Unichain Airdrop

Unichain is a Layer 2 network developed by Uniswap Labs to enhance Ethereum's capabilities. It operates as part of the Optimism Superchain and is designed to reduce transaction costs, offer faster block times, and enable seamless cross-chain swaps. Early testnet users of Unichain are positioning themselves well for potential future rewards.

Airdrop farming steps

Step-by-Step Guide to Farming Unichain Airdrop

Visit Unichain: Visit https://www.unichain.org/ and navigate to the documentation portal at https://docs.unichain.org/docs

Set Up a Wallet: Download a wallet or set up an existing one by adding the following network information:

Chain Name: Unichain Sepolia

Chain ID: 1301

RPC URL: https://sepolia.unichain.org

Currency Symbol: ETH

Block Explorer: https://sepolia.uniscan.xyz/

Use the Sepolia Faucet: Claim testnet ETH for Unichain via the QuickNode faucet, Superchain faucet or thirdweb faucet.

Bridge Funds: Bridge ETH and other supported assets from Ethereum Sepolia (L1) to Unichain Sepolia via Superbridge or Bird.gg.

Set up a Node: Set up a Unichain node following the instructions available in the documentation: https://docs.unichain.org/docs/getting-started/set-up-a-node

Interact and Build on Unichain: Interact with the Unichain testnet, create pools and deploy smart contracts to increase your chance at receiving rewards.

Follow Unichain's Social Media Outlets: Follow Unichain on X (Twitter) and Discord to stay informed about a potential airdrop in the future.

Project Review

Problem Solved

Unichain primarily seeks to address the scalability and efficiency issues of Ethereum. Its key contributions include:

Transaction Speed: By integrating Flashbot’s Rollup Boost and leveraging a trusted execution environment (TEE), Unichain enables sub-second block times and reduces transaction processing times to 200-250 milliseconds, which significantly enhances speed compared to the Ethereum mainnet.

Cost Reduction: Unichain aims to lower transaction fees by 95%, making it much more cost-effective for users and developers, especially for DeFi activities like trading on Uniswap.

Interoperability: Built on Optimism’s OP Stack, Unichain ensures smooth interoperability within the Optimism Superchain ecosystem, promoting seamless integration with other Layer 2 networks and enabling a more scalable and interconnected DeFi environment.

Decentralization: Through the future introduction of a community validation network, Unichain enhances decentralization by allowing full nodes to stake UNI to verify blocks, reducing risks tied to unfinalized transactions.

Tokenomics

The $UNI token, previously used exclusively for Uniswap governance, will now expand its role on Unichain. In Unichain, $UNI will be staked by validators in the Unichain Validation Network (UVN), a decentralized validator network that enhances block validation and ensures quicker transaction finality. Validators must stake $UNI to validate blocks, earning rewards based on their stake-weight and promoting network stability and security through periodic attestations, which support Unichain’s infrastructure for seamless DeFi interactions.

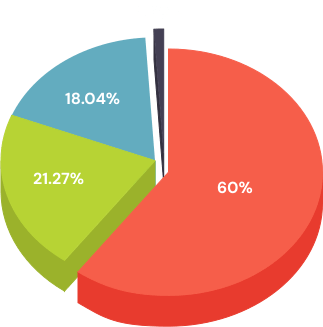

At genesis, UNI's 1 billion supply was allocated with 60% to Uniswap community members, 21.27% to team members, 18.04% to investors, and 0.69% to advisors. Additionally, an annual inflation rate of 2% will start after the initial four-year vesting period, ensuring long-term engagement.

Perspectives

Unichain’s launch embodies the growing trend of dApps creating their own dedicated L2s to capture more value and control their user experience. By moving to its own OP Stack-based L2, Unichain aims to address inefficiencies in the DeFi ecosystem—particularly issues with high Ethereum transaction fees, MEV extraction, and limited $UNI token utility. This self-contained chain allows Uniswap to reduce fees, internalize MEV, and introduce staking rewards for $UNI holders, enhancing the token’s appeal.

However, this approach could contribute to liquidity fragmentation within Ethereum, as DeFi platforms prioritize their own L2s. Although Unichain is interoperable within the Optimism ecosystem, it may struggle to attract external developers to build on it if it operates as a dapp-specific L2 rather than a general-purpose L2.

Competing with established L2s and maintaining developer interest will be key to its long-term success. Unichain’s reliance on Uniswap’s popularity provides a strong foundation but doesn't guarantee sustainability without broader ecosystem support. Its success could hinge on effectively attracting and incentivizing additional dApps, or it risks solidifying as a Uniswap-centric chain.

