Fed Chair in the Spotlight: All Eyes on Powell’s Words

On May 7 at 2:30 PM ET, Jerome Powell, Chair of the U.S. Federal Reserve, will take the stage after the two-day FOMC meeting wraps up. And the stakes? Sky high—especially for crypto markets. As the U.S. economy wrestles with inflation and rate speculation, Powell’s speech could trigger a boom or bust reaction in digital assets like Bitcoin and Ethereum. Historically, Fed commentary has sent waves across financial markets, and crypto is often the most sensitive to rate decisions.

Where to Watch Powell’s Speech

The speech will be livestreamed on the Federal Reserve’s official YouTube channel, X (formerly Twitter), and the Fed website. Coverage will also stream across platforms like CoinGape and other news outlets. But this isn’t just about watching—it’s about what’s at stake. Investors are watching for clues on rate cuts, which could impact everything from DeFi lending rates to Bitcoin’s price direction.

Rate Cut or Hold? Here's What the Experts Say

Despite Trump’s vocal pressure on the Fed to cut rates, that outcome seems unlikely this month. Analysts from Goldman Sachs and Bank of America are forecasting multiple cuts in 2025, but not necessarily in May.

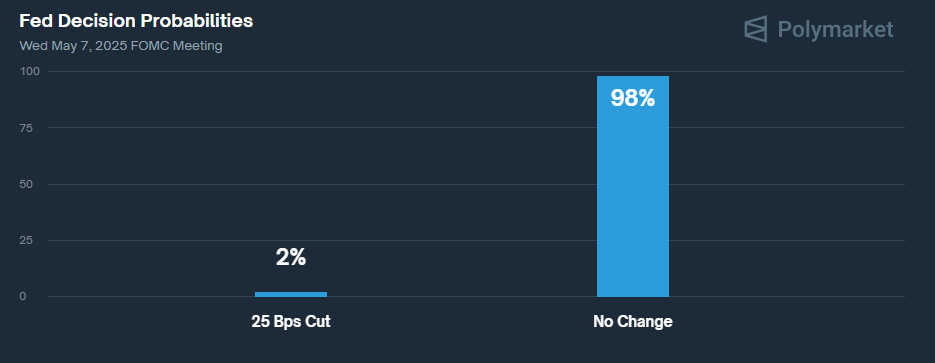

- Polymarket odds: 98% chance no rate cut.

- Bank of America: Predicts 4 cuts in 2025.

- Goldman Sachs: Predicts 3 cuts, but starting July at the earliest.

The strong labor market—adding 177,000 jobs in April—and 2.6% inflation rate suggest the Fed will likely hold rates steady at 4.25%-4.50%. Unemployment is also stable at 4.2%, weakening the argument for immediate easing

Source: Polymarket

Crypto’s Fate Hangs in the Balance

The crypto market is already on edge, with Bitcoin trading lower amid uncertainty. Market watchers say that volatility is inevitable, regardless of Powell’s message.

If Powell signals future cuts, it could be the green light bulls need. Cheaper borrowing and increased liquidity would fuel investor risk appetite, sending BTC and altcoins climbing. But if Powell reinforces a hawkish, data-driven approach, expect short-term bearish momentum.

June 18 & Beyond: What's Next for Crypto?

Even after May 7, the next FOMC meeting on June 18 will remain a major event. Combined with other macroeconomic data, the crypto market’s direction could be shaped by months of Fed commentary. Until then, investors should expect whiplash-level swings. Powell’s words may not immediately move rates—but they will move markets.