Puffer Finance

Puffer is a native liquid restaking protocol (nLRP) built on Eigenlayer, designed to make ETH staking more accessible and rewarding. With Puffer, users can permissionlessly run a validator with less than 2 ETH, enjoy liquid staking rewards, and benefit from Eigenlayer’s integration for boosted restaking incentives. The protocol offers anti-slash protection, MEV autonomy, and immediate access to execution rewards, simplifying the staking journey.

Airdrop farming steps

Step-by-Step Guide to Farming Puffer Finance

Visit the Crunchy Carrot Quest page: Navigate to https://quest.puffer.fi/home

Connect your wallet: Choose from a list of available wallet options.

Select Puffer Family: Choose from a list of available options. Each family is led by different members of the Puffer ecosystem.

Stake ETH: Stake ETH, stETH, or wstETH to receive pufETH. Each pufETH you hold awards 30 Puffer Points.

Provide Liquidity: Optionally, you can provide liquidity by depositing pufETH into an integrated DeFi protocol. Each pool provides different boosts on your Puffer Points, up to 2x.

Complete Galxe Quests: Visit https://app.galxe.com/quest/pufferfinance and complete any active Galxe quests for additional Puffer Points.

Project Review

Problem Solved

Puffer addresses the high barrier to entry and complexity of Ethereum staking and restaking. Traditionally, participating in Ethereum’s Proof of Stake (PoS) requires a minimum of 32 ETH and technical knowledge to run a validator, limiting access for most users. Liquid staking solutions like Lido and Rocket Pool ease liquidity concerns but lack integration with restaking, which provides additional rewards by securing extra networks.

Puffer combines liquid staking and restaking into a single protocol, allowing users to stake with as little as 1 ETH and earn both PoS and restaking rewards via Eigenlayer integration. It simplifies the staking process for both stakers and node operators (NoOps), provides security features like anti-slashing technology, and introduces Validator Tickets (VTs) for more flexibility and decentralization. By lowering capital requirements and allowing users to operate validators or earn rewards without them, Puffer makes staking more inclusive, cost-effective, and lucrative, helping further decentralize and secure the Ethereum network.

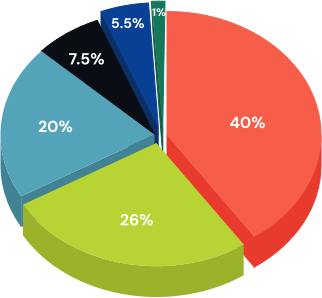

Tokenomics

$PUFFER, the governance token of the Puffer ecosystem, is structured to encourage community engagement and sustainable growth. With a total supply of 1 billion tokens, distribution emphasizes decentralization and community involvement. Ecosystem & Community allocations (40%) fund initiatives like airdrops, community incentives, and liquidity provision. Early supporters benefit from the Crunchy Carrot Quest airdrops (7.5% and 5.5% across two seasons).

To support Ethereum development, 1% of $PUFFER supply backs Ethereum core projects, reinforcing Ethereum’s foundational role for UniFi, Puffer’s L2 rollup. Core team members and advisors receive 20% with a 3-year vesting schedule, ensuring long-term commitment, while 26% is reserved for investors with a similar vesting period.

The governance-driven structure of $PUFFER empowers community members to guide Puffer’s future through vePUFFER, enabling transparent, decentralized decision-making across Puffer’s staking, restaking, and UniFi rollup projects.

Perspectives

Puffer’s future hinges on advancing decentralized staking and restaking by making it more accessible, secure, and profitable. As Ethereum’s demand for scalable and secure staking solutions grows, Puffer is positioned to attract a broad user base due to its low-entry requirements and dual rewards (PoS and restaking) via Eigenlayer integration. The protocol's anti-slashing tech and unique Validator Tickets offer solutions to major industry concerns, like validator penalties and centralized power among staking providers.

Looking forward, Puffer aims to increase its protocol automation, specifically by transitioning Guardian responsibilities to smart contracts as Ethereum implements relevant EIPs (Guardians are trusted Puffer community members acting as a DAO to oversee validator performance, manage penalties, and ensure protocol integrity). This move would enhance decentralization and reduce reliance on human oversight.

Additionally, as it builds out its market for trading Validator Tickets and integrates with more DeFi protocols, Puffer could offer stakers even more flexibility and earning opportunities, potentially boosting pufETH’s value. If successful, Puffer may significantly contribute to Ethereum’s decentralization and resilience, fostering a more democratized ecosystem for staking and restaking.

In addition to its innovations in staking and restaking, Puffer aims to expand Ethereum's ecosystem with its UniFi based rollup, designed to reduce fragmentation by connecting dApps, liquidity, and users without bridges. UniFi introduces the universal gas token unifiETH and leverages Puffer's native restaked validators for fast, reliable transaction confirmations. This strategic L2 complements Ethereum by enabling gasless transactions, economic alignment with L1, and a unified DeFi experience, potentially driving sustained value back to Ethereum’s base layer.

Founders and Team

Founded in late 2022, Puffer Finance quickly attracted attention, securing support from the Ethereum Foundation via a grant aimed at enhancing validator security and mitigating risks within the ecosystem. In keeping with the project’s decentralized philosophy, Puffer Finance operates without traditional C-level executives. Instead, the project's operations and development are driven by its two founding contributors, Amir Forouzani and Jason Vranek. Amir previously worked as a Data Scientist at NASA, while Jason brings Web3 experience as a former Research Engineer at Chainlink.