That said, remaining a Uniswap-centric chain isn’t necessarily a drawback, Uniswap has demonstrated strong, sustained growth and demand. Unichain’s future likely hinges on whether it can sustain Uniswap’s current momentum or expand even further, potentially attracting more users and value. If successful, Unichain could solidify itself as a powerhouse in DeFi by extending Uniswap’s reach and capabilities.

Founders and Team

Unichain is developer by the team behind Uniswap Labs and Uniswap Foundation. It is not publicly disclosed who works on Unichain, however, the whitepaper of the project is authored by Uniswap's core team members, including CEO Hayden Adams, protocol engineer Mark Toda and product lead Alexander Karys.

The proven expertise of the team behind Uniswap ensures that Unichain is led and developed by a capable and passionate team with experience leading a Web3 project to success. Unichain has also gained the support of notable figures in the Web3 space, including Robert Miller, Daniel Marzec, and Hasu from Flashbots, Karl Floersch from OP Labs, and Daniel Robinson from Paradigm.

Funding

To date, Unichain has not pursued independent funding through traditional investment rounds. However, the project benefits from the technical expertise of the Uniswap Labs team and operational support from the Uniswap Foundation. Given Uniswap’s total capital raise of $176M since inception, Unichain is well-positioned to leverage the financial backing and strategic resources of its parent organization.

Community

Since its announcement in October 2024, Unichain has quickly garnered attention, amassing a following of 30,000 on X (Twitter) within its first month. Leveraging Uniswap’s established community, Unichain engages with over 50,000 members through Uniswap’s Discord server. The project is also focused on expanding its developer ecosystem, with Uniswap Foundation introducing grants to incentivize DeFi developers on Unichain.

Although Unichain’s community is still growing, it benefits significantly from Uniswap’s extensive network, which serves as the largest on-chain marketplace with over 16 million wallets in total that contribute billions in weekly transaction volume across thousands of tokens.

Competitors

Unichain, like many Ethereum L2s, isn’t in direct competition with Ethereum itself, rather, it contributes to a broader push for scalability, helping unlock Ethereum’s full potential by addressing high fees and transaction speeds that deter mass adoption. By building on Optimism’s OP Stack and joining its superchain ecosystem, Unichain positions itself among L2s aiming to enhance Ethereum’s appeal through better user experience and cost efficiency. This aligns with Ethereum’s growth drivers—technological innovation, user expansion, dApp proliferation, and even potential big tech adoption.

However, Unichain faces an already competitive landscape filled with established general-purpose L2s, such as Arbitrum and Optimism, as well as high-performance L1s outside of Ethereum. While Unichain need not surpass every other solution in a “last man standing” battle, it does face the challenge of differentiating itself. Many users and developers prioritize interoperability, seeing it as essential for DeFi’s future growth. Unichain’s adoption of the Optimism superchain framework shows commitment to this, but it also raises questions about the superchain’s current popularity and whether Unichain will expand beyond it.

Ultimately, Unichain’s success may depend on its ability to build upon Uniswap’s established demand while remaining flexible enough to engage a broader ecosystem and potentially integrate with other L2s or cross-chain networks.

Conclusion

Unichain’s launch embodies the growing trend of application-specific chains, a move that aligns with Uniswap’s strategic aim to capture greater value from its own ecosystem. With Unichain, Uniswap can internalize transaction costs and enhance $UNI token value by channeling MEV revenue and staking rewards directly to token holders. This model allows Uniswap to reduce its dependence on Ethereum’s fee structure, offering users a streamlined and cost-effective DeFi experience while benefiting from Uniswap’s own robust community and liquidity base.

However, from a market standpoint, Unichain joins a crowded field of L2 solutions, each vying to become the “standard” for scalability. Rather than bringing cohesion, the proliferation of these chains risks fragmenting liquidity across isolated ecosystems, potentially limiting the broader DeFi market’s growth.

For Unichain, the challenge will be to compete effectively against established L2s, attracting sustained volumes and liquidity while navigating inherent security concerns tied to its unique architecture. Uniswap’s large user base and reputation offer a solid starting advantage, but Unichain’s true success will hinge on whether it can evolve beyond a single-application chain and attract a wider ecosystem, avoiding the pitfalls of an isolated walled garden in an increasingly interconnected DeFi landscape.

Other Details:

Unichain has yet to confirm any specific incentivization plans for testnet participants. However, it is not uncommon for projects to withhold details about airdrops or rewards during early testing phases, only to reward early adopters later on. Given the minimal time required to complete the necessary steps, positioning oneself as an early testnet user could be beneficial should Unichain decide to offer future incentives.