists like Kestutis, who leads the mining game initiative with his experience in sales and project management.

Although the team is not fully transparent, team photos are often shared on the project's social media channels, which increases its credibility. Based in Vilnius, Lithuania, the team seeks to revive the spirit of the country’s former national currency (the Litas) in digital form.

Funding

Investors: Rollman Management Digital

Litas has secured substantial funding to fuel its development. The project closed a private token sale in January 2025 that raised a $20 million investment commitment from Rollman Management Digital - a private investment and management consulting boutique. In addition to the token sales, Litas allocated 12% of its token supply to a treasury for ongoing development needs. This treasury, combined with the raised funds, is intended to support the rollout of its roadmap.

Notably, the Litas ecosystem is not solely dependent on external funding, it is already generating revenue through integrated businesses. One flagship venture in the Litas network (DaddyWonderland) achieved $110,000 in profit and 15,000 users in 2024. All businesses on the platform contribute 30% of their revenue back into the Litas ecosystem for growth, creating a self-sustaining funding loop.

With $20 million raised plus growing internal revenues, Litas appears to have adequate resources to execute its roadmap. Still, the team will need to manage these funds wisely – the current capital should be sufficient to reach major milestones if budgeted prudently, but any missteps or unforeseen costs could necessitate additional funding down the line.

Community

Litas has rapidly built a sizable community, driven in large part by its airdrop-style engagement strategies. On social media, the project’s official X account amassed over 30,000 followers within less than a year of launching, signaling strong global interest. This growth has been spurred by active marketing campaigns such as token giveaways and a referral program.

More uniquely, Litas introduced a play-to-earn “Miner Game” within its wallet app that rewards users with points every hour, which can later translate into token rewards. Participants are encouraged to check in frequently and invite friends to maximize points, explicitly “to qualify for a potential airdrop” according to the team. This gamified mining campaign has drawn a large number of users and greatly expanded Litas’s reach.

For now, sentiment in the community is upbeat, fueled by the anticipation of rewards. The true test will be retaining these users after any token airdrop occurs. Litas will need to continue delivering on its roadmap and engaging transparently to convert short-term airdrop chasers into long-term supporters of the ecosystem.

Competitors

Litas operates at the intersection of DeFi and traditional crowdfunding, and thus faces competition on multiple fronts. In the crypto space, several projects are exploring real-world asset financing. Platforms like Centrifuge, Goldfinch, and Maple Finance are bringing off-chain loans and assets onto blockchain networks in various forms.

However, many of these cater to institutional investors or require strict KYC, whereas Litas is positioning itself as a more retail-friendly, privacy-focused alternative. By targeting small business fundraising, Litas is entering a niche that is not yet crowded, but it will need to demonstrate clear advantages in simplicity and returns to stand out.

Beyond crypto-native rivals, Litas also competes with traditional fundraising avenues. Established platforms such as Kickstarter and equity crowdfunding sites (e.g. Republic) dominate SME funding in the fiat world. While they lack crypto features, they benefit from user trust and regulatory clarity. Litas will have to match their ease-of-use and credibility while offering the added value of blockchain integration.

The RWA DeFi sector is still young and no dominant player has emerged, which is an opportunity for Litas. That said, its broad scope means it must execute well on all fronts to fend off both specialized DeFi competitors and any traditional platforms that may pivot into blockchain. Speed and reliability of execution will be key to securing a lasting edge.

Conclusion

Litas presents a compelling yet high-stakes opportunity for early contributors. On one hand, the project checks many boxes that airdrop hunters and long-term crypto investors look for: a clear problem being solved, a novel solution with real use cases, a well-funded and capable team, and strong community traction. The alignment of the LITAS token with real business revenues (through enforced buybacks) is a positive indicator for future value creation.

If the team executes its roadmap and taps into the enormous RWA market as envisioned, early adopters who accumulate tokens or points now could see significant upside – both from token appreciation and from any official airdrops or reward distributions as the platform matures.

On the other hand, Litas is still in its infancy, and the actual delivery of its promises lies ahead. The substantial community interest is at least partly incentive-driven, which means the real challenge will come after tokens are distributed, when speculative holders decide whether to stay or sell. The project’s long-term success hinges on hitting its regulatory milestones and proving that real businesses can be funded and deliver returns via the platform.

In summary, Litas is an interesting new platform with some serious potential and momentum behind it – but it should be approached with realistic expectations. Early participants could be well rewarded if Litas achieves its vision, yet they should remain mindful of the execution and market risks inherent in this endeavor.