The team consists of 21 members, with Puffer Finance actively promoting decentralized participation by encouraging users to become node operators and engage in the governance process.

Funding

From: Ethereum Foundation.

Investors: Jump Crypto (lead), IoTeX, Arcanum Capital.

Investors: Lemniscap (lead), Lightspeed Faction (lead), Brevan Howard Digital, Bankless Ventures, Animoca Ventures, DACM, LBank Labs, 33DAO, WAGMI33, Concave, SNZ, Token Pocket, Canonical Crypto.

Angels: DiscusFish: Co-founder of F2Pool & Cobo, Sreeram Kannan: Founder of Eigen layer, Frederick Allen: Staking Sales Lead at Coinbase Institutional, Calvin Liu: Head of Strategy at Eigen Layer, Ramble: Founder of the North American Blockchain Association, Mrblock: Core Contributor at Curve, Ladislaus von Daniels: Staking Educator, Richard Malone: Head of Business at Obol Labs.

Investor: Binance Labs.

Investors: Brevan Howard Digital (lead), Electric Capital (lead), Coinbase Ventures, Franklin Templeton, Avon Ventures, Kraken Ventures, Lemniscap, Lightspeed Faction, Consensys, Mechanism Capital, GSR Ventures, CoinSummer, Animoca Ventures, Leadblock Bitpanda Ventures, SNZ Capital, Breed VC, Cherubic Ventures, DeWhales Capital, Longhash, Inception, Mask Network, AP Capital, Formless Capital, Web3Port, StakeFish, A41, Everstake, Neuler, InfStones, Ebanker, Moonhill Capital, Swissborg, Bas1s Ventures, Canonical Crypto.

Puffer Finance has successfully raised nearly $25 million through multiple fundraising rounds, attracting substantial backing from prominent institutional investors and angel investors. Their pre-seed round was spearheaded by Jump Crypto, while the seed round was led by Lemniscap and Lightspeed Faction. Other significant participants in the seed round included Brevan Howard Digital, Bankless Ventures, Animoca Ventures, Kucoin Ventures, as well as notable individuals such as Sreeram Kannan, Founder of Eigen Layer, and Frederick Allen, Head of Staking Business at Coinbase.

The project’s most notable milestone came during its Series A round ($18M), which was led by Brevan Howard Digital and Electric Capital. This round also garnered support from key institutional investors like Coinbase Ventures, Kraken Ventures, and Consensys. Additionally, Binance Labs invested in Puffer Finance to integrate its native liquid restaking token within the BNB Chain ecosystem, enabling users to earn Ethereum PoS and restaking rewards.

Community

Puffer Finance has built a sizable community, with over 357,000 followers on X (formerly Twitter) and 100,000 members on its Discord server. However, this large following is largely driven by ongoing airdrop campaigns, which have incentivized social engagement. Despite the impressive numbers, actual community interaction appears limited, as posts on X average fewer than 100 likes, suggesting a gap between the follower count and active engagement.

While community activity may not fully reflect the project's following, sentiment within the community remains positive, with no significant FUD surrounding the project.

Competitors

The ETH liquid restaking sector is gaining momentum, with notable players like Etherfi, Renzo, Kelp DAO, and Swell, alongside Puffer. All are integrated with EigenLayer and offer unique restaking options, yet competition ultimately revolves around two critical factors: yield and security. As users often move capital to optimize yield, each protocol’s success depends on maximizing rewards while safeguarding user assets.

Puffer seeks to stand out by providing both Ethereum PoS and restaking rewards through a single Liquid Staking Token (LST), pufETH, simplifying the process for users to earn enhanced returns. Similar to Swell’s introduction of an L2, Puffer’s UniFi solution is a dedicated Layer 2 that aims to boost transaction speed and liquidity, seamlessly integrating with Ethereum and adding value to its protocol offerings.

To ensure security, Puffer’s anti-slashing measures, such as its Secure-Signer technology, protect validators against slashable incidents, preserving capital and boosting user confidence. This combination of yield, security, and ecosystem integration positions Puffer as a strong, yield-maximizing choice within the liquid restaking landscape.

Conclusion

Puffer Finance presents a comprehensive solution to the complexities and barriers in Ethereum staking, combining liquid staking and restaking into a streamlined, accessible protocol. By enabling users to run a validator with as little as 1-2 ETH and offering a single token, pufETH, to capture both PoS and restaking rewards, Puffer addresses both accessibility and profitability for a wide range of users. Security remains a core priority, with anti-slashing technology like Secure-Signer providing robust protection against validator penalties.

With high demand for liquid restaking and an innovative Layer 2 rollup solution, UniFi, Puffer aims to enhance Ethereum’s scalability and user experience by fostering composability and reducing ecosystem fragmentation. This strong positioning in a competitive landscape, alongside decentralized governance powered by the $PUFFER token, empowers the community in shaping Puffer's future direction.

Challenges remain, particularly in maintaining yield competitiveness, managing dependency on EigenLayer and transitioning Guardian oversight to smart contracts. However, Puffer’s proactive approach to these challenges and dedication to decentralization and security make it a promising player in the liquid restaking space. Overall, Puffer Finance’s innovative design offers a secure, efficient, and community-driven platform that could significantly contribute to Ethereum's long-term resilience and decentralization.