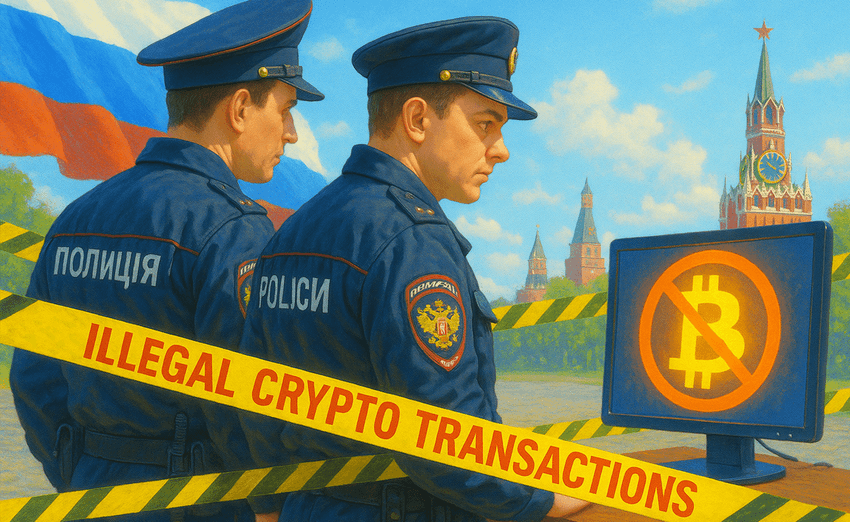

Russia Drafts New Rules for Crypto Sanctions

Russia is preparing a legal framework to penalize unauthorized cryptocurrency transactions, signaling a tougher stance on unregulated digital asset use. The country’s Prosecutor General, Alexander Gutsan, announced that new legislative amendments are being developed to establish both criminal penalties and a procedure for confiscating illegally traded crypto.

The announcement came during a summit of the Commonwealth of Independent States (CIS), where Gutsan emphasized the importance of tightening control over digital assets amid concerns about money laundering, corruption, terrorism, and drug trafficking.

Crypto Oversight Tightens Across the Federation

Gutsan revealed that Russian prosecutors have already built a monitoring system for digital currency operations to combat illicit finance. These mechanisms allow authorities to track crypto transactions linked to crimes and terrorist financing.

At the same time, Gutsan acknowledged that the digital economy is “becoming increasingly important” for Russia’s future, suggesting that the government aims to regulate rather than outright ban crypto usage.

Still, analysts say the tone of the new measures reflects a “crime and punishment” approach - cracking down on unauthorized users while keeping the market open only for tightly supervised entities.

Crypto Still in Legal Gray Area

Despite its growing adoption, Russia’s crypto industry remains largely unregulated. The only standing law, “On Digital Financial Assets” (DFA) - enacted in 2021 - focuses mainly on tokenized real-world assets issued by state-approved institutions.

Cryptocurrency is legally recognized as property, but not as a means of payment, and the Russian ruble remains the only official currency. The digital ruble, a CBDC, is set for phased introduction starting next September, further cementing state dominance over the financial system.

Limited Use, Experimental Zones

Currently, crypto payments are allowed only for select Russian companies under an “experimental legal regime” (ELR) - mainly for international settlements that bypass Western sanctions.

This regime also allows a few “highly qualified investors” to buy and sell cryptocurrencies, though the Central Bank of Russia has insisted on keeping this group small. In contrast, the Ministry of Finance is lobbying for broader investor access, with comprehensive crypto regulations expected in 2026.

Growing Adoption Despite Restrictions

Even without clear laws, crypto adoption in Russia has soared. Officials estimate that around 20 million Russians hold some form of cryptocurrency, with total holdings exceeding $40 billion.

Efforts to suppress peer-to-peer trading and restrict suspicious bank transactions have so far failed to curb the underground crypto economy. Still, some lawmakers have gone as far as proposing criminal charges for illegal crypto transactions - a move that has drawn comparisons to Soviet-era currency bans.

If enacted, the new framework would make Russia one of the few major economies to criminalize unregulated crypto activity while simultaneously developing a state-backed digital currency.